Hedge funds and other investment firms run by legendary investors like Israel Englander and Ray Dalio are entrusted to manage billions of dollars of accredited investors’ money because they are without peer in the resources they use to identify the best investments for their chosen investment horizon. Moreover, they are more willing to invest a greater amount of their resources in small-cap stocks than big brokerage houses, and this is often where they generate their outperformance, which is why we pay particular attention to their best ideas in this space.

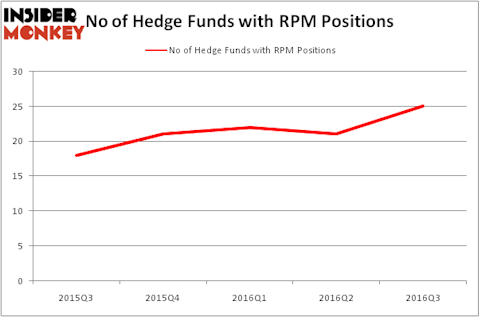

RPM International Inc. (NYSE:RPM) shareholders have witnessed an increase in activity from the world’s largest hedge funds in recent months. RPM was in 25 hedge funds’ portfolios at the end of the third quarter of 2016. There were 21 hedge funds in our database with RPM holdings at the end of the previous quarter. At the end of this article we will also compare RPM to other stocks including The Middleby Corporation (NASDAQ:MIDD), DDR Corp (NYSE:DDR), and EnCana Corporation (USA) (NYSE:ECA) to get a better sense of its popularity.

Follow Rpm International Inc (NYSE:RPM)

Follow Rpm International Inc (NYSE:RPM)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

Keeping this in mind, we’re going to take a peek at the fresh action encompassing RPM International Inc. (NYSE:RPM).

Hedge fund activity in RPM International Inc. (NYSE:RPM)

At Q3’s end, a total of 25 of the hedge funds tracked by Insider Monkey were long this stock, an increase of 19% from one quarter earlier. With hedgies’ positions undergoing their usual ebb and flow, there exists a select group of notable hedge fund managers who were increasing their stakes significantly (or already accumulated large positions).

Of the funds tracked by Insider Monkey, Jim Simons’s Renaissance Technologies has the biggest position in RPM International Inc. (NYSE:RPM), worth close to $31.2 million and comprising 0.1% of its total 13F portfolio. The second largest stake is held by Alyeska Investment Group, managed by Anand Parekh, which holds a $29.2 million position; the fund has 0.3% of its 13F portfolio invested in the stock. Some other professional money managers that are bullish consist of Cliff Asness’s AQR Capital Management, Joel Greenblatt’s Gotham Asset Management and Nick Niell’s Arrowgrass Capital Partners.

As one would reasonably expect, key money managers were breaking ground themselves. Millennium Management, managed by Israel Englander, initiated the largest position in RPM International Inc. (NYSE:RPM). According to regulatory filings, the fund had $3.4 million invested in the company at the end of the quarter. Ben Levine, Andrew Manuel and Stefan Renold’s LMR Partners also made a $2.9 million investment in the stock during the quarter. The other funds with brand new RPM positions are Alec Litowitz and Ross Laser’s Magnetar Capital, Simon Sadler’s Segantii Capital, and Mike Vranos’s Ellington.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as RPM International Inc. (NYSE:RPM) but similarly valued. These stocks are The Middleby Corporation (NASDAQ:MIDD), DDR Corp (NYSE:DDR), EnCana Corporation (USA) (NYSE:ECA), and DexCom, Inc. (NASDAQ:DXCM). All of these stocks’ market caps resemble RPM’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| MIDD | 26 | 345362 | 7 |

| DDR | 18 | 207446 | 2 |

| ECA | 37 | 2159354 | 11 |

| DXCM | 26 | 300295 | 1 |

As you can see these stocks had an average of 27 hedge funds with bullish positions and the average amount invested in these stocks was $753 million. That figure was a meager $130 million in RPM’s case. EnCana Corporation (USA) (NYSE:ECA) is the most popular stock in this table. On the other hand DDR Corp (NYSE:DDR) is the least popular one with only 18 bullish hedge fund positions. RPM International Inc. (NYSE:RPM) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard ECA might be a better candidate to consider a long position.

Disclosure: none.