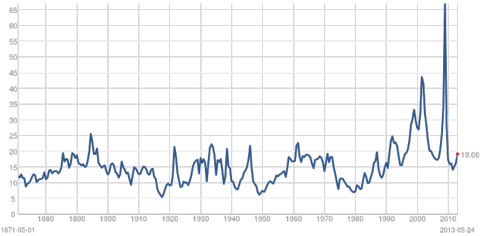

Who doesn’t love dividends? In looking for great dividend stocks, I’ve come across five cheap dividend stocks with safe dividends, where they all have a payout ratio of less than 50%. The cheapness of these stocks is in the fact that they all trade with price-to-earnings ratios of less than 16.5x, which is below the market’s 19x P/E.

S&P 500 Market P/E

Source: multpl.com

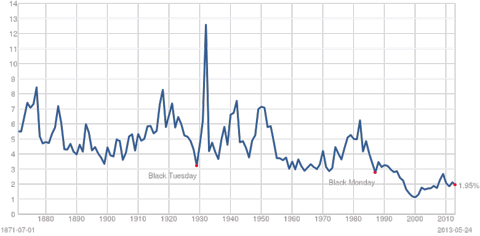

What’s more is that all five of the stocks below pay a dividend yield of at least 2.2%. A dividend payment becomes even more important in a low-interest environment, where fixed income is low-yielding, rates on savings accounts and CDs are abysmal and the overall market dividend yield is forced downward; currently, the S&P 500 dividend yield is well off historical averages, with a 1.9% average dividend yield, compared to the historical average of a 4.4% dividend yield.

S&P 500 Dividend Yield

Source: multpl.com

The five stocks below have been growing their dividend payments by at least 8% annually over the last five years, and have upped there dividends consecutively for at least 30 years. Three are in the industrial space and two are in the retail sector. Let’s start with the industrial and equipment makers.

Industrial dividends

These stocks include Illinois Tool Works Inc. (NYSE:ITW), Stanley Black & Decker, Inc. (NYSE:SWK) and Air Products & Chemicals, Inc. (NYSE:APD):

| Illinois Tool | Black & Decker | Air Products | |

| Price to earnings | 11.6 | 15.5 | 16.3 |

| Dividend yield | 2.2% | 2.5% | 3.1% |

| Dividend payout | 26% | 38% | 51% |

| 5-year dividend growth | 9.9% | 8.1% | 11% |

| Years of dividend increases | 38 | 45 | 31 |

Source: AAII

From fiscal 2012 to 2017, Illinois is expecting organic growth that’ll be 200 basis points above industrial production by 2017; and operating margins and a return on invested capital to be above 20% by 2017; with 100% free cash flow conversion and 12% earnings per share CAGR beyond 2017.

Its policy for returning capital to shareholders has been consistent. During the first quarter of 2013, shares worth $366 million were repurchased, and management anticipates repurchasing $850 million in shares during the rest of 2013, an increase from the earlier forecast of $500 million.

Relational Investors remains Illinois Tool Works Inc. (NYSE:ITW)’s top hedge fund owner with some 10 million shares, which makes up 11.7% of the fund’s public-equity portfolio (check out Relational’s top stocks).

Stanley Black & Decker, Inc. (NYSE:SWK) manufactures tools and engineered security solutions across the globe. The company was formed after The Stanley Works acquired Black & Decker Corporation in the first quarter of fiscal 2010 — Stanley’s shareholders own around 50.5% of the combined company and Black & Decker shareholders own the rest. The company’s top segment is its construction and do-it-yourself unit, accounting for some 50% of revenue. This segment manufactures and markets hand tools, consumer mechanic tools, storage systems, pneumatic tools and fasteners.

The secret to Stanley Black & Decker, Inc. (NYSE:SWK)’s long-term growth includes investing two-thirds of its capital in acquisitions and growth, and returning the other one-third to shareholders. As well, Stanley has a diversified customer base and a presence across the world.

As for the long-term growth, the company is looking to expand into emerging markets, creating a smart-tools market, and tapping opportunities in the offshore oil and gas pipeline market. These and other initiatives are expected to contribute $800 to $900 million of annualized revenue growth and $200 million in operating income over a three-year term — the revenue breakdown is $150 million in 2013 and $350 million each in 2014 and 2015.

Air Products & Chemicals, Inc. (NYSE:APD) makes industrial gases as well as a variety of polymer and performance chemicals. It also supplies processing equipment. The company happens to be the world’s largest supplier of hydrogen and helium.

Given its leading position in the gases business, Air Products & Chemicals, Inc. (NYSE:APD) is well positioned to capitalize on the cyclical recovery in its core industrial end-markets. Over the next 10 years, the company foresees incremental global hydrogen demand and has seven refinery projects in the pipeline.

Some of the initiatives Air Products & Chemicals, Inc. (NYSE:APD) hopes to utilize for increasing earnings are headcount reduction, keeping a tight control on SG&A expenses and undertaking work-process improvement initiatives. As well, the company is still returning capital to shareholders. In March, the company raised its quarterly dividend to $0.71 per share from $0.64, representing an 11% increase. The company is also making share repurchases, having bought back shares worth $460 million during the first half of fiscal 2013.

The final two dividend picks include retail giants Wal-Mart Stores, Inc. (NYSE:WMT) and Target Corporation (NYSE:TGT). Both of these stocks are trading inline from a valuation perspective and dividend strength.

| Wal-Mart | Target | |

| Price to earnings | 15.7 | 15.4 |

| Dividend yield | 2.4% | 2.2% |

| Dividend payout | 37% | 32% |

| 5-year dividend growth | 13.5% | 20.5% |

| Years of dividend increases | 39 | 45 |

Source: AAII

Wal-Mart, the multinational retailer, is the world’s biggest private employer with more than 2 million employees, and with 8,500 stores in 15 countries. Its Wal-Mart U.S. segment accounts for 59% of sales, the international segment is 29%, and Sam’s Club 12%.

Part of the long-term revenue driver will be rising sales in the international segment; international sales increased 12.1% in fiscal 2011, 15.3% in fiscal 2012 and 7.4% in fiscal 2013. Helping drive future growth will be the inclusion of the acquisition of a 51% stake in Massmart Holdings, which will help the company capture market share in South Africa.

Now for the reason many love the stock, its solid and consistent dividend growth. Wal-Mart Stores, Inc. (NYSE:WMT) has been great at returning value to shareholders, increasing the dividend every year since it first declared a dividend in 1974. Wal-Mart has paid dividends worth $5.4 billion in fiscal 2013, $5.0 billion in 2012 and $4.4 billion in 2011. In February of this year, the company upped its dividend with an 18% increase.

Heading into the second quarter, there were a total of 52 hedge funds bullish the stock, a 9% fall from the previous quarter. Worth noting is that Arrowstreet Capital sold off the largest position in the stock, worth an estimated $92 million (check out Arrowstreet’s portfolio).

Target Corporation (NYSE:TGT), after selling its credit-card arm, gets 98% of its revenue from retail. These include its large-format general merchandise and food stores in the U.S. and online. Much like Wal-Mart Stores, Inc. (NYSE:WMT), Target is superb at managing cash flow. During the fourth-quarter fiscal 2012, Target bought back about 10.4 million shares for $645 million, and paid dividends of $234 million. The company also recently hiked its annual dividend by 20% to $1.44, and expects it to increase to $3.00 per share or more by 2017.

Part of the big initiative for the stock is expansion into international markets, namely Canada and Latin America. Its eye has been on the Canadian market for a long time, and now Target Corporation (NYSE:TGT) plans to open 124 stores in fiscal 2013. Its other initiative is CityTarget stores. Target now plans to introduce a smaller store format of 60,000 to 100,000 square feet compared with the current format of 125,000 to 180,000 square feet. This will help the company tap urban markets, where real estate space is an issue.

Target Corporation (NYSE:TGT) saw top hedge fund owner by shares, Levin Capital Strategies, upping its stake to 1.8 million shares during the first quarter (check out Levin’s high yielders).

Bottom line

Dividends can be a big part of portfolios during low interest-rate environments and I have a special appreciation for dividend-paying stocks. But what makes these stocks even greater is the expectation that the dividend payments should continue to move higher and the realization of the stocks’ under-pricing will lead to higher stock prices. Both of the major retailers, Target Corporation (NYSE:TGT) and Wal-Mart Stores, Inc. (NYSE:WMT), should perform nicely on the back of a rebounding economy. As, well the rebounding economy and urbanization of developing markets will be key tailwinds for the industrial stocks.

Marshall Hargrave has no position in any stocks mentioned. The Motley Fool recommends Illinois Tool Works.

The article 5 Cheap Fast-Growing Dividends originally appeared on Fool.com.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.