Investing in hedge funds can bring large profits, but it’s not for everybody, since hedge funds are available only for high-net-worth individuals. They generate significant returns for investors to justify their large fees and they allocate a lot of time and employ a complex analysis to determine the best stocks to invest in. A particularly interesting group of stocks that hedge funds like is the small-caps. The huge amount of capital does not allow hedge funds to invest a lot in small-caps, but our research showed that their most popular small-cap ideas are less efficiently priced and generate stronger returns than their large- and mega-cap picks and the broader market. That is why we follow the hedge fund activity in the small-cap space.

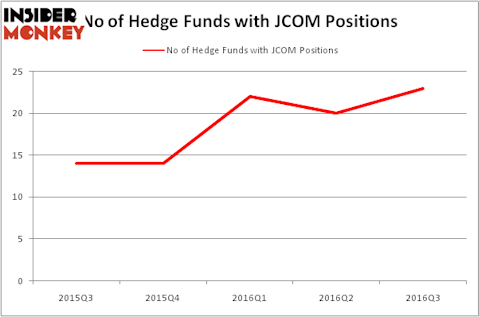

Is J2 Global Inc (NASDAQ:JCOM) going to take off soon? Prominent investors are betting on the stock. The number of bullish hedge fund bets went up by 3 recently. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as OneMain Holdings Inc (NYSE:OMF), Yanzhou Coal Mining Co Ltd (ADR) (NYSE:YZC), and Gerdau SA (ADR) (NYSE:GGB) to gather more data points.

Follow Ziff Davis Inc. (NASDAQ:ZD)

Follow Ziff Davis Inc. (NASDAQ:ZD)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

Now, we’re going to take a look at the fresh action regarding J2 Global Inc (NASDAQ:JCOM).

How have hedgies been trading J2 Global Inc (NASDAQ:JCOM)?

At the end of the third quarter, a total of 23 of the hedge funds tracked by Insider Monkey were long this stock, up by 15% from the second quarter of 2016. With the smart money’s capital changing hands, there exists a few key hedge fund managers who were upping their holdings considerably (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, Cardinal Capital, managed by Amy Minella, holds the number one position in J2 Global Inc (NASDAQ:JCOM). According to regulatory filings, the fund has a $41.6 million position in the stock, comprising 1.9% of its 13F portfolio. The second most bullish fund manager is Chuck Royce of Royce & Associates, with a $24.7 million position; 0.2% of its 13F portfolio is allocated to the stock. Other professional money managers with similar optimism consist of Joel Greenblatt’s Gotham Asset Management, Cliff Asness’s AQR Capital Management and Glenn Russell Dubin’s Highbridge Capital Management.

As one would reasonably expect, specific money managers were leading the bulls’ herd. Hutchin Hill Capital, managed by Neil Chriss, established the largest position in J2 Global Inc (NASDAQ:JCOM). According to its latest 13F filing, the fund had $1.8 million invested in the company at the end of the quarter. Peter Algert and Kevin Coldiron’s Algert Coldiron Investors also initiated a $0.5 million position during the quarter. The other funds with new positions in the stock are Andrew Feldstein and Stephen Siderow’s Blue Mountain Capital, Ken Griffin’s Citadel Investment Group, and Gavin Saitowitz and Cisco J. del Valle’s Springbok Capital.

Let’s now take a look at hedge fund activity in other stocks similar to J2 Global Inc (NASDAQ:JCOM). These stocks are OneMain Holdings Inc (NYSE:OMF), Yanzhou Coal Mining Co Ltd (ADR) (NYSE:YZC), Gerdau SA (ADR) (NYSE:GGB), and Valmont Industries, Inc. (NYSE:VMI). All of these stocks’ market caps resemble JCOM’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| OMF | 19 | 308132 | -1 |

| YZC | 2 | 3494 | -1 |

| GGB | 11 | 118035 | -2 |

| VMI | 21 | 341199 | -2 |

As you can see these stocks had an average of 13 hedge funds with bullish positions and the average amount invested in these stocks was $193 million. That figure was $184 million in JCOM’s case. Valmont Industries, Inc. (NYSE:VMI) is the most popular stock in this table. On the other hand Yanzhou Coal Mining Co Ltd (ADR) (NYSE:YZC) is the least popular one with only 2 bullish hedge fund positions. Compared to these stocks J2 Global Inc (NASDAQ:JCOM) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Disclosure: none.