Alcoa Inc. (NYSE:AA) recently reported its preliminary financial results based on which we provide a unique peer-based analysis of the company. Our analysis is based on the company’s performance over the last twelve months (unless stated otherwise). For a more detailed analysis of this company (and over 40,000 other global equities) please visitwww.capitalcube.com.

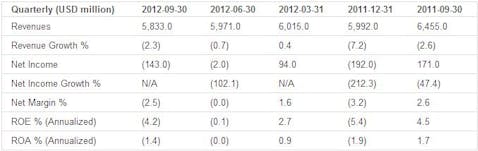

Alcoa Inc.’s analysis versus peers uses the following peer-set: NORSK HYDRO A.S.A NOK1.098 (LON:NHY), Hindalco Industries Ltd. (500440-IN), National Aluminum Co. Ltd. (532234-IN), Alumina Limited (NYSE:AWC), Aluminum Corp. of China Limited (NYSE:ACH) and Kaiser Aluminum Corp. (NASDAQ:KALU). The table below shows the preliminary results along with the recent trend for revenues, net income and returns.

Valuation Drivers

Alcoa Inc.’s current Price/Book of 0.7 is about median in its peer group. The market expects AA-US to grow faster than the median of its chosen peers (PE of 127.5 compared to peer median of 19.3) and to improve its current ROE of -1.7% which is below its peer median of 1.5%. Thus, the market seems to expect a turnaround in AA-US’s current performance.

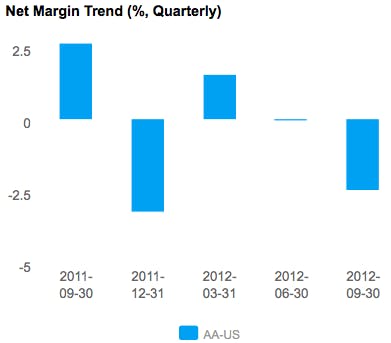

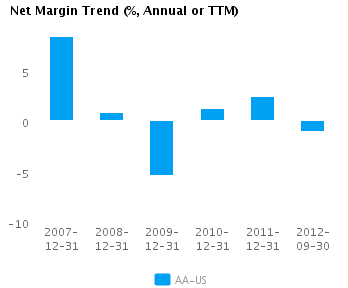

The company’s profit margins are below peer median (currently -1.0% vs. peer median of 1.6%) while its asset efficiency is about median (asset turns of 0.6x compared to peer median of 0.7x). AA-US’s net margin is less than (but within one standard deviation of) its five-year average net margin of 1.5%.

Economic Moat

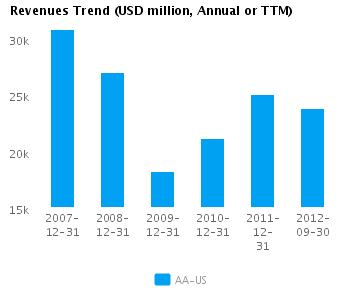

Changes in the company’s revenues are in-line with its peers (annual revenue changed by 18.6%) but its earnings performance has been better — its annual earnings changed by 134.0% compared to the peer median of 78.0%, implying that it has better cost control relative to its peers. AA-US currently converts every 1% of change in revenue into 7.2% of change in annual reported earnings.

AA-US’s return on assets is less than its peer median currently (-0.6% vs. peer median 1.3%). It has also had less than peer median returns on assets over the past five years (1.4% vs. peer median 2.9%). This performance suggests that the company has persistent operating challenges relative to peers.

The company’s gross margin of 12.8% is around peer median suggesting that AA-US’s operations do not benefit from any differentiating pricing advantage. In addition, AA-US’s pre-tax margin is less than the peer median (-1.3% compared to 2.8%) suggesting relatively high operating costs.

Growth & Investment Strategy

While AA-US’s revenues have increased more slowly than the peer median (-2.4% vs. 4.1% respectively for the past three years), the market currently gives the company a higher than peer median PE ratio of 127.5. The stock price may be factoring in some sort of a strategic play.

AA-US’s annualized rate of change in capital of 1.3% over the past three years is less than its peer median of 7.7%. This below median investment level has also generated a less than peer median return on capital of -0.2% averaged over the same three years. This outcome suggests that the company has invested capital relatively poorly and now may be in maintenance mode.

Earnings Quality

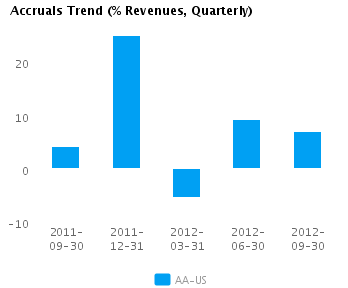

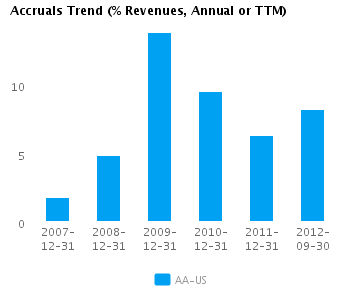

AA-US reported relatively weak net income margins for the last twelve months (-1.0% vs. peer median of 1.6%). This weak margin performance and relatively conservative accrual policy (8.2% vs. peer median of 2.4%) suggest the company might likely be understating its net income, possibly to the extent that there might even be some sandbagging of the reported net income numbers.

AA-US’s accruals over the last twelve months are positive suggesting a buildup of reserves. In addition, the level of accrual is greater than the peer median — which suggests a relatively strong buildup in reserves compared to its peers.

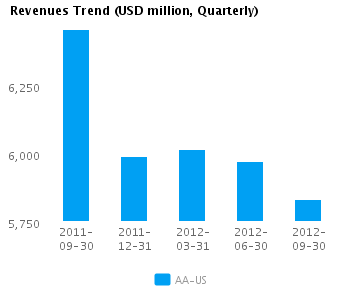

Trend Charts