Below, I compiled a list of George Soros’ dividend stock picks from Soros Fund Management LLC’s most recent 13-F filing. Soros had more than $10 million invested in each stock in my list. All stocks in this list have a dividend yield above 3%. George Soros’ other top holdings are listed on Insider Monkey. I obtained hedge fund holdings from Insider Monkey, 10-Year Summary data from Morningstar and all other market data from Finviz.

| Stock | Market Cap (Billion $) | Industry | Dividend Yield | P/E | Profit Margin | % Port in 13F Portfolio |

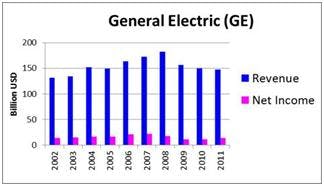

| General Electric (GE) | 225.0 | Diversified Machinery | 3.2% | 15.8 | 9.9% | 2.58% |

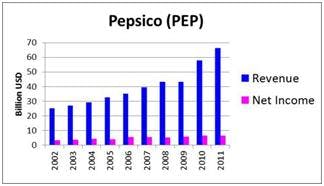

| Pepsico (PEP) | 106.8 | Beverages – Soft Drinks | 3.1% | 18.4 | 9.1% | 0.91% |

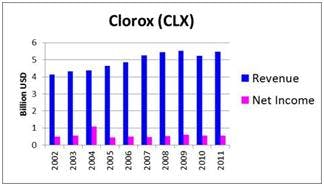

| Clorox (CLX) | 9.5 | Housewares & Accessories | 3.5% | 17.8 | 9.9% | 0.70% |

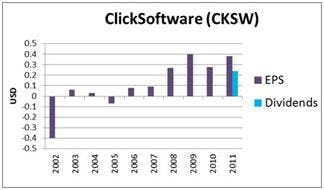

| ClickSoftware (CKSW) | 0.2 | Internet Software & Services | 4.3% | 30.0 | 8.9% | 0.29% |

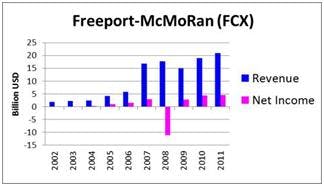

| Freeport-McMoRan (FCX) | 37.3 | Copper | 3.2% | 12.8 | 22.1% | 0.18% |

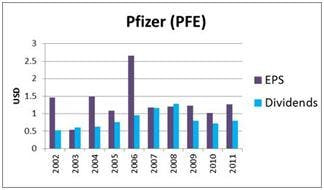

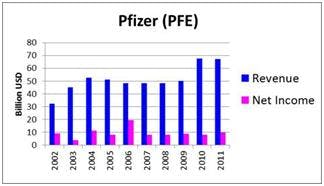

| Pfizer (PFE) | 183.4 | Drug Manufacturers – Major | 3.6% | 21.4 | 13.9% | 0.17% |

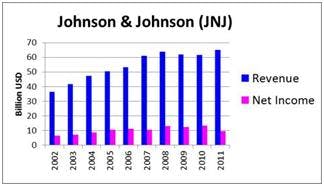

| Johnson & Johnson (JNJ) | 195.5 | Drug Manufacturers – Major | 3.4% | 23.3 | 12.4% | 0.15% |

General Electric Company (NYSE:GE) is a technology and financial services company operating worldwide. GE recently traded at $21.31 with a trailing price to earnings of 15.79 and a forward price to earnings of 12.46. GE has a 3.19% dividend yield and gained 37.66% during the past 12 months. The stock has a market cap of $225 billion and Total Debt/Equity Ratio of 3.52. Soros had $179 million invested in GE shares. Soros Fund Management increased its holdings of GE by 585% during the second quarter. Ken Fisher’s Fisher Asset Management holds the largest position in GE with its $653 million investment at the end of June.

PepsiCo, Inc. (NYSE:PEP) provides various beverages, dairy products, and other foods worldwide. PEP recently traded at $69.05 with a trailing price to earnings of 18.41 and a forward price to earnings of 15.66. PEP has a 3.11% dividend yield and gained 14.51% during the past 12 months. The stock has a market cap of $106.8 billion and Total Debt/Equity Ratio of 1.3. Soros had $63 million invested in PEP shares.

The Clorox Company (NYSE:CLX) provides consumer and professional products worldwide. CLX recently traded at $73.05 with a trailing price to earnings of 17.77 and a forward price to earnings of 15.74. CLX has a 3.5% dividend yield and gained 14.84% during the past 12 months. The stock has a market cap of $9.5 billion. Soros initiated a $49 million brand new position in CLX during the second quarter. Israel Englander’s Millennium Management and Jim Simons’ Renaissance Technologies both reduced their holdings of CLX during the second quarter.

ClickSoftware Technologies Ltd. (NASDAQ:CKSW) provides software products and solutions for workforce management worldwide. CKSW recently traded at $7.51 with a trailing price to earnings of 30.04 and a forward price to earnings of 15.02. CKSW has a 4.26% dividend yield and lost 19.85% during the past 12 months. The stock has a market cap of $235 million and Total Debt/Equity Ratio of 0. Soros had $21 million invested in CKSW shares. Soros Fund Management increased its holdings of CKSW by 171% during the second quarter.

Freeport-McMoRan Copper & Gold Inc. (NYSE:FCX) engages in the exploration, mining, and production of mineral resources. FCX recently traded at $39.26 with a trailing price to earnings of 12.75 and a forward price to earnings of 8.28. FCX has a 3.18% dividend yield and gained 4.58% during the past 12 months. The stock has a market cap of $37.3 billion and Total Debt/Equity Ratio of 0.21. Soros had $13 million invested in FCX shares.

Pfizer Inc. (NYSE:PFE) is one of the leading biopharmaceutical companies operating worldwide. PFE recently traded at $24.55 with a trailing price to earnings of 21.35 and a forward price to earnings of 10.54. PFE has a 3.58% dividend yield and gained 32.13% during the past 12 months. The stock has a market cap of $183.4 billion and Total Debt/Equity Ratio of 0.48. Soros had $12 million invested in PFE shares. Irving Kahn, one of legendary value investor Benjamin Graham’s students, hold 2.5 million shares of PFE at the end of September. PFE is the top holding of Irving Kahn.

Johnson & Johnson (NYSE:JNJ) provides various products in the health care field worldwide. JNJ recently traded at $70.9 with a trailing price to earnings of 23.32 and a forward price to earnings of 12.91. JNJ has a 3.44% dividend yield and gained 16.06% during the past 12 months. The stock has a market cap of $195.5 billion and Total Debt/Equity Ratio of 0.29. Soros had $10 million invested in JNJ shares.