I am a huge Research In Motion Ltd (NASDAQ:BBRY) BlackBerry critic. A lot of you are aware of this fact, and may find it disenchanting. But believe me, if I thought there were a good risk to reward ratio, I would take the risk. But to declare BlackBerry’s victory complete, it is far too soon to do that.

Here is the problem

I am not fully convinced that even if Research In Motion Ltd (NASDAQ:BBRY) BlackBerry was to increase its advertising spend by an additional $500 million that it could actually compete against other large technology companies in the space. I don’t deny that the new phone could be a potential game changer, as the BlackBerry Z10 is attracting a lot of attention.

Let’s assume Research In Motion Ltd (NASDAQ:BBRY) BlackBerry increases its spending and in fact is able to win back some of its lost customers. We still have to look at two facts before we proceed any further with the analysis.

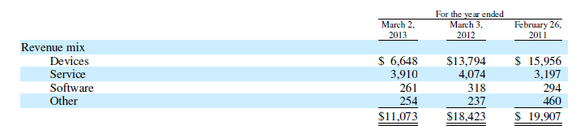

The company reported a humongous decline in device sales Year over Year. It went from selling $13.79 billion in devices in fiscal year 2012 to $6.64 billion in device sales for fiscal year 2013. The precipitous decline in device sales is bad. First of all, these are high-end devices that come with two-year contracts in many cases. The problem is that Research In Motion Ltd (NASDAQ:BBRY) BlackBerry defectors have switched either to Android or iOS. Anyone who jumped ship from BlackBerry products would have to wait two years before buying into another Research In Motion Ltd (NASDAQ:BBRY) BlackBerry device, which puts BlackBerry in a difficult position.

Source: ComScore

In the same period, Apple Inc. (NASDAQ:AAPL) and Microsoft Corporation (NASDAQ:MSFT) have been able to gain market share. Whereas Google Inc (NASDAQ:GOOG) and BlackBerry lost market share. Since Google Inc (NASDAQ:GOOG) has such a large part of the market with 53.4% of it, a 1.4% loss can be pardonable, but to BlackBerry a 1.2% market share loss, from 6.4% market share is huge. The decline cannot be stemmed with new products. Products don’t sell themselves, especially not in a more mature market.

Retail support is waning

I am not fully convinced that BlackBerry will be able to compete with its new stream of devices. Yes, I agree that they are beautiful. But many with any familiarity with a BlackBerry device have already jumped ship in favor of an Apple Inc. (NASDAQ:AAPL) or Android device. Not to mention BlackBerry is now facing competition with Microsoft Corporation (NASDAQ:MSFT), which it did not have to do before. That being the case, BlackBerry has to win new customers. Customers are in all many cases are not going to be familiar with the BlackBerry operating system.

This means that BlackBerry’s plans to increase advertising spend by 50% may fall short of pulling money out of consumers’ wallets. BlackBerry needs the support of third party sellers to move its products. But in any store setting, the highest volume products are always placed in the most visible location on the sales floor.

Where to focus

The cornerstone of savvy investing is knowing when to take a risk and when not to. Sometimes you can squeeze by with a narrow window of opportunity and profit handsomely from the ignorance of others. But often, in the technology space, a company’s decline is a gradual death. New product releases often lift the hopes of investors, but you cannot invest into a company based solely on a new product- that is too risky. Even the management team’s guidance, in its latest earnings transcript, fails to bring any real hope. The CFO stated that advertising spend increases will be at 50%, along with break-even revenues. The break-even revenues, plus the increase in advertising can be interpreted as advantageous news by some. But if the company were to miss its own guidance the stock could fall drastically.