Hedge Funds and other institutional investors have just completed filing their 13Fs with the Securities and Exchange Commission, revealing their equity portfolios as of the end of September. At Insider Monkey, we follow over 700 of the best-performing investors and by analyzing their 13F filings, we can determine the stocks that they are collectively bullish on. One of their picks is TransDigm Group Incorporated (NYSE:TDG), so let’s take a closer look at the sentiment that surrounds it in the current quarter.

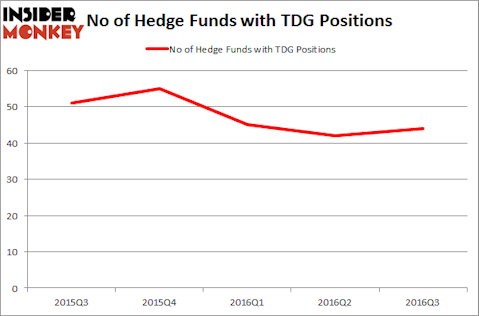

TransDigm Group Incorporated (NYSE:TDG) was in 44 hedge funds’ portfolios at the end of September. TDG investors should be aware of an increase in support from the world’s most elite money managers recently. There were 42 hedge funds in our database with TDG positions at the end of the previous quarter. At the end of this article we will also compare TDG to other stocks including Freeport-McMoRan Copper & Gold Inc. (NYSE:FCX), Check Point Software Technologies Ltd. (NASDAQ:CHKP), and W.W. Grainger, Inc. (NYSE:GWW) to get a better sense of its popularity.

Follow Transdigm Group Inc (NYSE:TDG)

Follow Transdigm Group Inc (NYSE:TDG)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

Copyright: chalabala / 123RF Stock Photo

With all of this in mind, we’re going to take a gander at the latest action surrounding TransDigm Group Incorporated (NYSE:TDG).

What does the smart money think about TransDigm Group Incorporated (NYSE:TDG)?

Heading into the fourth quarter of 2016, a total of 44 of the hedge funds tracked by Insider Monkey were bullish on this stock, a 5% bump from the second quarter of 2016. With hedgies’ sentiment swirling, there exists a select group of noteworthy hedge fund managers who were increasing their holdings substantially (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, Lone Pine Capital, managed by Stephen Mandel, holds the number one position in TransDigm Group Incorporated (NYSE:TDG). Lone Pine Capital has a $650.7 million position in the stock, comprising 2.9% of its 13F portfolio. Coming in second is Sharlyn C. Heslam of Stockbridge Partners, with a $440.4 million position; 21.2% of its 13F portfolio is allocated to the company. Remaining peers with similar optimism contain Robert Joseph Caruso’s Select Equity Group, Dan Loeb’s Third Point and John Griffin’s Blue Ridge Capital.

As industry-wide interest jumped, key money managers were leading the bulls’ herd. Citadel Investment Group, managed by Ken Griffin, established the largest call position in TransDigm Group Incorporated (NYSE:TDG). Citadel Investment Group had $5.9 million invested in the company at the end of the quarter. Anand Parekh’s Alyeska Investment Group also initiated a $3.2 million position during the quarter. The other funds with new positions in the stock are Ben Levine, Andrew Manuel and Stefan Renold’s LMR Partners, Alec Litowitz and Ross Laser’s Magnetar Capital, and George Hall’s Clinton Group.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as TransDigm Group Incorporated (NYSE:TDG) but similarly valued. We will take a look at Freeport-McMoRan Copper & Gold Inc. (NYSE:FCX), Check Point Software Technologies Ltd. (NASDAQ:CHKP), W.W. Grainger, Inc. (NYSE:GWW), and Loews Corporation (NYSE:L). This group of stocks’ market caps are closest to TDG’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| FCX | 36 | 1550951 | 6 |

| CHKP | 35 | 1013225 | 4 |

| GWW | 17 | 186511 | -2 |

| L | 21 | 319227 | -2 |

As you can see these stocks had an average of 27.25 hedge funds with bullish positions and the average amount invested in these stocks was $767 million. That figure was $3.48 billion in TDG’s case. Freeport-McMoRan Copper & Gold Inc. (NYSE:FCX) is the most popular stock in this table. On the other hand W.W. Grainger, Inc. (NYSE:GWW) is the least popular one with only 17 bullish hedge fund positions. Compared to these stocks TransDigm Group Incorporated (NYSE:TDG) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers and have a lot of money invested into it, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Disclosure: None