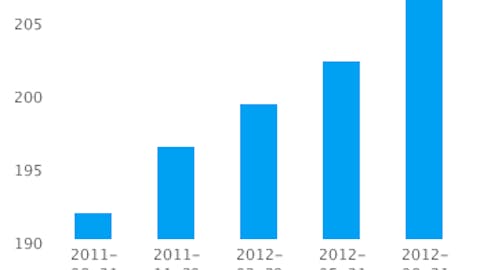

According to the company’s most recent 10-Q, revenue was 5% higher in the second quarter than it had been a year earlier. This was a slightly higher top-line growth rate than what Msci Inc had done in the first quarter, and sales were up on a q/q basis as well. However, lower net income than in Q2 2011 brought earnings down to a 3% increase in the first half of the year versus the same period last year. The lower margins were largely due to higher interest expenses, as operating income actually performed well. On a geographic basis, the Americas- responsible for slightly over half of revenue- led the company higher, offsetting weaker performance in EMEA and Asia/Australia in the first six months of 2012.

At a $3.2 billion market capitalization, Msci Inc trades at 18 times trailing earnings even though its stock price has fallen 18% over the last year versus a rising market. We think that analytical software is a good business to be in, but so far the company hasn’t impressed us with its performance and we’d have to expect growth to pick up in order for that pricing to make sense. Sell-side analysts are in fact optimistic, and the stock trades at 13 times their expectations for 2013.

We would consider investment management software company Advent Software, Inc. (NASDAQ:ADVS), service management software company BMC Software, Inc. (NASDAQ:BMC), information management software provider Open Text Corporation (NASDAQ:OTEX), and customer relationship software company salesforce.com, inc. (NYSE:CRM) to be a good peer group for Msci. salesforce.com is still struggling to be profitable at all, even though its market cap is over $20 billion and its stock has outperformed the S&P 500 over the last year. It did increase its revenue by 34% in its second fiscal quarter (which ended in July) compared to the same period in 2011. Read more about salesforce.com. Advent is another software company which is dependent on a growth thesis: it trades at 22 times forward earnings estimates, even though it is considerably smaller than Msci at a $3.2 billion market cap and its income growth last quarter was not particularly strong. We would avoid it.

Open Text carries a trailing P/E multiple of 25, but high expected growth over the next several quarters gives it a forward earnings multiple of 9 and a five-year PEG ratio of 0.9. However, its earnings fell 72% in its most recent quarter compared to a year earlier despite a small increase in revenue. The analyst projections look good, but we would need more convincing that the company can meet those targets. BMC is fairly similar to Msci on a multiples basis; it trades at trailing and forward P/Es of 19 and 11, respectively. Note, however, that Wall Street analysts expect strong growth here as well- despite a sizable decline in earnings over the last year.

We don’t particularly like Msci’s valuation. However, its peer group is priced on the basis of considerably higher growth rates over the next year even while their businesses have often been poorer performers. We might want to research some of its peers further as potential shorts to pair with a long in Msci.