Legendary investors such as Leon Cooperman and Seth Klarman earn enormous amounts of money for themselves and their investors by doing in-depth research on small-cap stocks that big brokerage houses don’t publish. Small cap stocks -especially when they are screened well- can generate substantial outperformance versus a boring index fund. That’s why we analyze the activity of those successful funds in these small-cap stocks. In the following paragraphs, we analyze Penn National Gaming, Inc (NASDAQ:PENN) from the perspective of those successful funds.

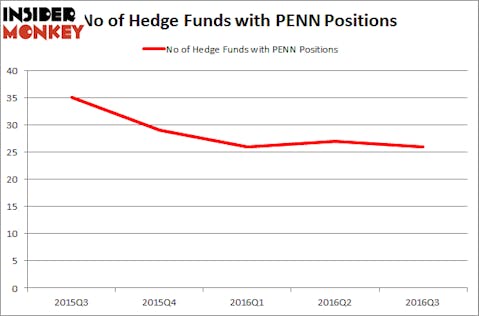

Penn National Gaming, Inc (NASDAQ:PENN) investors should be aware of a decrease in activity from the world’s largest hedge funds in recent months. PENN was in 26 hedge funds’ portfolios at the end of September. There were 27 hedge funds in our database with PENN positions at the end of the previous quarter. At the end of this article we will also compare PENN to other stocks including Popeyes Louisiana Kitchen Inc (NASDAQ:PLKI), BancFirst Corporation (NASDAQ:BANF), and First Bancorp (NYSE:FBP) to get a better sense of its popularity.

Follow Penn Entertainment Inc. (NASDAQ:PENN)

Follow Penn Entertainment Inc. (NASDAQ:PENN)

Receive real-time insider trading and news alerts

We care about hedge fund sentiment because historically hedge funds’ stock picks delivered strong risk adjusted returns. There are certain segments of the market where hedge funds’ stock picks performed much better than its benchmarks. For instance, the 30 most popular mid-cap stocks among the best performing hedge funds returned 18% over the last 12 months outpacing S&P 500 Index by more than 10 percentage points. We developed this strategy 2.5 years ago and started sharing its picks in our quarterly newsletter. It bested the S&P 500 Index ETFs by delivering a solid 39% vs. 22% gain for its benchmarks.

magicinfoto / Shutterstock.com

What does the smart money think about Penn National Gaming, Inc (NASDAQ:PENN)?

At Q3’s end, a total of 26 of the hedge funds tracked by Insider Monkey held long positions in this stock, a drop of 4% from one quarter earlier. On the other hand, there were a total of 29 hedge funds with a bullish position in PENN at the beginning of this year. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

When looking at the institutional investors followed by Insider Monkey, Dmitry Balyasny’s Balyasny Asset Management has the number one position in Penn National Gaming, Inc (NASDAQ:PENN), worth close to $51.8 million. The second most bullish fund manager is Parag Vora of HG Vora Capital Management, with a $45.5 million position; the fund has 5.9% of its 13F portfolio invested in the stock. Other peers that are bullish contain Paul Reeder and Edward Shapiro’s PAR Capital Management, Jim Simons’ Renaissance Technologies and Steven Tananbaum’s GoldenTree Asset Management. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.