Hedge funds and large money managers usually invest with a focus on the long-term horizon and, therefore, short-lived dips on the charts, usually don’t make them change their opinion towards a company. The second half of 2015 and the first few months of this year was a stressful period for hedge funds. However, things have been taking a turn for the better in the second half of this year. Small-cap stocks which hedge funds are usually overweight outperformed the market by double digits and it may be a good time to pay attention to hedge funds’ picks before it is too late. In this article we are going to analyze the hedge fund sentiment towards Westlake Chemical Corporation (NYSE:WLK) to find out whether it was one of their high conviction long-term ideas.

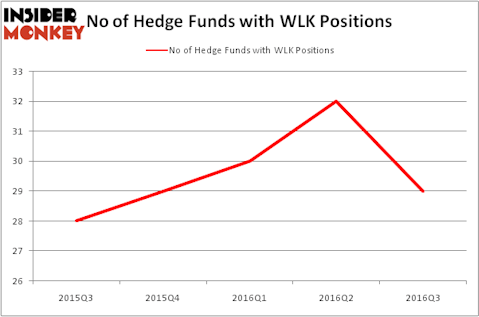

Is Westlake Chemical Corporation (NYSE:WLK) a buy here? Investors who are in the know are really getting less bullish. The number of bullish hedge fund positions that are disclosed in regulatory 13F filings were trimmed by 3 lately. WLKwas in 29 hedge funds’ portfolios at the end of September. There were 32 hedge funds in our database with WLK holdings at the end of the previous quarter. At the end of this article we will also compare WLK to other stocks including PulteGroup, Inc. (NYSE:PHM), ASML Holding N.V. (ADR) (NASDAQ:ASML), and 58.com Inc (ADR) (NYSE:WUBA) to get a better sense of its popularity.

Follow Westlake Corp (NYSE:WLK)

Follow Westlake Corp (NYSE:WLK)

Receive real-time insider trading and news alerts

We follow over 700 hedge funds and other institutional investors and by analyzing their quarterly 13F filings, we identify stocks that they are collectively bullish on and develop investment strategies based on this data. One strategy that outperformed the market over the last year involves selecting the 100 best-performing funds and identifying the 30 mid-cap stocks that they are collectively most bullish on. Over the past year, this strategy generated returns of 18%, topping the 8% gain registered by S&P 500 ETFs. We launched this strategy 2.5 years ago and it returned more than 39% since then, vs. 22% gain registered by the S&P 500 ETFs.

With all of this in mind, we’re going to take a peek at the fresh action encompassing Westlake Chemical Corporation (NYSE:WLK).

What does the smart money think about Westlake Chemical Corporation (NYSE:WLK)?

At the end of the third quarter, a total of 29 of the hedge funds tracked by Insider Monkey were bullish on this stock, a drop of 9% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards WLK over the last 5 quarters. With hedgies’ capital changing hands, there exists a few key hedge fund managers who were boosting their stakes substantially (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Dmitry Balyasny’s Balyasny Asset Management has the number one position in Westlake Chemical Corporation (NYSE:WLK), worth close to $110.8 million, amounting to 0.6% of its total 13F portfolio. The second most bullish fund manager is Soroban Capital Partners, led by Eric W. Mandelblatt, which holds a $108.2 million position; the fund has 0.7% of its 13F portfolio invested in the stock. Remaining professional money managers that hold long positions contain Cliff Asness’s AQR Capital Management, Chuck Royce’s Royce & Associates and Phill Gross and Robert Atchinson’s Adage Capital Management. We should note that Soroban Capital Partners is among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.