Hedge funds run by legendary names like Nelson Peltz and David Tepper make billions of dollars a year for themselves and their super-rich accredited investors (you’ve got to have a minimum of $1 million liquid to invest in a hedge fund) by spending enormous resources on analyzing and uncovering data about small-cap stocks that the big brokerage houses don’t follow. Small caps are where they can generate significant out-performance. These stocks have been on a tear since the end of June, outperforming large-cap index funds by more than 10 percentage points. That’s why we pay special attention to hedge fund activity in these stocks.

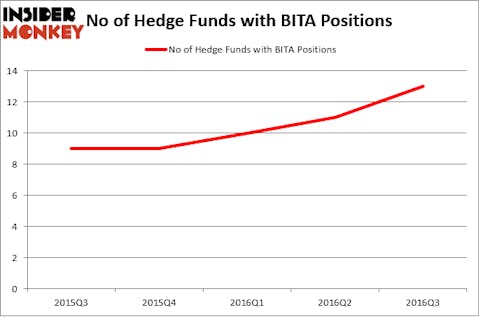

Is Bitauto Hldg Ltd (ADR) (NYSE:BITA) worth your attention right now? Prominent investors are indeed becoming more confident. The number of bullish hedge fund investments moved up by 2 lately. BITA was in 13 hedge funds’ portfolios at the end of the third quarter of 2016. There were 11 hedge funds in our database with BITA positions at the end of the previous quarter. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as National Beverage Corp. (NASDAQ:FIZZ), Party City Holdco Inc (NYSE:PRTY), and Synaptics, Incorporated (NASDAQ:SYNA) to gather more data points.

Follow Bitauto Holdings Ltd (NYSE:BITA)

Follow Bitauto Holdings Ltd (NYSE:BITA)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

YURALAITS ALBERT/Shutterstock.com

What does the smart money think about Bitauto Hldg Ltd (ADR) (NYSE:BITA)?

At the end of the third quarter, a total of 13 of the hedge funds tracked by Insider Monkey were bullish on this stock, an 18% increase from the previous quarter, and the third quarter in a row in which the number of bullish hedge fund positions has increased. Below, you can check out the change in hedge fund sentiment towards BITA over the last 5 quarters. With hedgies’ capital changing hands, there exists an “upper tier” of notable hedge fund managers who were boosting their stakes significantly (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, William von Mueffling’s Cantillon Capital Management has the biggest position in Bitauto Hldg Ltd (ADR) (NYSE:BITA), worth close to $81 million, accounting for 1.1% of its total 13F portfolio. On Cantillon Capital Management’s heels is Peter Rathjens, Bruce Clarke and John Campbell of Arrowstreet Capital, with a $16.4 million position. Some other professional money managers that are bullish include Fang Zheng’s Keywise Capital Management, Thomas E. Claugus’ GMT Capital, and George Soros’ Soros Fund Management. We should note that Soros Fund Management is among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.