When you buy a share of stock, you own a piece of a business. Smart investors take the time to understand what’s going on behind the scenes at the business level to understand the performance of the stock.

Facebook Inc (NASDAQ:FB)’s recent quarter was a blockbuster that sent shares up more than 30%. The company reported incredible improvements in mobile — improvements that need some explaining.

Behind Facebook’s surge

First, let’s recap what made Facebook Inc (NASDAQ:FB)’s recent quarter so exceptional:

- Monthly active users were up 21% year over year to 1.15 billion.

- Mobile monthly active users were up 51% year over year to 819 million.

- Advertising revenue grew 61% to $1.6 billion.

- Mobile advertising revenue grew to 41% of total revenue.

Investors should find plenty to like in the quarterly earnings report. But I want to go deeper: why is Facebook Inc (NASDAQ:FB)’s mobile segment doing so well?

Numbers behind online advertising

Facebook Inc (NASDAQ:FB)’s advertising comes in two forms: in-content newsfeed ads and right hand sidebar ads.

Right hand sidebar ads have been a staple on the site for years. New ads in a user’s news feed are relatively new, and incredibly profitable.

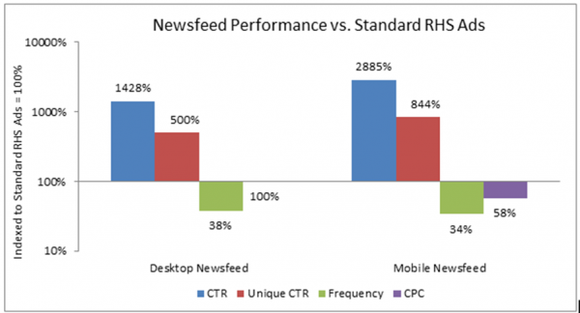

Here’s a chart that compares newsfeed advertising versus right-hand sidebar ads from Adobe:

On desktop, newsfeed ads see click throughs at a rate 13 times higher than sidebar ads. Mobile users click through at a rate nearly 28 times greater.

Newsfeed ads have a lower cost per click (42% lower), but that rate should rise over time to match the cost-per-click (CPC) of in-content advertising. Facebook Inc (NASDAQ:FB)’s results were infinitely better than rivals. Google Inc (NASDAQ:GOOG) reported declining costs per click of 2% for the seventh quarter in a row. Mobile ads certainly aren’t helping the search engine giant, which noticed a big disparity between mobile and desktop profitability. Each page viewed via mobile browser instead of a desktop browser is less profitable for Google. The death of the PC is the death of Google’s massive CPCs.

Meanwhile, Yahoo! Inc. (NASDAQ:YHOO) reports that it has more than 340 million mobile active users, but generates only $125 million, or less than $0.40, in annual revenue per user. Facebook Inc (NASDAQ:FB), in comparison, generated $650 million in revenue from 819 million users in a single quarter. Facebook’s mobile revenue of $0.80 per quarter per user is 8 times higher than Yahoo!’s mobile revenue generation. It’s easy to see why analysts love Facebook’s mobile traffic.

Room for upside

Facebook Inc (NASDAQ:FB) can increase revenue on its in-content advertising in a number of ways:

1) Bring in new advertisers to drive up the cost per click to meet right hand sidebar advertising.

2) Increase the number of active users.

3) Increase the number of in-content advertising.

I’m not so sure Facebook Inc (NASDAQ:FB) can manage perpetual increases in active users, or increase the amount of in-content advertising. Nor do I believe Facebook can increase in-content CPCs because higher CPC ads would likely lead to lower CTRs.

Facebook Inc (NASDAQ:FB)’s surge in mobile users is partly the result of new notifications that alert users to post new status updates or look at a new status from a friend. These notifications are highly annoying, but they bring users to the app each day. New notification settings came about in the first quarter, so the second quarter is the first chance to see how well they worked to drive users to the app.

Judging by the quarterly report, it’s working very, very well. Now you know partially why Facebook Inc (NASDAQ:FB)’s mobile monthly users popped 51%.

Now, how about increasing the amount of advertising? At present, 5% of all newsfeed content is advertising. So out of every 20 updates, one is a paid placement. Increasing this to 10% would likely have a substantial impact on usage. One ad is tolerable, several ads might not be.