Many investors, including Carl Icahn or Stan Druckenmiller, have been saying for a while now that Trump presidency will be good for publicly traded stocks (at least in the very short term) due to lower taxes and higher GDP growth rates. Both investors profited handsomely from this analysis during the 5 hours immediately following Donald Trump’s election victory. The markets, especially small-cap stocks, kept rallying in the following three weeks. Nevertheless, there are still opportunities in individual stocks and we believe the stocks with strong hedge fund bullish stance are a good place to look for investment ideas. In this article we will find out how hedge fund sentiment to China Telecom Corporation Limited (ADR) (NYSE:CHA) changed recently.

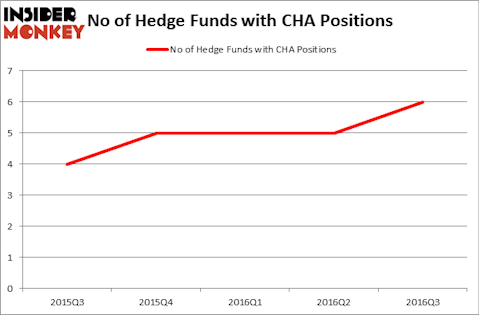

China Telecom Corporation Limited (ADR) (NYSE:CHA) investors should be aware of an increase in activity from the world’s largest hedge funds in recent months. CHA was in 6 hedge funds’ portfolios at the end of the third quarter of 2016. There were 5 hedge funds in our database with CHA holdings at the end of the second quarter. At the end of this article we will also compare CHA to other stocks including Yahoo! Inc. (NASDAQ:YHOO), Syngenta AG (ADR) (NYSE:SYT), and Aetna Inc. (NYSE:AET) to get a better sense of its popularity.

Follow China Telecom Corp Ltd (NASDAQ:CHA)

Follow China Telecom Corp Ltd (NASDAQ:CHA)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

Zhao jian kang / Shutterstock.com

How are hedge funds trading China Telecom Corporation Limited (ADR) (NYSE:CHA)?

Heading into the fourth quarter of 2016, a total of 6 of the hedge funds tracked by Insider Monkey held long positions in this stock, a 20% increase from one quarter earlier, hitting a yearly high. The graph below displays the number of hedge funds with bullish positions in CHA over the last 5 quarters. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

When looking at the institutional investors followed by Insider Monkey, Peter Rathjens, Bruce Clarke and John Campbell of Arrowstreet Capital holds the most valuable position in China Telecom Corporation Limited (ADR) (NYSE:CHA). Arrowstreet Capital has a $6.6 million position in the stock. On Arrowstreet Capital’s heels is Renaissance Technologies, one of the largest hedge funds in the world, holding a $3.9 million position. Remaining peers that are bullish comprise Israel Englander’s Millennium Management, Warren Lammert’s Granite Point Capital, and Jane Mendillo’s Harvard Management Co. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds, which is based on the performance of their 13F long positions in non-micro-cap stocks.

With general bullishness amongst the heavyweights, key hedge funds have been driving this bullishness. Granite Point Capital assembled the most outsized position in China Telecom Corporation Limited (ADR) (NYSE:CHA). Granite Point Capital had $0.4 million invested in the company at the end of the quarter. Harvard Management Co also made a $0.2 million investment in the stock during the quarter.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as China Telecom Corporation Limited (ADR) (NYSE:CHA) but similarly valued. We will take a look at Yahoo! Inc. (NASDAQ:YHOO), Syngenta AG (ADR) (NYSE:SYT), Aetna Inc. (NYSE:AET), and Automatic Data Processing (NASDAQ:ADP). All of these stocks’ market caps are closest to CHA’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| YHOO | 90 | 8274108 | 9 |

| SYT | 36 | 1223559 | 3 |

| AET | 49 | 2341253 | -12 |

| ADP | 32 | 817244 | -2 |

As you can see these stocks had an average of 52 hedge funds with bullish positions and the average amount invested in these stocks was $3.16 billion. That figure was just $13 million in CHA’s case. Yahoo! Inc. (NASDAQ:YHOO) is the most popular stock in this table. On the other hand Automatic Data Processing (NASDAQ:ADP) is the least popular one with only 32 bullish hedge fund positions. Compared to these stocks China Telecom Corporation Limited (ADR) (NYSE:CHA) is even less popular than ADP. Considering that hedge funds aren’t fond of this stock in relation to other companies analyzed in this article, it may be a good idea to analyze it in detail and understand why the smart money isn’t behind this stock.

Disclosure: None