It would make sense that in the most profitable vehicle segment — full-size pickups — you would find the most heated rivalry. That certainly holds true between America’s two largest automakers, Ford Motor Company (NYSE:F) and General Motors Company (NYSE:GM). In the world of trucks you’re either a Ford or a Chevy guy, and that’s that — there’s no switching sides or gray area. The rivalry is stuff of legends, and while Ford has been dominating truck sales since the recession, GM now has one thing it can tout over its crosstown rival, at least for now: its No. 1 safety rating. Will that help the Silverado in its push to finally top the F-Series for the best-selling truck?

I doubt it. Here’s why.

King of the hill

If you’ve been keeping track, the F-Series has been America’s best-selling truck for 31 years now. The Silverado has had second place locked down but can’t gain any ground on the F-Series.

Graph by author; 0information from Automotive News Data Center. 2013 projected from sales through July.

Ford Motor Company (NYSE:F)’s F-Series has even widened the sales gap since the recession, because some consumers refuse to buy from General Motors Company (NYSE:GM) after its taxpayer-fueled bailout. GM loyalists often point out that if you combine all of GM’s full-size sales, between the Silverado and Sierra, they do outsell Ford — but that hasn’t been true recently.

Graph by author; information from Autmotive News DataCenter. 2013 projected from sales through July.

Once again, since the recession Ford Motor Company (NYSE:F) has widened the sales gap even when you combine Silverado and Sierra sales. Right now General Motors Company (NYSE:GM) is pushing back, with both of its trucks receiving complete redesigns for the 2014 model, while the next-generation F-150 is a year away. This may be GM’s small window of opportunity to gain ground, and sales for the Silverado and Sierra have surged 45% and 49%, respectively, for July as the new designs hit showrooms across the nation.

To follow up a great sales performance in July, the 2014 Silverado and Sierra just received a five-star overall safety rating from the National Highway Traffic Safety Administration. Those two are the first full-size pickups to get the highest safety rating possible since the tougher judging system was implemented three years ago.

“Silverado and Sierra set a benchmark for pickup truck safety by offering a full array of advanced features designed to protect occupants before, during, and after a collision,” Gay Kent, General Motors Company (NYSE:GM) general director of vehicle safety and crashworthiness, said in a statement, according to Automotive News.

Why it doesn’t matter

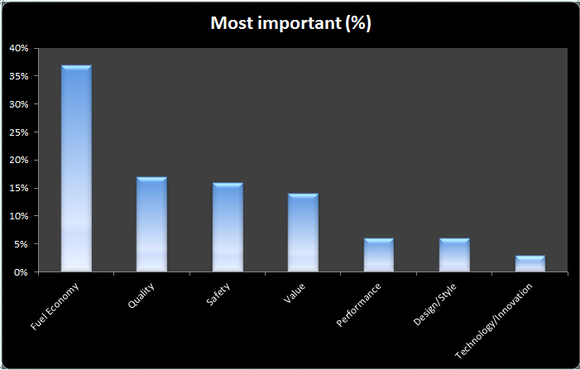

Even though Silverado and Sierra sales are surging, I don’t believe its No. 1 safety rank will be enough to win back the sales crown this year — in part because only 14% of consumers rank safety as their top priority when purchasing a vehicle.

Graph by authorl information from Consumer Reports.

Another reason I don’t think the Silverado will top the F-Series is that the truck segment is insanely loyal. Moreover, Ford Motor Company (NYSE:F) is No. 1 in brand loyalty, according to an R.L. Polk survey. Even the less loyal consumers that remain on the fence about making a purchase may opt to wait for the next-generation F-150 — and if it looks anything like the Atlas concept, it’s going to draw major attention.

Ford’s F-150 Atlas concept. Photo: Ford Motor.

Investing takeaway

The development of truck sales may be the most important thing to Ford Motor Company (NYSE:F) and General Motors Company (NYSE:GM) investors, because it’s estimated that each truck sale can bring as much as $10,000 in bottom-line profits. That’s a large amount per vehicle, and full-size trucks are estimated to bring in the majority of profits for the two automakers. On top of profits, the F-Series and Silverado are the two best-selling vehicles in the U.S. by a landslide, which means they represent the fastest way to gain or lose market share — a figure that investors eye very closely. Moreover, transaction prices of trucks continue to rise faster than the industry average, according to TrueCar — meaning that every year, full-size truck sales become more and more important.

If Ford continues to widen its lead in full-size truck sales, its revenues, profits, and market share will continue to improve as we’ve seen over the past year, during which time Ford’s stock price has responded with a 73% rise. If Ford’s next generation F-150 is a hit and continues to dominate the full-size segment, it will be a huge win for investors over the next five years.

The article Will Chevy’s 2014 Silverado Top Ford’s F-Series? originally appeared on Fool.com and is written by Daniel Miller.

Fool contributor Daniel Miller owns shares of Ford and General Motors. The Motley Fool recommends Ford and General Motors and owns shares of Ford.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.