Our extensive research has shown that imitating the smart money can generate significant returns for retail investors, which is why we track more than 700 prominent money managers and analyze their quarterly 13F filings. The stocks that are heavily bought by hedge funds historically outperformed the market, though there is no shortage of high profile gigantic failures like hedge funds’ recent losses in Valeant. Let’s take a closer look at what the funds we track think about Stryker Corporation (NYSE:SYK) in this article.

Stryker Corporation (NYSE:SYK) shareholders have witnessed an increase in activity from the world’s largest hedge funds recently. At the end of this article we will also compare SYK to other stocks including Public Storage (NYSE:PSA), Caterpillar Inc. (NYSE:CAT), and Paypal Holdings Inc (NASDAQ:PYPL) to get a better sense of its popularity.

Follow Stryker Corp (NYSE:SYK)

Follow Stryker Corp (NYSE:SYK)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

everything possible/Shutterstock.com

Keeping this in mind, we’re going to go over the fresh action encompassing Stryker Corporation (NYSE:SYK).

How have hedgies been trading Stryker Corporation (NYSE:SYK)?

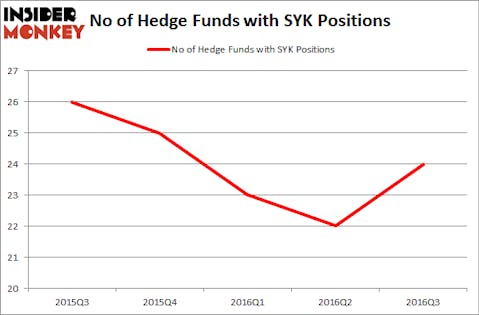

Heading into the fourth quarter of 2016, a total of 24 of the hedge funds tracked by Insider Monkey held long positions in this stock, up 9% from the second quarter of 2016. With hedge funds’ sentiment swirling, there exists an “upper tier” of noteworthy hedge fund managers who were boosting their holdings meaningfully (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Donald Yacktman’s Yacktman Asset Management has the biggest position in Stryker Corporation (NYSE:SYK), worth close to $147.2 million and comprising 1.3% of its total 13F portfolio. Coming in second is Alyeska Investment Group, led by Anand Parekh, holding a $111.8 million position; 1.1% of its 13F portfolio is allocated to the company. Remaining peers that are bullish encompass Ric Dillon’s Diamond Hill Capital, Israel Englander’s Millennium Management and Phill Gross and Robert Atchinson’s Adage Capital Management.