There are several ways to beat the market, and investing in small cap stocks has historically been one of them. We like to improve the odds of beating the market further by examining what famous hedge fund operators such as Carl Icahn and George Soros think. Those hedge fund operators make billions of dollars each year by hiring the best and the brightest to do research on stocks, including small cap stocks that big brokerage houses simply don’t cover. Because of Carl Icahn and other successful funds’ exemplary historical records, we pay attention to their small cap picks. In this article, we use hedge fund filing data to analyze Air Methods Corp (NASDAQ:AIRM) .

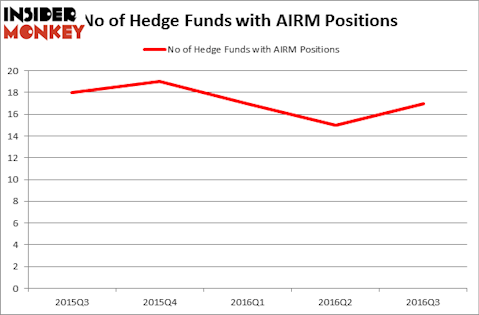

Air Methods Corp (NASDAQ:AIRM) shareholders witnessed an increase in support from the world’s most successful money managers during the third quarter, as the number of funds in our database long the stock advanced by two to 17. At the end of this article we will also compare AIRM to other stocks including Coca-Cola Bottling Co. Consolidated (NASDAQ:COKE), Fossil Inc (NASDAQ:FOSL), and Seaspan Corporation (NYSE:SSW) to get a better sense of its popularity.

Follow Air Methods Corp (NASDAQ:AIRM)

Follow Air Methods Corp (NASDAQ:AIRM)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

bluebay/Shutterstock.com

With all of this in mind, let’s review the recent action surrounding Air Methods Corp (NASDAQ:AIRM).

How are hedge funds trading Air Methods Corp (NASDAQ:AIRM)?

Heading into the fourth quarter of 2016, a total of 17 of the hedge funds tracked by Insider Monkey were bullish on this stock, an increase of 13% from the previous quarter. On the other hand, there were a total of 19 hedge funds with a bullish position in AIRM at the beginning of this year. With the smart money’s positions undergoing their usual ebb and flow, there exists an “upper tier” of key hedge fund managers who were increasing their holdings meaningfully (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, J. Daniel Plants’ Voce Capital holds the most valuable position in Air Methods Corp (NASDAQ:AIRM) which has a $32.8 million position in the stock, comprising 42.1% of its 13F portfolio. Coming in second is Amy Minella’s Cardinal Capital, which reported a $27.5 million position; 1.3% of its 13F portfolio is allocated to the stock. Remaining peers that are bullish encompass Ken Grossman and Glen Schneider’s SG Capital Management and Israel Englander’s Millennium Management. We should note that SG Capital Management is among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.