The 700+ hedge funds and money managers tracked by Insider Monkey have already compiled and submitted their 13F filings for the third quarter, which unveil their equity positions as of September 30. We went through these filings, fixed typos and other more significant errors and identified the changes in hedge fund positions. Our extensive review of these public filings is finally over, so this article is set to reveal the smart money sentiment towards Energy Recovery, Inc. (NASDAQ:ERII).

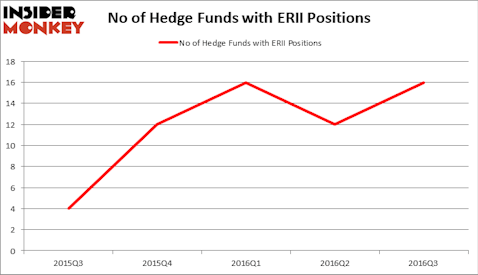

Is Energy Recovery, Inc. (NASDAQ:ERII) a marvelous investment right now? Prominent investors are genuinely becoming more confident. The number of bullish hedge fund bets that are revealed through the 13F filings rose by 4 recently. ERII was in 16 hedge funds’ portfolios at the end of September. There were 12 hedge funds in our database with ERII holdings at the end of the previous quarter. At the end of this article we will also compare ERII to other stocks including Raven Industries, Inc. (NASDAQ:RAVN), TCP Capital Corp (NASDAQ:TCPC), and Ambac Financial Group, Inc. (NASDAQ:AMBC) to get a better sense of its popularity.

Follow Energy Recovery Inc. (NASDAQ:ERII)

Follow Energy Recovery Inc. (NASDAQ:ERII)

Receive real-time insider trading and news alerts

We follow over 700 hedge funds and other institutional investors and by analyzing their quarterly 13F filings, we identify stocks that they are collectively bullish on and develop investment strategies based on this data. One strategy that outperformed the market over the last year involves selecting the 100 best-performing funds and identifying the 30 mid-cap stocks that they are collectively most bullish on. Over the past year, this strategy generated returns of 18%, topping the 8% gain registered by S&P 500 ETFs. We launched this strategy 2.5 years ago and it returned more than 39% since then, vs. 22% gain registered by the S&P 500 ETFs.

Sakarin Sawasdinaka/Shutterstock.com

Hedge fund activity in Energy Recovery, Inc. (NASDAQ:ERII)

Heading into the fourth quarter of 2016, a total of 16 of the hedge funds tracked by Insider Monkey held long positions in this stock, a rise of 33% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards ERII over the last 5 quarters. With hedge funds’ sentiment swirling, there exists a select group of noteworthy hedge fund managers who were increasing their stakes considerably (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, Millennium Management, one of the 10 largest hedge funds in the world, has the largest position in Energy Recovery, Inc. (NASDAQ:ERII), worth close to $6.8 million. On Millennium Management’s heels is Venator Capital Management, led by Brandon Osten, which holds a $6.6 million position; the fund has 4.3% of its 13F portfolio invested in the stock. Some other hedge funds and institutional investors that hold long positions encompass Richard Driehaus’ Driehaus Capital, Cliff Asness’ AQR Capital Management and Ken Griffin’s Citadel Investment Group. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.