Billionaire hedge fund managers such as Steve Cohen and Stan Druckenmiller can generate millions or even billions of dollars every year by pinning down high-potential small-cap stocks and pouring cash into these candidates. Small-cap stocks are overlooked by most investors, brokerage houses, and financial services hubs, while the unlimited research abilities of the big players within the hedge fund industry can easily identify the undervalued and high-potential stocks that reside the ignored corners of equity markets. There are numerous small-cap stocks that have turned out to be great winners, which is one of the main reasons the Insider Monkey team pays close attention to the hedge fund activity in relation to these stocks.

In this article, we will discuss the latest hedge fund activity surrounding CommVault Systems, Inc. (NASDAQ:CVLT). Overall, the stock witnessed an increase in popularity as the number of funds from our database holding long positions went up by four. However, the level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Penumbra Inc (NYSE:PEN), Liberty Media Corp (NASDAQ:LMCA), and Liberty Media Corp (NASDAQ:LMCK) to gather more data points.

Follow Commvault Systems Inc (NASDAQ:CVLT)

Follow Commvault Systems Inc (NASDAQ:CVLT)

Receive real-time insider trading and news alerts

We care about hedge fund sentiment because historically hedge funds’ stock picks delivered strong risk adjusted returns. There are certain segments of the market where hedge funds’ stock picks performed much better than its benchmarks. For instance, the 30 most popular mid-cap stocks among the best performing hedge funds returned 18% over the last 12 months outpacing S&P 500 Index by more than 10 percentage points. We developed this strategy 2.5 years ago and started sharing its picks in our quarterly newsletter. It bested the S&P 500 Index ETFs by delivering a solid 39% vs. 22% gain for its benchmarks.

Manczurov/Shutterstock.com

Keeping this in mind, we’re going to review the key action encompassing CommVault Systems, Inc. (NASDAQ:CVLT).

What does the smart money think about CommVault Systems, Inc. (NASDAQ:CVLT)?

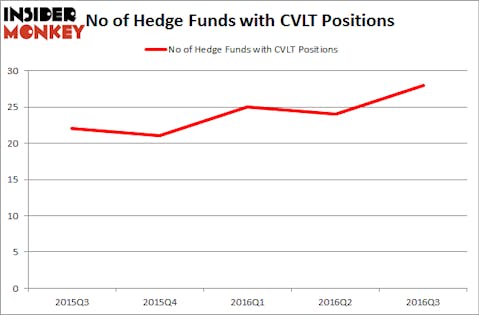

Heading into the fourth quarter of 2016, a total of 28 of the hedge funds tracked by Insider Monkey were long this stock, a change of 17% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards CVLT over the last five quarters. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

When looking at the institutional investors followed by Insider Monkey, Jim Simons’ Renaissance Technologies has the biggest position in CommVault Systems, Inc. (NASDAQ:CVLT), worth close to $68.4 million, corresponding to 0.1% of its total 13F portfolio. Coming in second is Park Presidio Capital, led by Lee Hicks and Jan Koerner, holding a $42.5 million position; the fund has 6.7% of its 13F portfolio invested in the stock. Some other members of the smart money that are bullish comprise D. E. Shaw’s D E Shaw, Clint Carlson’s Carlson Capital, and Israel Englander’s Millennium Management. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.

As one would reasonably expect, key money managers were breaking ground themselves. Citadel Investment Group, led by Ken Griffin, established the most outsized position in CommVault Systems, Inc. (NASDAQ:CVLT). Citadel Investment Group had $14.7 million invested in the company at the end of the quarter. Principal Global Investors’s Columbus Circle Investors also initiated a $14 million position during the quarter. The other funds with new positions in the stock are Dmitry Balyasny’s Balyasny Asset Management, Anand Parekh’s Alyeska Investment Group, and Cliff Asness’ AQR Capital Management.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as CommVault Systems, Inc. (NASDAQ:CVLT) but similarly valued. We will take a look at Penumbra Inc (NYSE:PEN), Liberty Media Corp (NASDAQ:LMCA), Liberty Media Corp (NASDAQ:LMCK), and AMAYA INC (NASDAQ:AYA). All of these stocks’ market caps are closest to CVLT’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| PEN | 17 | 158341 | 4 |

| LMCA | 29 | 285626 | 8 |

| LMCK | 19 | 651364 | -1 |

| AYA | 18 | 713268 | 1 |

As you can see these stocks had an average of 21 funds with bullish positions and the average amount invested in these stocks was $452 million. That figure was $295 million in CVLT’s case. Liberty Media Corp (NASDAQ:LMCA) is the most popular stock in this table. On the other hand Penumbra Inc (NYSE:PEN) is the least popular one with only 17 bullish hedge fund positions. CommVault Systems, Inc. (NASDAQ:CVLT) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard Liberty Media Corp (NASDAQ:LMCA) might be a better candidate to consider taking a long position in.

Disclosure: none