It seems that the masses and most of the financial media hate hedge funds and what they do, but why is this hatred of hedge funds so prominent? At the end of the day, these asset management firms do not gamble the hard-earned money of the people who are on the edge of poverty. Truth be told, most hedge fund managers and other smaller players within this industry are very smart and skilled investors. Of course, they may also make wrong bets in some instances, but no one knows what the future holds and how market participants will react to the bountiful news that floods in each day. The S&P 500 Index gained 7.6% in the 12 month-period that ended November 21, while less than 49% of its stocks beat the benchmark. In contrast, the 30 most popular mid-cap stocks among the top hedge fund investors tracked by the Insider Monkey team returned 18% over the same period, which provides evidence that these money managers do have great stock picking abilities. That’s why we believe it isn’t a waste of time to check out hedge fund sentiment before you invest in a stock like Franklin Electric Co. (NASDAQ:FELE).

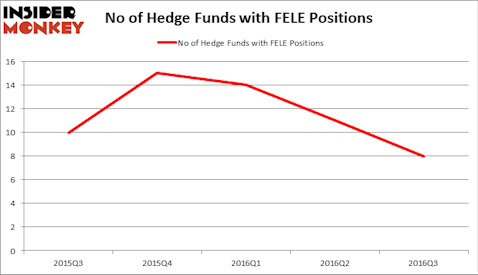

Franklin Electric Co. (NASDAQ:FELE) has seen a decrease in hedge fund interest in recent months. FELE was in 8 hedge funds’ portfolios at the end of September. There were 11 hedge funds in our database with FELE holdings at the end of the previous quarter. At the end of this article we will also compare FELE to other stocks including G&K Services Inc (NASDAQ:GK), Advanced Energy Industries, Inc. (NASDAQ:AEIS), and Lexicon Pharmaceuticals, Inc. (NASDAQ:LXRX) to get a better sense of its popularity.

Follow Franklin Electric Co Inc (NASDAQ:FELE)

Follow Franklin Electric Co Inc (NASDAQ:FELE)

Receive real-time insider trading and news alerts

We care about hedge fund sentiment because historically hedge funds’ stock picks delivered strong risk adjusted returns. There are certain segments of the market where hedge funds’ stock picks performed much better than its benchmarks. For instance, the 30 most popular mid-cap stocks among the best performing hedge funds returned 18% over the last 12 months outpacing S&P 500 Index by more than 10 percentage points. We developed this strategy 2.5 years ago and started sharing its picks in our quarterly newsletter. It bested the S&P 500 Index ETFs by delivering a solid 39% vs. 22% gain for its benchmarks.

crystal51/Shutterstock.com

How have hedgies been trading Franklin Electric Co. (NASDAQ:FELE)?

Heading into the fourth quarter of 2016, a total of 8 of the hedge funds tracked by Insider Monkey were bullish on this stock, down by 27% from the previous quarter. On the other hand, there were a total of 15 hedge funds with a bullish position in FELE at the beginning of this year. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Chuck Royce’s Royce & Associates has the number one position in Franklin Electric Co. (NASDAQ:FELE), worth close to $51.8 million. The second largest stake is held by Impax Asset Management, led by Ian Simm, holding a $48 million position; the fund has 2.2% of its 13F portfolio invested in the stock. Some other hedge funds and institutional investors that are bullish encompass Mario Gabelli’s GAMCO Investors, Jeffrey Bronchick’s Cove Street Capital and Michael Platt and William Reeves’ BlueCrest Capital Mgmt. We should note that Impax Asset Management is among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.

Due to the fact that Franklin Electric Co. (NASDAQ:FELE) has experienced falling interest from the aggregate hedge fund industry, it’s easy to see that there is a sect of hedge funds that decided to sell off their full holdings heading into Q4. It’s worth mentioning that Ken Griffin’s Citadel Investment Group dumped the biggest stake of all the hedgies studied by Insider Monkey, valued at close to $2 million in stock, and Millennium Management, one of the 10 largest hedge funds in the world, was right behind this move, as the fund said goodbye to about $0.8 million worth of shares.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as Franklin Electric Co. (NASDAQ:FELE) but similarly valued. We will take a look at G&K Services Inc (NASDAQ:GK), Advanced Energy Industries, Inc. (NASDAQ:AEIS), Lexicon Pharmaceuticals, Inc. (NASDAQ:LXRX), and HMS Holdings Corp. (NASDAQ:HMSY). This group of stocks’ market caps resemble FELE’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| GK | 11 | 169989 | 0 |

| AEIS | 16 | 151847 | 0 |

| LXRX | 18 | 113394 | 1 |

| HMSY | 19 | 98394 | 0 |

As you can see these stocks had an average of 16 hedge funds with bullish positions and the average amount invested in these stocks was $133 million. That figure was $127 million in FELE’s case. HMS Holdings Corp. (NASDAQ:HMSY) is the most popular stock in this table. On the other hand G&K Services Inc (NASDAQ:GK) is the least popular one with only 11 bullish hedge fund positions. Compared to these stocks Franklin Electric Co. (NASDAQ:FELE) is even less popular than GK. Considering that hedge funds aren’t fond of this stock in relation to other companies analyzed in this article, it may be a good idea to analyze it in detail and understand why the smart money isn’t behind this stock. This isn’t necessarily bad news. Although it is possible that hedge funds may think the stock is overpriced and view the stock as a short candidate, they may not be very familiar with the bullish thesis. In either case more research is warranted.

Disclosure: None