Hedge funds and other institutional investors have just completed filing their 13Fs with the Securities and Exchange Commission, revealing their equity portfolios as of the end of September. At Insider Monkey, we follow over 700 of the best-performing investors and by analyzing their 13F filings, we can determine the stocks that they are collectively bullish on. One of their picks is NextEra Energy Inc (NYSE:NEE), so let’s take a closer look at the sentiment that surrounds it in the current quarter.

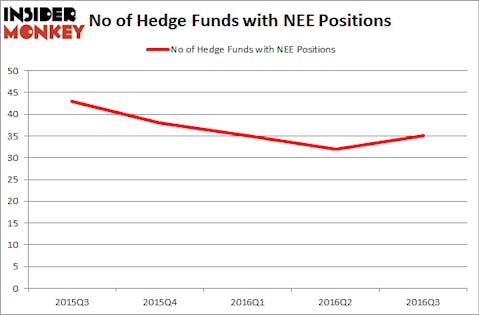

NextEra Energy Inc (NYSE:NEE) has actually seen an increase in support from the world’s most elite money managers in recent months. NEE was in 35 hedge funds’ portfolios at the end of September. There were 32 hedge funds in our database with NEE positions at the end of the previous quarter. At the end of this article we will also compare NEE to other stocks including American International Group Inc (NYSE:AIG), Duke Energy Corp (NYSE:DUK), and The Bank of Nova Scotia (USA) (NYSE:BNS) to get a better sense of its popularity.

Follow Nextera Energy Inc (NYSE:NEE)

Follow Nextera Energy Inc (NYSE:NEE)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

UbjsP/Shutterstock.com

Keeping this in mind, let’s check out the new action regarding NextEra Energy Inc (NYSE:NEE).

How have hedgies been trading NextEra Energy Inc (NYSE:NEE)?

At the end of the third quarter, a total of 35 of the hedge funds tracked by Insider Monkey were bullish on this stock, an increase of 9% from the previous quarter. With the smart money’s sentiment swirling, there exists a few notable hedge fund managers who were increasing their stakes considerably (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, Adage Capital Management, led by Phill Gross and Robert Atchinson, holds the largest position in NextEra Energy Inc (NYSE:NEE). The fund has a $166 million position in the stock, comprising 0.5% of its 13F portfolio. Sitting at the No. 2 spot is Jim Simons’ Renaissance Technologies which holds a $135 million position; the fund has 0.2% of its 13F portfolio invested in the stock. Remaining members of the smart money that hold long positions encompass Stuart J. Zimmer’s Zimmer Partners, Jonathan Barrett and Paul Segal’s Luminus Management and Cliff Asness’s AQR Capital Management.

As industrywide interest jumped, some big names have been driving this bullishness. Zimmer Partners, managed by Stuart J. Zimmer, created the biggest position in NextEra Energy Inc (NYSE:NEE). The fund had $91.5 million invested in the company at the end of the quarter. Jonathan Barrett and Paul Segal’s Luminus Management also initiated a $68.5 million position during the quarter. The other funds with new positions in the stock are John Burbank’s Passport Capital, Jos Shaver’s Electron Capital Partners, and David Harding’s Winton Capital Management.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as NextEra Energy Inc (NYSE:NEE) but similarly valued. We will take a look at American International Group Inc (NYSE:AIG), Duke Energy Corp (NYSE:DUK), The Bank of Nova Scotia (USA) (NYSE:BNS), and Eni SpA (ADR) (NYSE:E). All of these stocks’ market caps are closest to NEE’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| AIG | 82 | 6994716 | -3 |

| DUK | 19 | 640205 | 1 |

| BNS | 14 | 272621 | -1 |

| E | 4 | 24526 | -2 |

As you can see these stocks had an average of 30 hedge funds with bullish positions and the average amount invested in these stocks was $1.98 billion. That figure was a modest $997 million in NEE’s case. American International Group Inc (NYSE:AIG) is the most popular stock in this table. On the other hand Eni SpA (ADR) (NYSE:E) is the least popular one with only 4 bullish hedge fund positions. NextEra Energy Inc (NYSE:NEE) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard AIG might be a better candidate to consider taking a long position in.

Disclosure: none.