Is Bank Of The Ozarks Inc (NASDAQ:OZRK) a good stock to buy? We are going to take a look at the hedge fund sentiment to answer this question because their sentiment has some short-term predictive power. Last spring, Muddy Waters’ Carson Block presented OZRK as his short idea at the Ira Sohn Conference. For some reason Muddy Waters’ research on OZRK wasn’t posted on its website but we were present at the Conference and took some notes. Carson Block thought the company is overextended and concentrated its loans in the construction industry. He claimed that the company can’t keep up its high growth rate and it may be inadequately capitalized in case default rates in the construction industry spike up. The stock was trading at around $39 before the Conference and went down as low as $36 within a couple of weeks. It didn’t really shake off the effects of this negative sentiment cast by Carson Block until after Trump’s election victory.

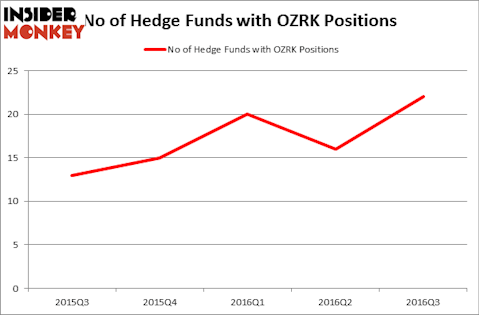

Our database indicates that hedge fund managers started doubting Block’s negative views and were turning bullish in the third quarter. The number of long hedge fund positions improved by 6 in recent months. OZRK was in 22 hedge funds’ portfolios at the end of September. There were 16 hedge funds in our database with OZRK positions at the end of the previous quarter. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Akorn, Inc. (NASDAQ:AKRX), Thor Industries, Inc. (NYSE:THO), and Paramount Group Inc (NYSE:PGRE) to gather more data points.

Follow Bank Ozk (NASDAQ:OZK)

Follow Bank Ozk (NASDAQ:OZK)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

cowardlion/shutterstock.com

Keeping this in mind, we’re going to view the key action regarding Bank Of The Ozarks Inc (NASDAQ:OZRK).

How are hedge funds trading Bank Of The Ozarks Inc (NASDAQ:OZRK)?

At the end of the third quarter, a total of 22 of the hedge funds tracked by Insider Monkey were long this stock, a change of 38% from the previous quarter. With hedge funds’ sentiment swirling, there exists a select group of key hedge fund managers who were increasing their holdings considerably (or already accumulated large positions).

Of the funds tracked by Insider Monkey, Michael Lowenstein’s Kensico Capital has the number one position in Bank Of The Ozarks Inc (NASDAQ:OZRK), worth close to $76.7 million, amounting to 1.4% of its total 13F portfolio. The second most bullish fund manager is Endicott Management, managed by Robert I. Usdan and Wayne K. Goldstein, which holds a $65.1 million position; the fund has 29.1% of its 13F portfolio invested in the stock. Some other members of the smart money with similar optimism comprise John Brennan’s Sirios Capital Management, Francois Rochon’s Giverny Capital and Ken Griffin’s Citadel Investment Group.

With a general bullishness amongst the heavyweights, specific money managers have been driving this bullishness. Kensico Capital, managed by Michael Lowenstein, established the most valuable position in Bank Of The Ozarks Inc (NASDAQ:OZRK). Kensico Capital had $76.7 million invested in the company at the end of the quarter. Robert I. Usdan and Wayne K. Goldstein’s Endicott Management also made a $65.1 million investment in the stock during the quarter. The other funds with new positions in the stock are Shawn Bergerson and Martin Kalish’s Waterstone Capital Management, Dmitry Balyasny’s Balyasny Asset Management, and D. E. Shaw’s D E Shaw.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as Bank Of The Ozarks Inc (NASDAQ:OZRK) but similarly valued. We will take a look at Akorn, Inc. (NASDAQ:AKRX), Thor Industries, Inc. (NYSE:THO), Paramount Group Inc (NYSE:PGRE), and Western Alliance Bancorporation (NYSE:WAL). This group of stocks’ market values match OZRK’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| AKRX | 28 | 500562 | -6 |

| THO | 25 | 317743 | 2 |

| PGRE | 14 | 243991 | 3 |

| WAL | 26 | 249621 | -8 |

As you can see these stocks had an average of 23.25 hedge funds with bullish positions and the average amount invested in these stocks was $328 million. That figure was $365 million in OZRK’s case. Akorn, Inc. (NASDAQ:AKRX) is the most popular stock in this table. On the other hand Paramount Group Inc (NYSE:PGRE) is the least popular one with only 14 bullish hedge fund positions. Bank Of The Ozarks Inc (NASDAQ:OZRK) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard AKRX might be a better candidate to consider a long position.