The wealth-building power of compound interest will never cease to amaze me. It’s a story of patience and attention to detail, where small, short-term differences add up to massive divergence over decades. And in the end, the biggest winners don’t always deliver the fattest share-price returns.

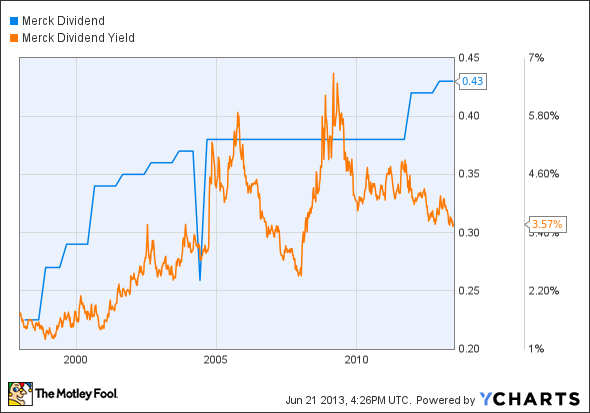

Today’s case in point is Merck & Co., Inc. (NYSE:MRK). The pharmaceutical giant’s quarterly dividend payout was stuck at $0.38 per share for many years until it started inching up again in 2012. At the same time, Merck shares went on a long upward run that ended up decreasing your dividend yields despite the higher payouts.

MRK Dividend data by YCharts.

So far, this looks like a terrible stock for income investors. Merck & Co., Inc. (NYSE:MRK)’s dividend yield is shrinking, and even the renewed payout growth remains anemic. Why bother?

Here’s why: Merck & Co., Inc. (NYSE:MRK)’s dividend was always generous. It doesn’t take much dividend growth or rising yields to make a big difference when you’re starting from a high base level.

Even now, at the end of the yield-reduction you saw in that last chart, Merck & Co., Inc. (NYSE:MRK) offers the third-richest yield among the 30 dividend-payers of the Dow Jones Industrial Average . At 3.7%, it’s nearly tied for third place with troubled chip titan Intel Corporation (NASDAQ:INTC), whose yield is enriched by the past year’s 9% share-price slide. Investors are worried about the death of the PC and Intel’s limited involvement in the new mobile-computing era.

Merck & Co., Inc. (NYSE:MRK) matches that yield despite a 23% higher share price, which acts as a headwind in this case.

Intel Corporation (NASDAQ:INTC) is a relative newcomer to the high-yield game, but Merck & Co., Inc. (NYSE:MRK) has plenty of shareholder-enriching history behind it. With the highly anticipated Baby Boomer retirement wave on the horizon, I wouldn’t be surprised to see Merck juicing its payouts with rising cash flows in coming years.

Now, back to the long-term patience we talked about earlier. It may be a wise move to lock in your base price today so you can enjoy the potential dividend increases to their full potential later on. To take a historical example, you could have bought Merck & Co., Inc. (NYSE:MRK) shares for $16.34 apiece 10 years ago. That was good for a 3.4% yield at the time — roughly comparable to today’s 3.7% dividend return.

Just sitting on your shares and collecting dividend checks would have given you $15.26 in cash since then — nearly enough to cover the cost of your original shares. The effective yield on your original shares would be a stellar 10.5% right now.