Reputable billionaire investors such as Nelson Peltz and David Tepper generate exorbitant profits for their wealthy accredited investors (a minimum of $1 million in investable assets would be required to invest in a hedge fund and most successful hedge funds won’t accept your savings unless you commit at least $5 million) by pinpointing winning small-cap stocks. There is little or no publicly-available information at all on some of these small companies, which makes it hard for an individual investor to pin down a winner within the small-cap space. However, hedge funds and other big asset managers can do the due diligence and analysis for you instead, thanks to their highly-skilled research teams and vast resources to conduct an appropriate evaluation process. Looking for potential winners within the small-cap galaxy of stocks? We believe following the smart money is a good starting point.

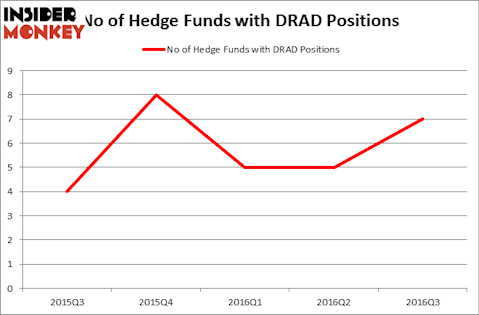

Digirad Corporation (NASDAQ:DRAD) has experienced an increase in enthusiasm from smart money recently. DRAD was in 7 hedge funds’ portfolios at the end of September. There were 5 hedge funds in our database with DRAD positions at the end of the previous quarter. At the end of this article we will also compare DRAD to other stocks including Hydra Industries Acquisition Corp. (NASDAQ:HDRA), Kindred Biosciences Inc (NASDAQ:KIN), and American Superconductor Corporation (NASDAQ:AMSC) to get a better sense of its popularity.

Follow Star Equity Holdings Inc. (NASDAQ:STRR)

Follow Star Equity Holdings Inc. (NASDAQ:STRR)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

A and N photography/Shutterstock.com

Hedge fund activity in Digirad Corporation (NASDAQ:DRAD)

Heading into the fourth quarter of 2016, a total of 7 of the hedge funds tracked by Insider Monkey were long this stock, a jump of 40% from the second quarter of 2016. The graph below displays the number of hedge funds with bullish position in DRAD over the last 5 quarters. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Jeffrey E. Eberwein’s Lone Star Value Management has the number one position in Digirad Corporation (NASDAQ:DRAD), worth close to $6 million, corresponding to 11.4% of its total 13F portfolio. The second largest stake is held by J. Carlo Cannell’s Cannell Capital which holds a $6 million position; 2.4% of its 13F portfolio is allocated to the stock. Some other hedge funds and institutional investors that hold long positions consist of Jim Simons’ Renaissance Technologies which is one of the largest hedge funds in the world, John Overdeck and David Siegel’s Two Sigma Advisors and Peter Algert and Kevin Coldiron’s Algert Coldiron Investors. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.

As industrywide interest jumped, key money managers have been driving this bullishness. Algert Coldiron Investors assembled the most outsized position in Digirad Corporation (NASDAQ:DRAD). Algert Coldiron Investors had $0.1 million invested in the company at the end of the quarter. Israel Englander’s Millennium Management also made a $0.1 million investment in the stock during the quarter.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Digirad Corporation (NASDAQ:DRAD) but similarly valued. These stocks are Hydra Industries Acquisition Corp. (NASDAQ:HDRA), Kindred Biosciences Inc (NASDAQ:KIN), American Superconductor Corporation (NASDAQ:AMSC), and Ballantyne Strong Inc (NYSEAMEX:BTN). This group of stocks’ market caps are similar to DRAD’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| HDRA | 5 | 13605 | 1 |

| KIN | 7 | 53912 | 0 |

| AMSC | 6 | 3865 | -3 |

| BTN | 5 | 23812 | 1 |

As you can see these stocks had an average of 6 hedge funds with bullish positions and the average amount invested in these stocks was $24 million. That figure was $17 million in DRAD’s case. Kindred Biosciences Inc (NASDAQ:KIN) is the most popular stock in this table. On the other hand Hydra Industries Acquisition Corp. (NASDAQ:HDRA) is the least popular one with only 5 bullish hedge fund positions. Digirad Corporation (NASDAQ:DRAD) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard KIN might be a better candidate to consider taking a long position in.

Disclosure: None