The 700+ hedge funds and money managers tracked by Insider Monkey have already compiled and submitted their 13F filings for the third quarter, which unveil their equity positions as of September 30. We went through these filings, fixed typos and other more significant errors and identified the changes in hedge fund positions. Our extensive review of these public filings is finally over, so this article is set to reveal the smart money sentiment towards Scientific Games Corp (NASDAQ:SGMS).

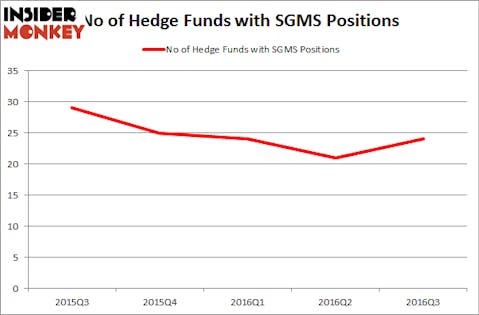

Scientific Games Corp (NASDAQ:SGMS) was in 24 hedge funds’ portfolios at the end of September. SGMS investors should be aware of an increase in enthusiasm from smart money of late. There were 21 hedge funds in our database with SGMS positions at the end of the previous quarter. At the end of this article we will also compare SGMS to other stocks including Trueblue Inc (NYSE:TBI), The Spectranetics Corporation (NASDAQ:SPNC), and Sun Hydraulics Corporation (NASDAQ:SNHY) to get a better sense of its popularity.

Follow Light & Wonder Inc. (NASDAQ:ASX:LNW)

Follow Light & Wonder Inc. (NASDAQ:ASX:LNW)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

Adam Ziaja / Shutterstock.com

What have hedge funds been doing with Scientific Games Corp (NASDAQ:SGMS)?

At Q3’s end, a total of 24 of the hedge funds tracked by Insider Monkey held long positions in this stock, up by 14% from one quarter earlier, which followed three quarters of declining ownership. With the smart money’s sentiment swirling, there exists a select group of noteworthy hedge fund managers who were boosting their holdings substantially (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Fine Capital Partners, managed by Debra Fine, holds the largest position in Scientific Games Corp (NASDAQ:SGMS). According to regulatory filings, the fund has an $84.4 million position in the stock, comprising 8.7% of its 13F portfolio. Coming in second is Nantahala Capital Management, led by Wilmot B. Harkey and Daniel Mack, holding a $51.8 million position of call options underlying SGMS shares; 6.2% of its 13F portfolio is allocated to the holding. Remaining members of the smart money that hold long positions contain Paul Reeder and Edward Shapiro’s PAR Capital Management and Adam Wolfberg and Steven Landry’s EastBay Asset Management.

With general bullishness amongst the heavyweights, key hedge funds were breaking ground themselves. Claar Advisors, managed by Gary Claar, initiated the most valuable position in Scientific Games Corp (NASDAQ:SGMS). The fund reportedly had $4.5 million invested in the company at the end of September. Eric Semler’s TCS Capital Management also initiated a $3.6 million position during the quarter. The other funds with new positions in the stock are Don Morgan’s Brigade Capital, Peter S. Park’s Park West Asset Management, and Matthew Hulsizer’s PEAK6 Capital Management.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Scientific Games Corp (NASDAQ:SGMS) but similarly valued. We will take a look at Trueblue Inc (NYSE:TBI), The Spectranetics Corporation (NASDAQ:SPNC), Sun Hydraulics Corporation (NASDAQ:SNHY), and Unit Corporation (NYSE:UNT). This group of stocks’ market caps are similar to SGMS’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| TBI | 11 | 120067 | -4 |

| SPNC | 25 | 160116 | 7 |

| SNHY | 5 | 95714 | -2 |

| UNT | 17 | 67434 | 3 |

As you can see these stocks had an average of 15 hedge funds with bullish positions and the average amount invested in these stocks was $111 million. That figure was $353 million in SGMS’s case. The Spectranetics Corporation (NASDAQ:SPNC) is the most popular stock in this table. On the other hand Sun Hydraulics Corporation (NASDAQ:SNHY) is the least popular one with only 5 bullish hedge fund positions. Scientific Games Corp (NASDAQ:SGMS) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard SPNC might be a better candidate to consider a long position in.

Disclosure: None