Is Dell Technologies Inc (NYSE:DVMT) a good equity to bet on right now? We like to check what the smart money thinks first before doing extensive research. Although there have been several high profile failed hedge fund picks, the consensus picks among hedge fund investors have historically outperformed the market after adjusting for known risk attributes. It’s not surprising given that hedge funds have access to better information and more resources to find the latest market-moving information.

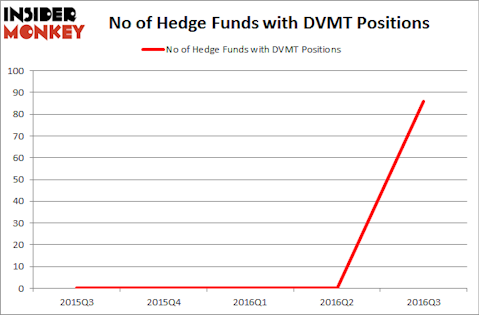

Dell Technologies Inc (NYSE:DVMT) investors should be aware of an increase in hedge fund sentiment lately. There were no hedge funds in our database with DVMT holdings at the end of the previous quarter. At the end of this article we will also compare DVMT to other stocks including Annaly Capital Management, Inc. (NYSE:NLY), Restaurant Brands International Inc (NYSE:QSR), and Discovery Communications Inc. (NASDAQ:DISCK) to get a better sense of its popularity.

Follow Dell Technologies Inc. (NYSE:DELL)

Follow Dell Technologies Inc. (NYSE:DELL)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

manaemedia / Shutterstock.com

Now, let’s analyze the new action encompassing Dell Technologies Inc (NYSE:DVMT).

Hedge fund activity in Dell Technologies Inc (NYSE:DVMT)

At Q3’s end, a total of 86 of the hedge funds tracked by Insider Monkey were long this stock, up from 0 positions at the end of the previous quarter. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Elliott Management, led by Paul Singer, holds the biggest position in Dell Technologies Inc (NYSE:DVMT). According to regulatory filings, the fund has a $346 million position in the stock, comprising 2.8% of its 13F portfolio. Coming in second is Seth Klarman of Baupost Group, with a $318 million position; the fund has 4.5% of its 13F portfolio invested in the stock. Some other professional money managers that are bullish consist of William B. Gray’s Orbis Investment Management, Matthew Halbower’s Pentwater Capital Management and D. E. Shaw’s D E Shaw. We should note that Orbis Investment Management is among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.

As aggregate interest increased, key hedge funds were leading the bulls’ herd. JANA Partners, led by Barry Rosenstein, created the most outsized position in Dell Technologies Inc (NYSE:DVMT). According to its latest 13F filing, the fund had $144 million invested in the company at the end of the quarter. Scott Ferguson’s Sachem Head Capital also made a $112 million investment in the stock during the quarter.

Let’s now take a look at hedge fund activity in other stocks similar to Dell Technologies Inc (NYSE:DVMT). We will take a look at Annaly Capital Management, Inc. (NYSE:NLY), Restaurant Brands International Inc (NYSE:QSR), Discovery Communications Inc. (NASDAQ:DISCK), and SCANA Corporation (NYSE:SCG). This group of stocks’ market valuations are closest to DVMT’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| NLY | 13 | 120034 | -4 |

| QSR | 32 | 3143758 | 1 |

| DISCK | 21 | 280090 | -3 |

| SCG | 18 | 254061 | 2 |

As you can see these stocks had an average of 21 hedge funds with bullish positions and the average amount invested in these stocks was $949 million. That figure was an impressive $3.59 billion in DVMT’s case. Restaurant Brands International Inc (NYSE:QSR) is the most popular stock in this table. On the other hand Annaly Capital Management, Inc. (NYSE:NLY) is the least popular one with only 13 bullish hedge fund positions. Compared to these stocks Dell Technologies Inc (NYSE:DVMT) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Disclosure: None