Enterprises that have continued to increase their dividend payments offer the ideal amount of stability that both institutional and individual investors like to see. These consecutively rising dividend rates that occur over multiple decades offer a fortified sense of confidence for investors looking for predictability. For many investors, veteran companies such as these have come to represent some of the most stable investments fit for a portfolio. Taken together, they can often serve as a firm foundation on which one can subsequently customize a tailored investment strategy.

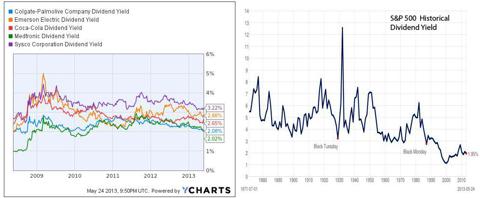

The following selection represents five companies that have consistently raised their dividend rates for two decades or more. Each of these companies have market capitalizations in excess of $10 billion, which helps to ensure market leadership. They also operate in distinct industries and collectively encompass a broad overview of the general economy. Comprehensively, each of these companies offer yields that exceed the average market dividend yield of 1.95% as represented by the S&P 500. This can be seen in the charts below. All values were taken as of May 24, 2013.

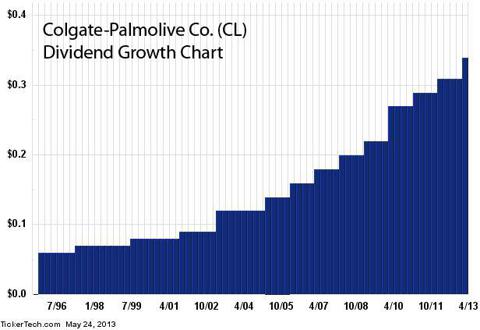

- Colgate-Palmolive Company (NYSE:CL): Colgate was founded in 1806, and its headquarters is in New York City. The company is a global consumer products leader with a focus on its core business segments of Oral Care, Personal Care, Home Care and Pet Nutrition. Overall, it specializes in the production and distribution of soaps, detergents, toothpastes, veterinary products, and more. Several of the company’s numerous brands include Colgate Total, Irish Spring, Speed Stick, Ajax and Palmolive. Colgate-Palmolive currently supports a market capitalization of $57.06 billion and a forward P/E ratio of 19.42. The company offers a forward annual dividend of 2.22% with a quarterly rate of $0.34. The company maintains a respectable payout ratio of 51% and has been raising its dividend since 1964.

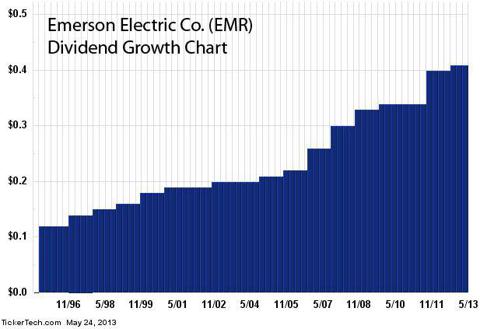

- Emerson Electric Co. (NYSE:EMR):As a diversified technology company with a global presence, Emerson provides solutions to industrial, commercial, and consumer markets. The company specializes in process management, industrial automation, network power, climate technologies, and commercial and residential solutions. The company currently supports a market capitalization of $40.93 billion, and currently trades at a forward price-to-earnings ratio of 14.60. The stock yields a forward annual dividend yield of 2.88% with a quarterly rate of $0.41. The company maintains a payout ratio of 57%. Emerson Electric has been raising its dividend for over 54 years.

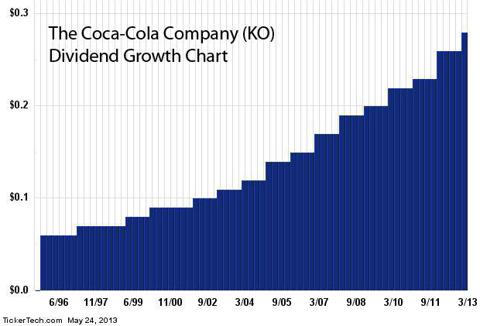

- The Coca-Cola Company (NYSE:KO): As a leading beverage corporation, the company is most commonly associated with its original brand of Coca-Cola. Yet the company has expanded into a global enterprise with over 500 brands in over 200 countries. Daily, it serves over 1.7 billion servings as an overwhelming testimony of the company’s global reach and impact. The company currently trades with a market capitalization of $188.13 billion at a forward price-to-earnings ratio of 18.13. The stock yields a forward dividend of 2.65% with a quarterly rate of $0.28. The Coca-Cola Company has been increasing its dividend every year since 1963.

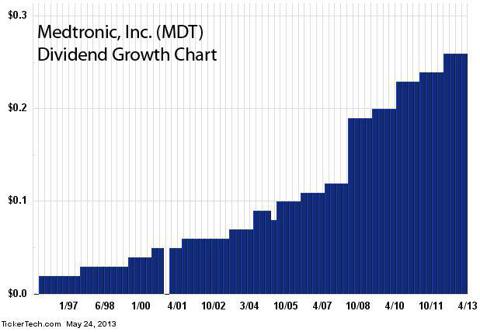

- Medtronic, Inc. (NYSE:MDT): Medtronic operates through its six business segments that revolve around Cardiac Rhythm Disease Management, Spinal & Biologics, CardioVascular, Neuromodulation, Diabetes, and Surgical Technologies. The company both manufactures and sells medical therapies that function around specific devices. Medtronic currently supports a market capitalization of $52.04 billion and a reasonable forward price-to-earnings ratio of 12.46. Trading with similar volatility as the market, it currently maintains a beta of 1.02. The company offers a forward annual dividend of 2.1% with a quarterly rate of $0.26. The company maintains a comfortable payout ratio of 31% and has been raising its dividend since 1978.

- SYSCO Corporation (NYSE:SYY): Founded in 1969, Sysco Corporation has grown to become the world’s largest diversified food distributor with over 400,000 clients throughout its many subsidiaries and fields of operation. The company operates 170 facilities throughout the United States & Canada and caters to restaurants, healthcare facilities, hotels, and other hospitality businesses. The company engages in the marketing and distribution of food products, related dining products, and food services. Sysco currently supports a market capitalization of $20.67 billion and an average forward price-to-earnings ratio of 17.24. The company offers a forward annual dividend of 3.21% with a quarterly rate of $0.28. The company maintains an average payout ratio of 42% and has been raising its dividend since 1971.