There are several ways to beat the market, and investing in small cap stocks has historically been one of them. We like to improve the odds of beating the market further by examining what famous hedge fund operators such as Carl Icahn and George Soros think. Those hedge fund operators make billions of dollars each year by hiring the best and the brightest to do research on stocks, including small cap stocks that big brokerage houses simply don’t cover. Because of Carl Icahn and other elite funds’ exemplary historical records, we pay attention to their small cap picks. In this article, we use hedge fund filing data to analyze Fabrinet (NYSE:FN).

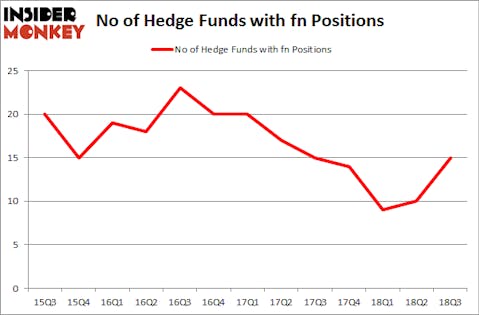

Is Fabrinet (NYSE:FN) worth your attention right now? Hedge funds are turning bullish. The number of long hedge fund positions went up by 5 recently. Our calculations also showed that fn isn’t among the 30 most popular stocks among hedge funds. FN was in 15 hedge funds’ portfolios at the end of the third quarter of 2018. There were 10 hedge funds in our database with FN positions at the end of the previous quarter.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 6.3% year to date (through December 3rd) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 18 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Let’s view the new hedge fund action regarding Fabrinet (NYSE:FN).

How have hedgies been trading Fabrinet (NYSE:FN)?

At the end of the third quarter, a total of 15 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 50% from the second quarter of 2018. Below, you can check out the change in hedge fund sentiment towards FN over the last 13 quarters. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Royce & Associates was the largest shareholder of Fabrinet (NYSE:FN), with a stake worth $75.6 million reported as of the end of September. Trailing Royce & Associates was Citadel Investment Group, which amassed a stake valued at $14.4 million. Ariel Investments, Hawk Ridge Management, and Citadel Investment Group were also very fond of the stock, giving the stock large weights in their portfolios.

Consequently, some big names were breaking ground themselves. Citadel Investment Group, managed by Ken Griffin, established the most valuable position in Fabrinet (NYSE:FN). Citadel Investment Group had $14.4 million invested in the company at the end of the quarter. Matthew Hulsizer’s PEAK6 Capital Management also initiated a $1.8 million position during the quarter. The other funds with new positions in the stock are Jim Simons’s Renaissance Technologies, Charles Davidson and Joseph Jacobs’s Wexford Capital, and David Costen Haley’s HBK Investments.

Let’s now review hedge fund activity in other stocks similar to Fabrinet (NYSE:FN). These stocks are FS Investment Corporation (NYSE:FSIC), Matson, Inc. (NYSE:MATX), Universal Insurance Holdings, Inc. (NYSE:UVE), and Waddell & Reed Financial, Inc. (NYSE:WDR). This group of stocks’ market valuations resemble FN’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| FSIC | 9 | 21686 | 2 |

| MATX | 9 | 14371 | 2 |

| UVE | 14 | 44205 | -1 |

| WDR | 17 | 146201 | 0 |

| Average | 12.25 | 56616 | 0.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 12.25 hedge funds with bullish positions and the average amount invested in these stocks was $57 million. That figure was $116 million in FN’s case. Waddell & Reed Financial, Inc. (NYSE:WDR) is the most popular stock in this table. On the other hand FS Investment Corporation (NYSE:FSIC) is the least popular one with only 9 bullish hedge fund positions. Fabrinet (NYSE:FN) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard WDR might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.