Hedge fund managers like David Einhorn, Dan Loeb, or Carl Icahn became billionaires through reaping large profits for their investors, which is why piggybacking their stock picks may provide us with significant returns as well. Many hedge funds, like Paul Singer’s Elliott Management, are pretty secretive, but we can still get some insights by analyzing their quarterly 13F filings. One of the most fertile grounds for large abnormal returns is hedge funds’ most popular small-cap picks, which are not so widely followed and often trade at a discount to their intrinsic value. In this article we will check out hedge fund activity in another small-cap stock: Vitamin Shoppe Inc (NYSE:VSI).

Is Vitamin Shoppe Inc (NYSE:VSI) a cheap investment right now? The best stock pickers are indeed in a pessimistic mood. The number of bullish hedge fund bets that are revealed through the 13F filings suffered a reduction of 2 lately. At the end of this article we will also compare VSI to other stocks including Chase Corporation (NYSEAMEX:CCF), NeoGenomics, Inc. (NASDAQ:NEO), and Nantkwest Inc (NASDAQ:NK) to get a better sense of its popularity.

Follow Vitamin Shoppe Inc. (NYSE:VSI)

Follow Vitamin Shoppe Inc. (NYSE:VSI)

Receive real-time insider trading and news alerts

We follow over 700 hedge funds and other institutional investors and by analyzing their quarterly 13F filings, we identify stocks that they are collectively bullish on and develop investment strategies based on this data. One strategy that outperformed the market over the last year involves selecting the 100 best-performing funds and identifying the 30 mid-cap stocks that they are collectively most bullish on. Over the past year, this strategy generated returns of 18%, topping the 8% gain registered by S&P 500 ETFs. We launched this strategy 2.5 years ago and it returned more than 39% since then, vs. 22% gain registered by the S&P 500 ETFs.

David Smart/Shutterstock.com

Hedge fund activity in Vitamin Shoppe Inc (NYSE:VSI)

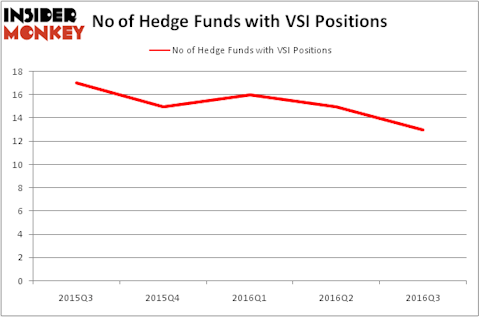

Heading into the fourth quarter of 2016, a total of 13 of the hedge funds tracked by Insider Monkey held long positions in this stock, a drop of 13% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards VSI over the last 5 quarters, which shows a clear downtrend, though within a narrow range. With hedgies’ sentiment swirling, there exists a select group of noteworthy hedge fund managers who were upping their stakes significantly (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, Carlson Capital, led by Clint Carlson, holds the number one position in Vitamin Shoppe Inc (NYSE:VSI). Carlson Capital has a $60.5 million position in the stock. Sitting at the No. 2 spot is Canyon Capital Advisors, led by Joshua Friedman and Mitchell Julis, which holds a $48.2 million position; the fund has 1.8% of its 13F portfolio invested in the stock. Other peers that are bullish consist of Thomas E. Claugus’ GMT Capital, Ken Griffin’s Citadel Investment Group, and Mario Gabelli’s GAMCO Investors. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.