Hedge funds are not perfect. They have their bad picks just like everyone else. Valeant, a stock hedge funds have loved, lost 79% during the last 12 months ending in November 21. Although hedge funds are not perfect, their consensus picks do deliver solid returns, however. Our data show the top 30 mid-cap stocks among the best performing hedge funds yielded an average return of 18% in the same time period, vs. a gain of 7.6% for the S&P 500 Index. Because hedge funds have a lot of resources and their consensus picks do well, we pay attention to what they think. In this article, we’ll analyze what the smart money investors we track at Insider Monkey think of AbbVie Inc (NYSE:ABBV).

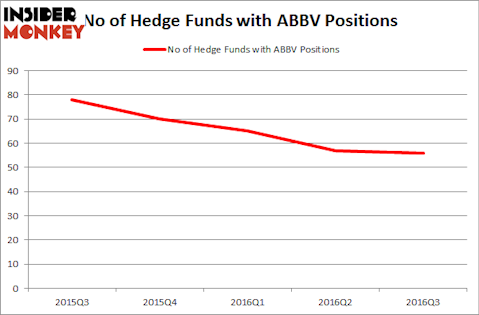

AbbVie Inc (NYSE:ABBV) has experienced a slight decrease in enthusiasm from smart money recently. At the end of September, there were 56 hedge funds holding shares. There had been 57 hedge funds in our database with ABBV positions at the end of the previous quarter. At the end of this article we will also compare AbbVie to other stocks including Schlumberger Limited. (NYSE:SLB), Nippon Telegraph & Telephone Corp (ADR) (NYSE:NTT), and Mastercard Inc (NYSE:MA) to get a better sense of its popularity.

Follow Abbvie Inc. (NYSE:ABBV)

Follow Abbvie Inc. (NYSE:ABBV)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

bikeriderlondon/Shutterstock.com

Now, we’re going to take a look at the recent action surrounding AbbVie Inc (NYSE:ABBV).

Hedge fund activity in AbbVie Inc (NYSE:ABBV)

At the end of the third quarter, a total of 56 of the hedge funds tracked by Insider Monkey held long positions in this stock, down by 2% from the end of June. With hedgies’ capital changing hands, there exists an “upper tier” of notable hedge fund managers who were boosting their stakes substantially (or already accumulated large positions).

Of the funds tracked by Insider Monkey, Baker Bros. Advisors, managed by Julian Baker and Felix Baker, holds the number one position in AbbVie Inc (NYSE:ABBV). Baker Bros. Advisors has a $904.6 million position in the stock, comprising 8.2% of its 13F portfolio. Sitting at the No. 2 spot is Neil Woodford of Woodford Investment Management, with a $695.6 million position; the fund has 28.1% of its 13F portfolio invested in the stock. Some other members of the smart money with similar optimism consist of Jonathon Jacobson’s Highfields Capital Management, Larry Robbins’s Glenview Capital and William B. Gray’s Orbis Investment Management.

Due to the fact that AbbVie Inc (NYSE:ABBV) has faced falling interest from the smart money, it’s safe to say that there is a sect of fund managers that elected to cut their entire stakes last quarter. Intriguingly, Benjamin A. Smith’s Laurion Capital Management dumped the largest position of all the hedgies followed by Insider Monkey, comprising an estimated $49.5 million in call options., and Ken Griffin’s Citadel Investment Group was right behind this move, as the fund said goodbye to about $21.3 million worth of shares.

Let’s check out hedge fund activity in other stocks similar to AbbVie Inc (NYSE:ABBV). We will take a look at Schlumberger Limited. (NYSE:SLB), Nippon Telegraph & Telephone Corp (ADR) (NYSE:NTT), Mastercard Inc (NYSE:MA), and United Parcel Service, Inc. (NYSE:UPS). This group of stocks’ market valuations resemble ABBV’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SLB | 59 | 1564821 | 4 |

| NTT | 10 | 182797 | -1 |

| MA | 84 | 7481554 | 2 |

| UPS | 40 | 1532311 | 7 |

As you can see these stocks had an average of 48 funds holding long positions and the average amount invested in these stocks was $2.69 billion. That figure was $4.17 billion in AbbVie’s case. Mastercard Inc (NYSE:MA) is the most popular stock in this table. On the other hand Nippon Telegraph & Telephone Corp (ADR) (NYSE:NTT) is the least popular one with only 10 bullish hedge fund positions. AbbVie Inc (NYSE:ABBV) is not the most popular stock in this group, but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard Mastercard Inc (NYSE:MA) might be a better candidate to consider a long position.