Crocs, Inc. (NASDAQ:CROX) is a company which grew its revenue from just $1 million in 2003 to $847 million by 2007 on the back of an unorthodox footwear product. I’m talking about the original Crocs, Inc. (NASDAQ:CROX) shoe, which looks like this:

This fantastical growth caused the stock to skyrocket, hitting a peak in 2008 of about $72 per share. This was about 36 times 2007 earnings, suggesting that the market believed that strong growth would continue.

But after seeing 138% revenue growth the year before sales decreased in 2008 by 15% and decreased again in 2009, a combination of the financial crisis and the fad-like nature of the product being the culprits. The stock plummeted.

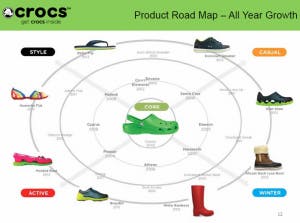

Since then the company has greatly diversified its product line, adding styles which don’t look as ridiculous as the original, and was able to grow revenue by 12% in 2012.

Gross margin has recovered nearly to the pre-crisis levels and both net income and free cash flow have turned strongly positive. Now that the stock trades at about $15 per share, is Crocs a good value?

Strong balance sheet

At the end of 2012 Crocs had $294 million in cash and only $10 million in debt and capital leases, leaving a net cash position of $284 million. This is about $3.16 in cash per share, which represents a little over 20% of the total market capitalization. This means that the market is valuing all of Crocs, Inc. (NASDAQ:CROX) future profits at about $12 per share.

Crocs, Inc. (NASDAQ:CROX) has been using some of this cash to buy back shares, with 1.9 million shares repurchased since November 2012 and 3.4 million shares remaining on its share repurchase authorization. This most recent burst in buybacks followed a steep drop in the share price, leading me to believe that the company is tactically buying back shares at low prices. Many companies overpay for their own shares, but it looks like Crocs has avoided that trap.

Profitability

EPS became turned positive in 2010 and has almost doubled in the two years since, growing from $0.76 per share to $1.44 per share in 2012. EPS growth grew by 16% in 2012 to $1.44 per share, leading to an adjusted P/E ratio of about 8.33 (after subtracting net cash from the market cap).

Instead of using net income for valuation purposes in many cases I prefer to look at owner earnings. This is similar to free cash flow but removes the effects of fluctuating working capital, which can cause the FCF to be extremely volatile. Owner earnings have grown from $73 million in 2010 to $107 million in 2011 and $137 million in 2012. On a per-share basis the 2012 value is $1.52, slightly higher than EPS and significantly higher than the free cash flow. This puts the adjusted Price/Owner Earnings ratio at about 7.9.

Data from Morningstar

The competition

Crocs is competing with big shoe companies like Nike (NYSE:NKE) as well as smaller companies like Deckers (NASDAQ:DECK). Nike trades at around 22 times owner earnings compared to Crocs 7.9, making the stock far more expensive. Being a much larger company, with revenue of $24 billion in 2012, Nike will have a much harder time growing at the rate required to justify its valuation. In the 5 years since 2008 Nike has only grown EPS at an annualized rate of just over 6%, from $1.87 per share to $2.37 per share. While Nike does have a very well known brand, the valuation is quite high for this level of growth.

Deckers saw revenue and earnings decline in the third quarter of 2012, which is not a good sign. EPS in 2011 was $5.07 per share, which makes the current share price of about $40 seem cheap, but shrinking earnings is concerning. Free cash flow was negative in 2011, and the company has taken on almost $6 in net debt per share compared to Crocs, Inc. (NASDAQ:CROX) pristine balance sheet. Deckers recently reported Q4 earnings, and while net income declined the results beat analyst expectations, causing the stock to jump higher. Another concern is that Deckers generates most of thier sales from Ugg Boots, so the company is far less diversified than Crocs. It basically looks like Crocs did a few years ago. A one-product fashion company is a dangerous one.

How much is Crocs worth?

Projecting growth for a company like Crocs, Inc. (NASDAQ:CROX) is difficult. Will people still be buying this stuff in 10 years? The diversification of the product line has certainly helped the long term prospects, but there’s certainly some risk that the products go out of style. I’ll value Crocs under three different scenarios to get a feel for how the market is currently valuing the company.

- Very slow growth – Owner earnings grow at 3% annually in perpetuity.

- Slow growth – Owner earnings grow by 6% annually for the next 10 years and by 3% annually after that

- Fast growth – Owner earnings grow by 10% annually for the next 10 years and by 3% annually after that.

The average analyst estimate for earnings growth is about 10%, which lines up well with my fast-growth scenario. I’ll use a discounted cash flow analysis to estimate the fair value under each of these scenarios, adding the value of the net cash to the value of the future cash flows. I’ll define a fair value range by using a discount rate of both 12% and 15%. The results are in the table below.

| Scenario | Low-end | High-end |

|---|---|---|

| Very slow growth | $16.21 | $20.56 |

| Slow growth | $18.91 | $24.56 |

| Fast growth | $23.53 | $31.47 |

With the stock currently trading around $15 per share even my very-slow-growth scenario suggests that it’s undervalued. If the company can manage to grow owner earnings by 10% annually, which is significantly slower than the last couple of years, then the stock is worth at least 50% more than its trading for today.

The Bottom Line

The risk in buying stock in a company like Crocs comes from the type of product which the company sells. There’s no guarantee that people will continue to buy the style of shoe which Crocs sells in the future. However, the stock offers a significant margin of safety at the current market price, and even if the company can only muster growth of 3% per year the stock is undervalued. I think that the rewards outweigh the risks here and that Crocs offers good value.

The article An Undervalued Shoe Company originally appeared on Fool.com and is written by Timothy Green.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.