Before we spend many hours researching a company, we’d like to analyze what hedge funds and billionaire investors think of the stock first. We would like to do so because the successful investors’ consensus returns have been exceptional. The top 30 mid-cap stocks among the best performing hedge funds in our database yielded an average return of 18% during the last 12 months, outperforming the S&P 500 Index funds by double digits. Although the successful funds occasionally have their duds, such as SunEdison and Valeant, the hedge fund picks seem to work on average. In the following paragraphs, we find out what the billionaire investors and hedge funds think of Madison Square Garden Co (NASDAQ:MSG) .

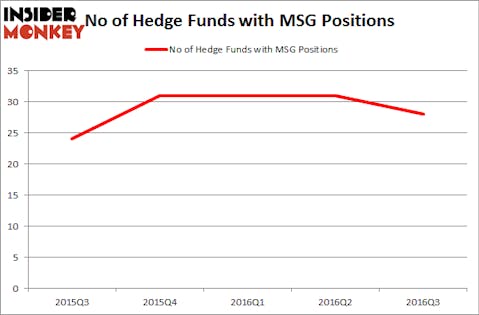

Madison Square Garden Co (NASDAQ:MSG) investors should pay attention to a decrease in hedge fund sentiment of late. MSG was in 28 hedge funds’ portfolios at the end of September. There were 31 hedge funds in our database with MSG holdings at the end of the previous quarter. At the end of this article we will also compare MSG to other stocks including Intercept Pharmaceuticals Inc (NASDAQ:ICPT), Elbit Systems Ltd. (USA) (NASDAQ:ESLT), and Gramercy Property Trust Inc (NYSE:GPT) to get a better sense of its popularity.

Follow Msg Networks Inc. (NYSE:MSGN)

Follow Msg Networks Inc. (NYSE:MSGN)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

Eugene Onischenko/Shutterstock.com

With all of this in mind, we’re going to take a peek at the key action encompassing Madison Square Garden Co (NASDAQ:MSG).

How are hedge funds trading Madison Square Garden Co (NASDAQ:MSG)?

Heading into the fourth quarter of 2016, a total of 28 of the hedge funds tracked by Insider Monkey were long this stock, a decline of 10% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards MSG over the last 5 quarters. With hedge funds’ capital changing hands, there exists an “upper tier” of noteworthy hedge fund managers who were increasing their holdings meaningfully (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, Kenneth Mario Garschina’s Mason Capital Management has the most valuable position in Madison Square Garden Co (NASDAQ:MSG), worth close to $169.8 million, corresponding to 14.4% of its total 13F portfolio. The second most bullish fund manager is GAMCO Investors, led by Mario Gabelli, which holds a $154.7 million position; 1% of its 13F portfolio is allocated to the stock. Remaining members of the smart money with similar optimism comprise John Khoury’s Long Pond Capital, John W. Rogers’s Ariel Investments and Howard Guberman’s Gruss Asset Management. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.