Predictions about future crop production vary greatly, but a large number of analysts are taking an increasingly negative view. Ecological degradation is a real thing. Water shortages and a growing population will all impact the global food supply. Countries facing greater food pressures will have to increase yields in whichever ways possible. Fertilizers offer a relatively simple and effective way to achieve this goal, and Potash Corp./Saskatchewan (USA) (NYSE:POT) is a low-cost producer of fertilizer inputs with a strong long-term plan.

BG Operating Income Annual data by YCharts

BG Free Cash Flow Yield data by YCharts

Food is a highly political issue. People who are starving are very prone to protest, and protests can quite easily lead to revolutions. Leaders are especially aware of this fact and are willing to go to great lengths to maintain their power by ensuring a stable food supply. Making sure that their farmers have a strong supply of fertilizer every year is a simple and effective precautionary measure that these leaders can take.

The Difficulties of Playing the Middle Man

It is very attractive to suspend exports in order to increase the domestic supply of foodstuffs. PotashCorp sells fertilizer inputs, and greater food supply constrictions will only increase the need to maintain and increase yields in the face of environmental degradation.

Middlemen who export from developing nations do not have the same luxury. In the event of severe droughts and export bans, there are simple fewer foodstuffs to export and lower volumes.

What do the Financials Show?

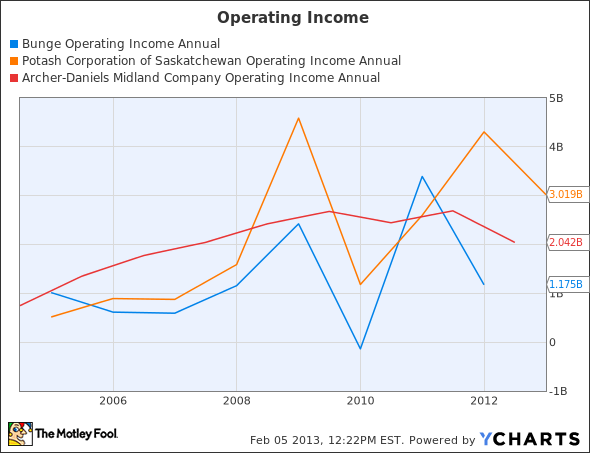

Out of the three companies examined here, Bunge has the highest total debt to equity ratio of 0.73. Its quick ratio of 0.4 is marginally better than Archer’s quick ratio of 0.3. Bunge’s ROI of 5.8% and ROA of 3.2% are both higher than Archer’s ROI of 3.8% and ROA of 3.8%. A higher debt load and the lower quick ratio are telltale signs of balance-sheet risks. The low ROA and ROI numbers show just how important high volumes are for maintaining these firms’ profits.

The majority of Bunge’s earnings come from its agribusiness though edible oil products, and milling products, and fertilizer make a small percentage of earnings. It’s expanding its sugarcane and bioenergy business in Brazil, but it also decided to sell off its fertilizer business in the region. Its expansion to Brazil and other emerging markets is part of their long term plan to focus on the world’s growing middle class.

Archer Daniels Midland Company (NYSE:ADM) focuses on oilseeds processing, corn processing, and general agricultural services. The firm has a total debt to equity ratio of 0.58 and is eying the Australian grain company, GrainCorp Ltd. After GrainCorp rejected an earlier bid, Archer went in and bought 5% more of the firm. Given Australia’s close proximity to the important Asian markets, Archer would greatly benefit from a greater footprint in the region.

The Case for PotashCorp

PotashCorp has a very low total debt to equity ratio of 0.42, Their ROI of 18.0% and ROA of 13.2% are healthy. This company is very different from global commodity traders and processors, so comparisons between these firms can only be made quiet loosely. PotashCorp’s status as a low-cost producer is seen in its gross margin of 52.2% and a profit margin of 26.2%. 2012 numbers came in a bit low, with negotiations for international sales still ongoing along with lower volumes. The firm’s stock price didn’t respond well to this news, but it doesn’t change the positive long term fundamentals of the firm. It sells potash, phosphate, and nitrogen to support a growing world and a growing middle class.

Conclusion

Bunge and Archer Daniels Midland are not poor companies — but I believe that PotashCrop is a better long-term investment, given the stability of selling fertilizer in the middle of an increasingly politicized global food market. The fact that PotashCorp is a low cost producer and based in the politically stable nation of Canada are further pluses that only add to its attractiveness.

The article Don’t Miss the Strength Behind PotashCorp originally appeared on Fool.com and is written by Joshua Bondy.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.