I am a huge Research In Motion Ltd (NASDAQ:BBRY) BlackBerry critic. A lot of you are aware of this fact, and may find it disenchanting. But believe me, if I thought there were a good risk to reward ratio, I would take the risk. But to declare BlackBerry’s victory complete, it is far too soon to do that.

Here is the problem

I am not fully convinced that even if Research In Motion Ltd (NASDAQ:BBRY) BlackBerry was to increase its advertising spend by an additional $500 million that it could actually compete against other large technology companies in the space. I don’t deny that the new phone could be a potential game changer, as the BlackBerry Z10 is attracting a lot of attention.

Let’s assume Research In Motion Ltd (NASDAQ:BBRY) BlackBerry increases its spending and in fact is able to win back some of its lost customers. We still have to look at two facts before we proceed any further with the analysis.

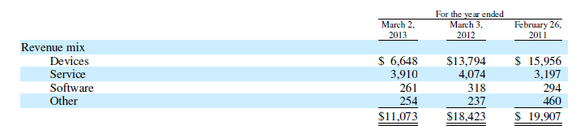

The company reported a humongous decline in device sales Year over Year. It went from selling $13.79 billion in devices in fiscal year 2012 to $6.64 billion in device sales for fiscal year 2013. The precipitous decline in device sales is bad. First of all, these are high-end devices that come with two-year contracts in many cases. The problem is that Research In Motion Ltd (NASDAQ:BBRY) BlackBerry defectors have switched either to Android or iOS. Anyone who jumped ship from BlackBerry products would have to wait two years before buying into another Research In Motion Ltd (NASDAQ:BBRY) BlackBerry device, which puts BlackBerry in a difficult position.

Source: ComScore

In the same period, Apple Inc. (NASDAQ:AAPL) and Microsoft Corporation (NASDAQ:MSFT) have been able to gain market share. Whereas Google Inc (NASDAQ:GOOG) and BlackBerry lost market share. Since Google Inc (NASDAQ:GOOG) has such a large part of the market with 53.4% of it, a 1.4% loss can be pardonable, but to BlackBerry a 1.2% market share loss, from 6.4% market share is huge. The decline cannot be stemmed with new products. Products don’t sell themselves, especially not in a more mature market.

Retail support is waning

I am not fully convinced that BlackBerry will be able to compete with its new stream of devices. Yes, I agree that they are beautiful. But many with any familiarity with a BlackBerry device have already jumped ship in favor of an Apple Inc. (NASDAQ:AAPL) or Android device. Not to mention BlackBerry is now facing competition with Microsoft Corporation (NASDAQ:MSFT), which it did not have to do before. That being the case, BlackBerry has to win new customers. Customers are in all many cases are not going to be familiar with the BlackBerry operating system.

This means that BlackBerry’s plans to increase advertising spend by 50% may fall short of pulling money out of consumers’ wallets. BlackBerry needs the support of third party sellers to move its products. But in any store setting, the highest volume products are always placed in the most visible location on the sales floor.

Where to focus

The cornerstone of savvy investing is knowing when to take a risk and when not to. Sometimes you can squeeze by with a narrow window of opportunity and profit handsomely from the ignorance of others. But often, in the technology space, a company’s decline is a gradual death. New product releases often lift the hopes of investors, but you cannot invest into a company based solely on a new product- that is too risky. Even the management team’s guidance, in its latest earnings transcript, fails to bring any real hope. The CFO stated that advertising spend increases will be at 50%, along with break-even revenues. The break-even revenues, plus the increase in advertising can be interpreted as advantageous news by some. But if the company were to miss its own guidance the stock could fall drastically.

For the company’s revenues to return to what they were in 2012, the company would have to double its sales from $6.6 billion to $13.8 billion. The likelihood of that happening is slim, even with a 50% increase in advertising spending.

The company is cutting costs to remain profitable, and in technology that’s like saying “we’re fending off the zombies by throwing one of the survivors into the pit so the rest of us can buy a little more time.”

What to invest in

Google is a terrific start. The company is heavily diversified: even if Motorola Mobility doesn’t become a smash-hit, it wouldn’t hurt Google much, as search advertising and web-based advertising continue to grow in the mid-teens. The company’s revenues from the Google Play store are likely to improve even further and catch up to Apple’s app store in the coming years. Giving Google several billion in high gross margin profit to cash in on, this seems far more reliable than waiting around for BlackBerry services to take off. Investors are banking on BlackBerry’s services becoming cross-platform compatible, but it just doesn’t compute financially as being a scalable business opportunity that represents any substantiating upside worth speculating on today.

Microsoft is another heavily diversified technology entity, even with the decline of the desktop computer. The company is hoping to make up for it through Windows 8 license sales through tablets. The company is well on track to winning the heart of consumers, as using a Windows product still feels familiar even with the changes from Windows 7 to Windows 8. The engineers over at Windows 8 have built an impressive computing experience that will give users a standardized experience across all computing form factors (tablet, phone, desktop, and laptop).

Microsoft’s consumer electronics division grew by 56% year-over-year in the first quarter, and with the launch of Xbox One, this rate of growth will improve even further. Skype is another bit of fantastic news as the number of Skype calls have grown by 56% year-over-year. The growth in consumer electronics and Skype calls is likely to continue.

Apple remains a compelling investment opportunity. The company plans to expand internationally and has increased its Apple store foot print around the world. Finally, there are rumored plans to sell devices at a cheaper price alongside the competition. The company is projected to grow its earnings by 20.88% on average over the next 5-years.

Conclusion

BlackBerry can cut some expenses to remain solvent over the short-term, but over the long-term BlackBerry needs to gain back some lost market share. BlackBerry’s business is too dependent on the success of its handsets. If BlackBerry misses earnings expectations for the full-year, the stock could fall drastically.

Alexander Cho has no position in any stocks mentioned. The Motley Fool recommends Apple and Google. The Motley Fool owns shares of Apple, Google, and Microsoft.

The article I Am Not Sold On BlackBerry’s Hype: Here Is Why originally appeared on Fool.com and is written by Alexander Cho.

Alexander is a member of The Motley Fool Blog Network — entries represent the personal opinion of the blogger and are not formally edited.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.