The 700+ hedge funds and money managers tracked by Insider Monkey have already compiled and submitted their 13F filings for the third quarter, which unveil their equity positions as of September 30. We went through these filings, fixed typos and other more significant errors and identified the changes in hedge fund positions. Our extensive review of these public filings is finally over, so this article is set to reveal the smart money sentiment towards TPG Specialty Lending Inc (NYSE:TSLX).

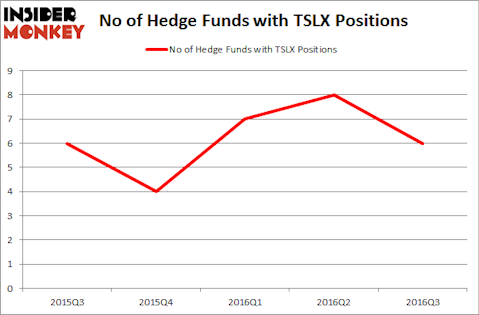

TPG Specialty Lending Inc (NYSE:TSLX) was in 6 hedge funds’ portfolios at the end of the third quarter of 2016. TSLX shareholders have witnessed a decrease in hedge fund sentiment recently. There were 8 hedge funds in our database with TSLX holdings at the end of the previous quarter. At the end of this article we will also compare TSLX to other stocks including The Spectranetics Corporation (NASDAQ:SPNC), Merit Medical Systems, Inc. (NASDAQ:MMSI), and WSFS Financial Corporation (NASDAQ:WSFS) to get a better sense of its popularity.

Follow Sixth Street Specialty Lending Inc. (NYSE:TSLX)

Follow Sixth Street Specialty Lending Inc. (NYSE:TSLX)

Receive real-time insider trading and news alerts

We follow over 700 hedge funds and other institutional investors and by analyzing their quarterly 13F filings, we identify stocks that they are collectively bullish on and develop investment strategies based on this data. One strategy that outperformed the market over the last year involves selecting the 100 best-performing funds and identifying the 30 mid-cap stocks that they are collectively most bullish on. Over the past year, this strategy generated returns of 18%, topping the 8% gain registered by S&P 500 ETFs. We launched this strategy 2.5 years ago and it returned more than 39% since then, vs. 22% gain registered by the S&P 500 ETFs.

Nonwarit/Shutterstock.com

Now, let’s check out the latest action encompassing TPG Specialty Lending Inc (NYSE:TSLX).

What does the smart money think about TPG Specialty Lending Inc (NYSE:TSLX)?

At Q3’s end, a total of 6 of the hedge funds tracked by Insider Monkey held long positions in this stock, fell by 25% from the second quarter of 2016. The graph below displays the number of hedge funds with bullish position in TSLX over the last 5 quarters. With hedge funds’ capital changing hands, there exists a few key hedge fund managers who were increasing their stakes considerably (or already accumulated large positions).

Of the funds tracked by Insider Monkey, Israel Englander’s Millennium Management, one of the largest hedge funds in the world, has the biggest position in TPG Specialty Lending Inc (NYSE:TSLX), worth close to $4 million. The second largest stake is held by D E Shaw’s D E Shaw, holding a $3.2 million position. Remaining hedge funds and institutional investors that are bullish include Robert B. Gillam’s McKinley Capital Management, Robert Raiff’s Raiff Partners and Millennium Management. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.

Now that we’ve mentioned the most bullish investors, let’s also take a look at some funds that cashed in their entire stakes in the stock during the third quarter. Intriguingly, Michael Johnston’s Steelhead Partners cashed in the biggest investment of all the investors followed by Insider Monkey, totaling close to $0.4 million in stock, and Ken Griffin’s Citadel Investment Group was right behind this move, as the fund sold off about $0.2 million worth of shares.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as TPG Specialty Lending Inc (NYSE:TSLX) but similarly valued. We will take a look at The Spectranetics Corporation (NASDAQ:SPNC), Merit Medical Systems, Inc. (NASDAQ:MMSI), WSFS Financial Corporation (NASDAQ:WSFS), and Universal Electronics Inc (NASDAQ:UEIC). This group of stocks’ market values are closest to TSLX’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SPNC | 25 | 160116 | 7 |

| MMSI | 16 | 63862 | -2 |

| WSFS | 14 | 78779 | 2 |

| UEIC | 9 | 29656 | 1 |

As you can see these stocks had an average of 16 hedge funds with bullish positions and the average amount invested in these stocks was $83 million. That figure was $16 million in TSLX’s case. The Spectranetics Corporation (NASDAQ:SPNC) is the most popular stock in this table. On the other hand Universal Electronics Inc (NASDAQ:UEIC) is the least popular one with only 9 bullish hedge fund positions. Compared to these stocks TPG Specialty Lending Inc (NYSE:TSLX) is even less popular than UEIC. Considering that hedge funds aren’t fond of this stock in relation to other companies analyzed in this article, it may be a good idea to analyze it in detail and understand why the smart money isn’t behind this stock. This isn’t necessarily bad news. Although it is possible that hedge funds may think the stock is overpriced and view the stock as a short candidate, they may not be very familiar with the bullish thesis. In either case more research is warranted.

Suggested Articles:

Jobs For Police Officers In The Private Sector

Easiest Countries To Register A Company

Most Expensive Furniture Brands In The World

Disclosure: None