At Insider Monkey, we think that an investor can beat the market by imitating smart moves of big hedge funds into the top pick they are bullish on. We track around 750 hedge funds, among which is Kevin Kotler‘s Broadfin Capital, and we are going to take a look at four companies from its equity portfolio, including Horizon Pharma PLC (NASDAQ:HZNP), Flamel Technologies S.A. (ADR)(NASDAQ:FLML), AngioDynamics, Inc. (NASDAQ:ANGO), and Retrophin Inc (NASDAQ:RTRX).

Broadfin Capital is New York City-based hedge fund, which, at the end of June, held a portfolio that was worth $1.03 billion. The fund’s eight long positions in the companies that had a market cap of at least $1 billion, delivered a return of 15.38% in the third quarter. Although our measurements of a weighted average return differ from the fund’s actual return, because we exclude short positions and some other instruments, they still present a powerful tool when it comes to estimating whether or not it’s worth imitating the fund’s investment moves. With that in mind, let’s take a closer look at the fund’s investments moves in the above-mentioned four companies.

Let us start with a biopharmaceutical company, Horizon Pharma PLC (NASDAQ:HZNP), in which Broadfin Capital slightly raised its stake by adding 40,471 shares, ending the quarter with a $113.05 million position, containing 6.86 million shares. In the next three months, the stock advanced by 10.1%. At the end of the second quarter, a total of 27 funds tracked by Insider Monkey were long this stock, down by 23% from one quarter earlier. According to Insider Monkey’s hedge fund database, James E. Flynn’s Deerfield Management had the number one position in Horizon Pharma PLC (NASDAQ:HZNP), worth close to $226.3 million, comprising 8.9% of its total 13F portfolio. Some other professional money managers that were bullish consisted of Mark Kingdon’s Kingdon Capital, Rob Citrone’s Discovery Capital Management and Carl Goldsmith and Scott Klein’s Beach Point Capital Management.

Follow Horizon Therapeutics Public Ltd Co (NASDAQ:HZNP)

Follow Horizon Therapeutics Public Ltd Co (NASDAQ:HZNP)

Receive real-time insider trading and news alerts

In pharmaceutical company Flamel Technologies S.A. (ADR) (NASDAQ:FLML) Broadfin Capital kept the stake unchanged at 4.39 million shares worth $47.2 million at the end of June. Keeping the stake unchanged the company was a good move since, in the following three months, the shares gained 15.5%. Heading into the third quarter of 2016, 13 funds followed by our team held long positions in this stock, up by 30% from the previous quarter. One of the largest stakes in the company was reported by Deerfield Management,which held $43.7 million worth of stock. Other investors bullish on the company included Portolan Capital Management, Millennium Management, and VHCP Management.

Follow Avadel Pharmaceuticals Plc (NASDAQ:AVDL)

Follow Avadel Pharmaceuticals Plc (NASDAQ:AVDL)

Receive real-time insider trading and news alerts

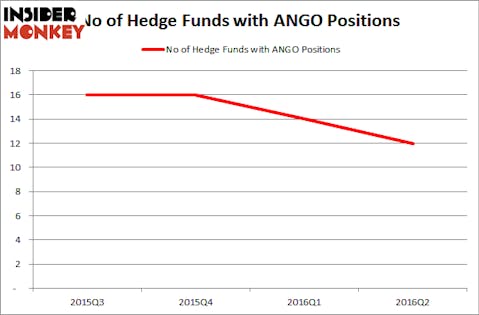

Broadfin Capital must have had positive expectations regarding AngioDynamics, Inc. (NASDAQ:ANGO) performance in the third quarter, since, during the second quarter, it had boosted its stake in the company by 44% to 3.61 million shares, which were worth $51.84 million. The bet paid off, as the stock brought a positive return of 22.1% during the third quarter. A total of 12 investors from our database held shares of AngioDynamics at the end of June, down by 14% over the quarter. Among the biggest shareholders of AngioDynamics, Inc. (NASDAQ:ANGO) was RGM Capital, which amassed a stake valued at $48.6 million. Royce & Associates, Renaissance Technologies, and D E Shaw also held valuable positions in the company.

Follow Angiodynamics Inc (NASDAQ:ANGO)

Follow Angiodynamics Inc (NASDAQ:ANGO)

Receive real-time insider trading and news alerts

The last stock we are going to examine in this article is Retrophin Inc (NASDAQ:RTRX), which returned 25.7% during the third quarter. In the second quarter, Broadfin had trimmed its exposure to the company by 10%, to 2.66 million shares, valued at $47.42 million. At the end of the second quarter, 18 funds followed by our team were bullish on this stock, down by 18% from the end of March. The largest stake in Retrophin Inc (NASDAQ:RTRX) was held by Scopia Capital, which reported holding $67.9 million worth of stock at the end of June. It was followed by Perceptive Advisors with a $58.4 million position. Other investors bullish on the company included Consonance Capital Management, and EcoR1 Capital.

Follow Travere Therapeutics Inc. (NASDAQ:TVTX)

Follow Travere Therapeutics Inc. (NASDAQ:TVTX)

Receive real-time insider trading and news alerts

Disclosure: None