Hedge funds are not perfect. They have their bad picks just like everyone else. Valeant, a stock hedge funds have loved, lost 79% during the last 12 months ending in November 21. Although hedge funds are not perfect, their consensus picks do deliver solid returns, however. Our data show the top 30 mid-cap stocks among the best performing hedge funds yielded an average return of 18% in the same time period, vs. a gain of 7.6% for the S&P 500 Index. Because hedge funds have a lot of resources and their consensus picks do well, we pay attention to what they think. In this article, we analyze what smart money investors think about Southwest Airlines Co. (NYSE:LUV).

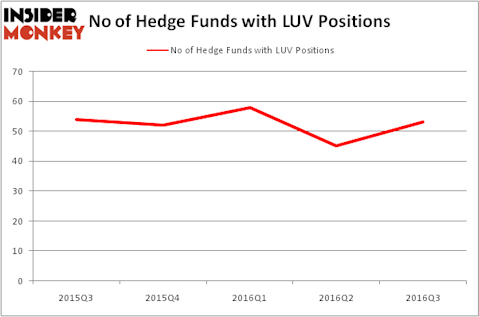

Southwest Airlines Co. (NYSE:LUV) investors should be aware of an increase in enthusiasm from smart money lately. Southwest was included in the equity portfolios of 53 funds from our database at the end of September. By comparison, there 45 funds with LUV positions at the end of the previous quarter. However, the level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Baxter International Inc. (NYSE:BAX), China Unicom (Hong Kong) Limited (ADR) (NYSE:CHU), and CSX Corporation (NYSE:CSX) to gather more data points.

Follow Southwest Airlines Co (NYSE:LUV)

Follow Southwest Airlines Co (NYSE:LUV)

Receive real-time insider trading and news alerts

Today there are a lot of indicators shareholders can use to grade their holdings. A couple of the most underrated indicators are hedge fund and insider trading indicators. We have shown that, historically, those who follow the best picks of the best fund managers can trounce the broader indices by a very impressive amount (see the details here).

06photo/Shutterstock.com

With all of this in mind, we’re going to take a look at the key action regarding Southwest Airlines Co. (NYSE:LUV).

Hedge fund activity in Southwest Airlines Co. (NYSE:LUV)

At the end of September, a total of 53 funds tracked by Insider Monkey were long this stock, up by 18% from the end of the second quarter. With hedgies’ capital changing hands, there exists a select group of noteworthy hedge fund managers who were increasing their stakes considerably (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, John Armitage’s Egerton Capital Limited has the biggest position in Southwest Airlines Co. (NYSE:LUV), worth close to $473.1 million, comprising 5.4% of its total 13F portfolio. Coming in second is Cliff Asness’ AQR Capital Management, with a $256.6 million position; the fund has 0.4% of its 13F portfolio invested in the stock. Other peers with similar optimism consist of Paul Reeder and Edward Shapiro’s PAR Capital Management, Doug Silverman and Alexander Klabin’s Senator Investment Group and Robert Polak’s Anchor Bolt Capital.