Cryder Capital Partners LLP is a London-based, privately-owned hedge fund that has been around since October 2011. Ferdinand Groos, who previously worked as a Managing Director at Rhone Capital LLC, currently acts as the Managing Partner at Cryder Capital Partners. Rhone Capital is a private equity firm under the control of Rhone Group LLC, specializing in middle market leveraged buyouts, recapitalizations, and partnership financings. So there is no doubt that Ferdinand Groos has relevant experience to successfully run his London-based hedge fund. According to the fund’s most recent 13F filing, the market value of Cryder Capital’s public equity portfolio equals $137.91 million as of June 30. In this article we will pinpoint and briefly discuss Ferdinand Groos’ largest stakes, which include positions in the following companies: HCA Holdings Inc. (NYSE:HCA), Google Inc. (NASDAQ:GOOG) and Roper Technologies Inc. (NYSE:ROP).

Why are we interested in the 13F filings of a select group of hedge funds? We use these filings to determine the top 15 small-cap stocks held by these elite funds based on 16 years of research that showed their top small-cap picks are much more profitable than both their large-cap stocks and the broader market as a whole; yet investors have been stuck (until now) investing in all of a hedge fund’s stocks: the good, the bad, and the ugly. Why pay fees to invest in both the best and worst ideas of a particular hedge fund when you can simply mimic the best ideas of the best fund managers on your own? These top small-cap stocks beat the S&P 500 Total Return Index by an average of nearly one percentage point per month in our backtests, which were conducted over the period of 1999 to 2012. Even better, since the beginning of forward testing at the end of August 2012, the strategy worked just as our research predicted and then some, outperforming the market every year and returning 139% over the last 34 months, which is more than 80 percentage points higher than the returns of the S&P 500 ETF (SPY) (see more details).

Follow Ferdinand Groos's Cryder Capital

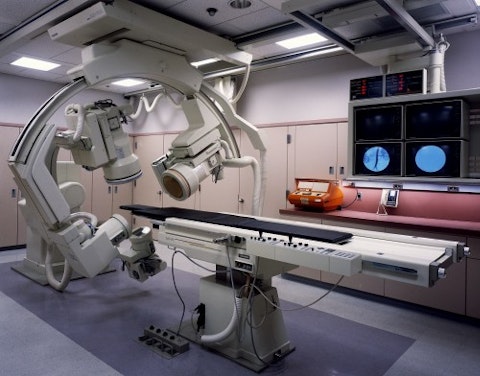

The most up-to-date 13F filing submitted by Cryder Capital Partners reveals that the fund initiated a long position in HCA Holdings Inc. (NYSE:HCA) in the second quarter, of 168,096 shares which are valued at $15.25 million as of June 30. HCA Holdings represents Ferdinand Groos’ top pick if looking at the value of the fund’s holdings, and it seems that the hedge fund made the move at the right time, as the stock has embarked on a strong uptrend since the beginning of the current year. The stock is up by more than 26% year-to-date after returning 20.6% over the second quarter and might keep rising considering the fact that the company’s preliminary financial results beat analysts’ estimates. To be more detailed, the biggest for-profit hospital chain by volume in the United States reported preliminary second quarter adjusted earnings of $1.37 per share, which outperformed analysts’ estimates of $1.33 per share. At the same time, the company announced that its revenue reached a figure of $9.9 billion, compared to the $9.77 billion figure anticipated by analysts. Within our database, Stephen Mandel’s Lone Pine Capital was the largest investor in HCA Holdings Inc. (NYSE:HCA) as of March 331, with 5.84 million shares.