Earlier this year, many hedge funds were holding a larger percentage of their assets in cash than at any other time in recent memory, as fears that the market was due for a correction abounded. This led to many small-cap stocks being hit hard, as hedge funds, which tend to be some of their staunchest backers, liquidated their holdings. Now however, hedge funds appear to be growing more confident and putting their money back into equities, which has led to small-cap stocks taking off, with the Russell 2000 ETF (IWM) having outperformed the S&P 500 ETF (SPY) by more than 10 percentage points since the end of June. In this article, we’ll see how this large shift in hedge fund activity impacted Panera Bread Co (NASDAQ:PNRA).

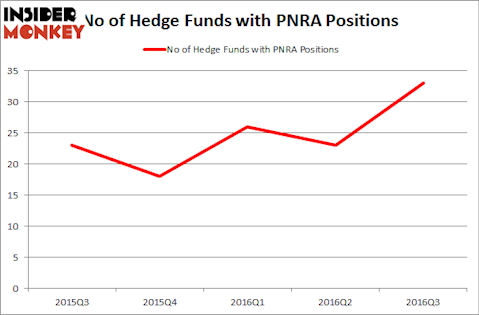

Is Panera Bread Co (NASDAQ:PNRA) a buy right now? The best stock pickers are in a bullish mood. The number of long hedge fund bets increased by 10 lately. PNRA was in 33 hedge funds’ portfolios at the end of September. There were 23 hedge funds in our database with PNRA positions at the end of the previous quarter. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as RenaissanceRe Holdings Ltd. (NYSE:RNR), Old Republic International Corporation (NYSE:ORI), and Voya Financial Inc (NYSE:VOYA) to gather more data points.

Follow Panera Bread Co (NASDAQ:PNRA)

Follow Panera Bread Co (NASDAQ:PNRA)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

Copyright: wolterk / 123RF Stock Photo

How have hedgies been trading Panera Bread Co (NASDAQ:PNRA)?

At the end of the third quarter, a total of 33 of the hedge funds tracked by Insider Monkey were bullish on this stock, a 43% leap from the second quarter of 2016, after several volatile quarters of hedge fund trading in the stock. With hedge funds’ positions undergoing their usual ebb and flow, there exists a select group of notable hedge fund managers who were upping their stakes substantially (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, Principal Global Investors’ Columbus Circle Investors has the biggest position in Panera Bread Co (NASDAQ:PNRA), worth close to $83.3 million. Sitting at the No. 2 spot is Conatus Capital Management, led by David Stemerman, holding a $57.5 million position. Remaining members of the smart money with similar optimism encompass Israel Englander’s Millennium Management, Jim Simons’ Renaissance Technologies, and James Crichton’s Hitchwood Capital Management.