After identifying the most popular stocks among hedge funds (see our entire Top 10 list here) according to their third quarter 13F filings, we have decided to break down the top five alcoholic beverage companies that hedge funds love. Many of these beverage companies should see a boost from a rise in expected employment that should in turn aid spending on alcoholic beverages. We also like the alcoholic beverage industry given its stability regardless of the economic backdrop. Our list includes the hundreds of hedge funds and prominent investors that are required by the SEC to disclose their public equity holdings quarterly. In descending order, we have outlined the most-loved alcoholic beverage stocks based on the aggregate number of funds owning each.

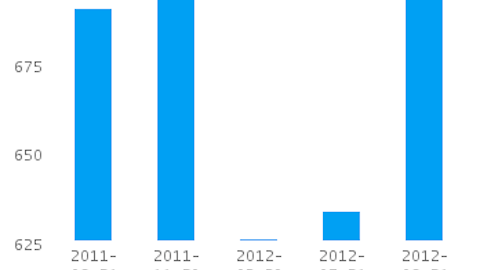

Diageo PLC (NYSE:DEO) had 19 filers owning the stock, putting it in fifth. Diageo has one of the leading premium alcoholic beverages portfolios with brands that include Smirnoff, Johnnie Walker, Guinness, Baileys and J&B—all in all 14 brands. Diageo trades in line with other premium liquor companies at 24x earnings, but has been penetrating the U.S. market better than others. Diageo now receives over 30% of its revenues from North America and the beverage company expects to see 2013 organic sales of 6% thanks in part to restructuring and focusing more on premium brands. While Diageo trades in line with peers on a trailing basis, its forward P/E of 17x may provide investors with a value play.

Molson Coors Brewing Company (NYSE:TAP) was fourth with a total of 23 filers at the end of 3Q. Being the fifth largest brewer in the world, Molson expects to see lagging growth in 2013 as wine and spirits take market share from beers. Despite the lackluster growth prospects, with its diversified product mix—with such products as Coors, Miller and Blue Moon—the argument could be made Molson is a value play. Trading at the cheapest P/E amongst its peers at only 14x earnings, investors might be over discounting the brewer’s growth prospects, including its acquisition of European brewer Starbev.

Beam Inc (NYSE:BEAM) saw a net increase of 5 filers and called 26 filers owners to be the third most popular alcoholic beverage stock owned by hedge funds in 3Q. Beam has quite a robust suite of brands that afford the spirit company a premium 26x trailing earnings valuation. Some of Beam’s top brands include Jim Beam and Maker’s Mark, while its fastest growing brands include Knob Creek bourbon and Effen vodka. Revenues are expected to be up 5% in 2013, driven by its strong U.S. presence, but expected growth in emerging markets will also play a role. Even with potential growth prospects that might be overlooked by investors – where the spirits company trades at 22x forward earnings compared to 26x trailing – Beam also pays a solid dividend yield of 1.5%.