Investors love stocks that consistently beat the Street without getting ahead of their fundamentals and risking a meltdown. The best stocks offer sustainable market-beating gains, with robust and improving financial metrics that support strong price growth. Does Darden Restaurants, Inc. (NYSE:DRI) fit the bill? Let’s take a look at what its recent results tell us about its potential for future gains.

What we’re looking for

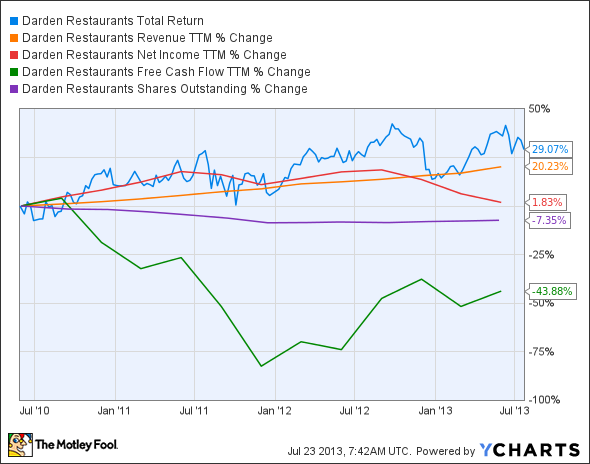

The graphs you’re about to see tell Darden Restaurants, Inc. (NYSE:DRI)’s story, and we’ll be grading the quality of that story in several ways:

- Growth: Are profits, margins, and free cash flow all increasing?

- Valuation: Is share price growing in line with earnings per share?

- Opportunities: Is return on equity increasing while debt to equity declines?

- Dividends: Are dividends consistently growing in a sustainable way?

What the numbers tell you

Now, let’s take a look at Darden Restaurants, Inc. (NYSE:DRI)’s key statistics:

DRI Total Return Price data by YCharts.

| Passing Criteria | 3-Year* Change | Grade |

|---|---|---|

| Revenue growth > 30% | 20.2% | Fail |

| Improving profit margin | (15.3%) | Fail |

| Free cash flow growth > Net income growth | (43.9%) vs. 1.9% | Fail |

| Improving EPS | 10.5% | Pass |

| Stock growth (+ 15%) < EPS growth | 29.1% vs. 10.5% | Fail |

Source: YCharts. * Period begins at end of Q2 (May) 2010.

DRI Return on Equity data by YCharts.

| Passing Criteria | 3-Year* Change | Grade |

|---|---|---|

| Improving return on equity | (6.1%) | Fail |

| Declining debt to equity | 49.8% | Fail |

| Dividend growth > 25% | 71.9% | Pass |

| Free cash flow payout ratio < 50% | 97.9% | Fail |

Source: YCharts. * Period begins at end of Q2 (May) 2010.

How we got here and where we’re going

Darden Restaurants, Inc. (NYSE:DRI) serves up an undercooked appetizer for investors here, earning a rather sad two out of nine passing grades. Underwhelming earnings growth and declining free cash flow do not make a good flavor pairing in this dish. Is there any hope left for Darden today?

These outlets don’t have much notable competition in fast casual, as seafood has been rather underrepresented in a niche dominated by Chipotle Mexican Grill, Inc. (NYSE:CMG) and other Mexican-themed locales. On the other hand, Red Lobster, despite historically offering a more upscale experience than Chipotle, does not exactly have the same brand cachet with consumers. Full disclosure: I worked my way through college as a Red Lobster server, so my perceptions may be colored by that experience.

Darden Restaurants, Inc. (NYSE:DRI) will also promote its value offerings with greater promotion across its brands. Olive Garden has reintroduced a buy-one-get-one promotion under the “Dinner Today, Dinner Tonight” tag line, which reinforces and strengthens its entry-level position in the Italian chain hierarchy. In addition to this, a new “Seafood Feast” promotion at Red Lobster will attract more value-conscious customers. A race to the bottom might not be in Darden’s best interest — net income has declined by 10% since the start of 201 and competitor Bloomin’ Brands Inc (NASDAQ:BLMN) of the Carrabba’s Italian franchise has suffered even more acutely as its net income has plunged nearly 40% in the same time frame. On the other hand, Chipotle’s net income is up nearly 40%, so the fast-casual concept could be big, if Red Lobster can make it work.