We have been waiting for this for a year and finally the third quarter ended up showing a nice bump in the performance of small-cap stocks. Both the S&P 500 and Russell 2000 were up since the end of the second quarter, but small-cap stocks outperformed the large-cap stocks by double digits. This is important for hedge funds, which are big supporters of small-cap stocks, because their investors started pulling some of their capital out due to poor recent performance. It is very likely that equity hedge funds will deliver better risk adjusted returns in the second half of this year. In this article we are going to look at how this recent market trend affected the sentiment of hedge funds towards AMERCO (NASDAQ:UHAL), and what that likely means for the prospects of the company and its stock.

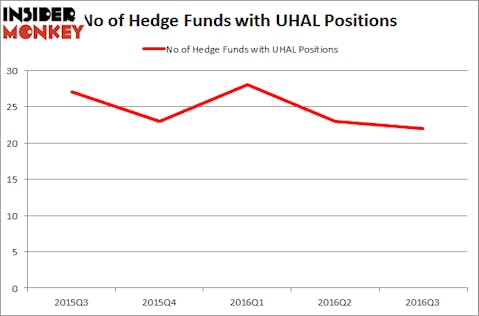

AMERCO (NASDAQ:UHAL) was in 22 hedge funds’ portfolios at the end of September. UHAL has experienced a decrease in activity from the world’s largest hedge funds of late. There were 23 hedge funds in our database with UHAL positions at the end of the previous quarter. At the end of this article we will also compare UHAL to other stocks including Cadence Design Systems Inc (NASDAQ:CDNS), New York Community Bancorp, Inc. (NYSE:NYCB), and Icahn Enterprises LP (NASDAQ:IEP) to get a better sense of its popularity.

Follow U-Haul Holding Co (NASDAQ:UHAL,UHALB)

Follow U-Haul Holding Co (NASDAQ:UHAL,UHALB)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

With all of this in mind, we’re going to take a gander at the new action regarding AMERCO (NASDAQ:UHAL).

What does the smart money think about AMERCO (NASDAQ:UHAL)?

At the end of the third quarter, a total of 22 of the hedge funds tracked by Insider Monkey held long positions in this stock, a drop of 4% from one quarter earlier. With hedge funds’ sentiment swirling, there exists a few noteworthy hedge fund managers who were boosting their stakes substantially (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, David Einhorn’s Greenlight Capital has the number one position in AMERCO (NASDAQ:UHAL), worth close to $71.3 million, amounting to 1.4% of its total 13F portfolio. Sitting at the No. 2 spot is Quincy Lee of Ancient Art, with a $48.2 million position; 8.8% of its 13F portfolio is allocated to the stock. Other professional money managers that hold long positions encompass Cliff Asness’s AQR Capital Management, Noah Levy and Eugene Dozortsev’s Newtyn Management and Shane Finemore’s Manikay Partners.