Before we spend days researching a stock idea we’d like to take a look at how hedge funds and billionaire investors recently traded that stock. S&P 500 Index returned about 7.6% during the last 12 months ending November 21, 2016. Most investors don’t notice that less than 49% of the stocks in the index outperformed the index. This means you (or a monkey throwing a dart) have less than an even chance of beating the market by randomly picking a stock. On the other hand, the top 30 mid-cap stocks among the best performing hedge funds had an average return of 18% during the same period. Hedge funds had bad stock picks like everyone else. We are sure you have read about their worst picks, like Valeant, in the media over the past year. So, taking cues from hedge funds isn’t a foolproof strategy, but it seems to work on average. In this article, we will take a look at what hedge funds think about Flex Ltd (NASDAQ:FLEX).

Is Flex Ltd (NASDAQ:FLEX) a superb investment right now? The smart money is taking a bearish view. The number of long hedge fund bets fell by 2 in recent months. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Rollins, Inc. (NYSE:ROL), Liberty Media Corp (NASDAQ:LMCA), and Omega Healthcare Investors Inc (NYSE:OHI) to gather more data points.

Follow Flex Ltd. (NASDAQ:FLEX)

Follow Flex Ltd. (NASDAQ:FLEX)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

Andor Bujdoso/Shutterstock.com

What have hedge funds been doing with Flex Ltd (NASDAQ:FLEX)?

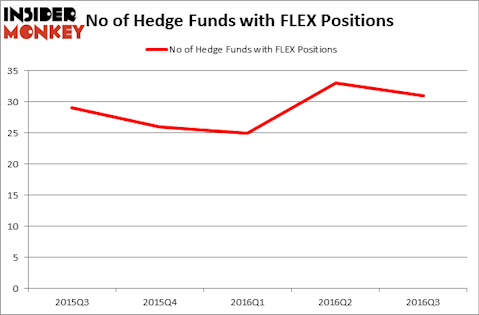

At the end of the third quarter, a total of 31 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -6% from the second quarter of 2016. With the smart money’s positions undergoing their usual ebb and flow, there exists an “upper tier” of noteworthy hedge fund managers who were boosting their holdings considerably (or already accumulated large positions).

Of the funds tracked by Insider Monkey, Larry Robbins’s Glenview Capital has the most valuable position in Flex Ltd (NASDAQ:FLEX), worth close to $530.8 million, corresponding to 3.8% of its total 13F portfolio. The second largest stake is held by Iridian Asset Management, managed by David Cohen and Harold Levy, which holds a $157.2 million position; 1.4% of its 13F portfolio is allocated to the company. Remaining hedge funds and institutional investors that hold long positions consist of Cliff Asness’s AQR Capital Management, Thomas E. Claugus’s GMT Capital and Richard S. Pzena’s Pzena Investment Management.

Because Flex Ltd (NASDAQ:FLEX) has witnessed falling interest from the smart money, it’s safe to say that there is a sect of fund managers that elected to cut their positions entirely in the third quarter. Intriguingly, Phill Gross and Robert Atchinson’s Adage Capital Management dropped the biggest stake of the 700 funds tracked by Insider Monkey, worth close to $5.3 million in call options. Ken Griffin’s fund, Citadel Investment Group, also dumped its call options., about $1.5 million worth. These moves are interesting, as total hedge fund interest was cut by 2 funds in the third quarter.

Let’s now review hedge fund activity in other stocks similar to Flex Ltd (NASDAQ:FLEX). These stocks are Rollins, Inc. (NYSE:ROL), Liberty Media Corp (NASDAQ:LMCA), Omega Healthcare Investors Inc (NYSE:OHI), and Liberty Media Corp (NASDAQ:LMCK). All of these stocks’ market caps are closest to FLEX’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ROL | 11 | 346487 | -4 |

| LMCA | 29 | 285626 | 8 |

| OHI | 11 | 50369 | -4 |

| LMCK | 19 | 651364 | -1 |

As you can see these stocks had an average of 17.5 hedge funds with bullish positions and the average amount invested in these stocks was $333 million. That figure was $1.35 billion in FLEX’s case. Liberty Media Corp (NASDAQ:LMCA) is the most popular stock in this table. On the other hand Rollins, Inc. (NYSE:ROL) is the least popular one with only 11 bullish hedge fund positions. Compared to these stocks Flex Ltd (NASDAQ:FLEX) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Suggested Articles:

Most Affordable Veterinary Schools

Most Underdeveloped Countries

Best Places To Visit In Africa

Disclosure: None