Small cell technology is already the next big thing in the IT & telecom industry.

While French research firm Idate recently predicted femtocell (or small cells) shipments will reach 23 million units worldwide within 2017, generating revenues of €931 million (a growth rate of 159% per year), another research firm, Dell’oro Group, claimed that the femtocell market will reach shipments of 62 million units by 2014, for $4 billion in revenue worldwide.

Needless to say, every tech company is doing their bit to get a head start. Likewise, Cisco Systems, Inc. (NASDAQ:CSCO) recently announced its intent to buy Swindon, U.K.-based Ubiquisys for $310 million in cash (and retention-based incentives).

“Cisco is ‘doubling down’ on its small cell business to accelerate strong momentum and growth in the mobility market,” said Kelly Ahuja, senior vice president and general manager, Cisco Mobility Business Group. “By acquiring Ubiquisys, we are expanding on our current mobility leadership and our end-to-end product portfolio, which includes integrated, licensed and unlicensed small cell solutions that are tightly coupled with SON, backhaul, and the mobile packet core. For service providers, Ubiquisys supports cost effective coverage and capacity that delivers a differentiated customer experience.”

Before we delve in further into the deal, let us see what other companies are doing.

At the recent Mobile World Congress 2013, Alcatel Lucent SA (ADR) (NYSE:ALU)‘s Director of Wireless Marketing Chris Kapuscinski talked about the company’s latest development in the field of small scale technology.

“It is very different from macro network deployment,” he explained, “because the scale is so very different. In a metro cell layer within a city center we will likely have hundreds more cell sites and carrier-grade Wi-Fi access points to cover the geography than would be the case for a macro network. The radio planning for that deployment requires almost constant calculations and re-calculations throughout the process.”

With these tech biggies already involved in the research and development of the next big thing, how can Cisco Systems, Inc. (NASDAQ:CSCO) be left behind? And what better than an acquisition of Ubiquisys at this point? With strong support from technology giants such as T-Mobile USA, Inc. and United Microelectronics Corp (ADR) (NYSE:UMC), Ubiquisys, the developer of 3G and LTE intelligent cells, has been ranked #1 in the latest Indoor Small Cell Vendor Matrix in terms of innovation and implementation, released by ABI Research.

“Ubiquisys takes the top spot on the back of its continued commitment to innovation with technologies like SideStep, CloudBase, and EdgeCloud, while keeping its commercial contracts ticking through partnerships with NEC and Nokia Siemens Networks,” commented Aditya Kaul, Principal Analyst and Practice Director, Mobile Networks, ABI Research. “Ubiquisys’ dedicated focus on the small cell area allows it to stay a couple of steps ahead of its larger rivals when it comes to introducing innovative techniques that should shape the future of the small cell market.”

With strong business collaboration with Texas Instruments Incorporated (NASDAQ:TXN) and Intel Corporation (NASDAQ:INTC) since 2011, the company has achieved solid progress. In September 2012, it was named as one of Britain’s fastest-growing private technology companies in the Sunday Times Hiscox Tech Track 100. In other words, Cisco Systems, Inc. (NASDAQ:CSCO) did make the right choice by going for Ubiquisys.

Notwithstanding the fact that Ubiquisys was the right choice to ensure Cisco’s fast progress in the femtocell and Wi-Fi technology, the question is whether the price of $310 million is bearable for Cisco Systems, Inc. (NASDAQ:CSCO) or not. In short, how does it affect the fundamentals with three consecutive acquisitions — Ubiquisys ($310 million), Intucell ($475 million), and BroadHop?

Just after the acquisition announcement, Fox Business cut its rating of Cisco Systems, Inc. (NASDAQ:CSCO)’s stock, quoting that it “will become increasingly more challenged to offset weaker-than-expected routing and switching demand as it works to transition to a more software and service centric business model,” according to Bloomberg Business Week.

And while that sounds logical, it is made all the more scary with the graph below.

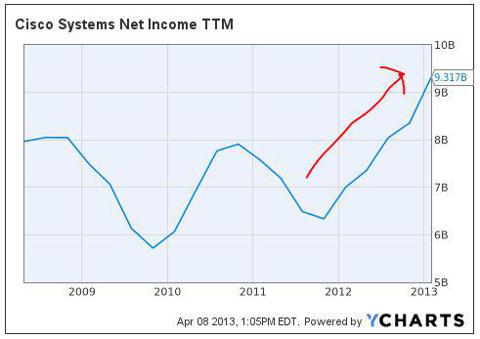

The business transition might affect the total revenue of the company. So, we can say the annual sales might just be stuck at $46 billion as in 2012, while research and development expenses (along with other expenses) will probably soar again in 2013. That will result in a drop in net income, affecting shareholders’ returns negatively.

Nevertheless, net income (TTM) has always followed a jagged path since 2008. It rose since mid-2012. Will it be able to continue the uptrend? That remains to be seen but it might not.

That said, it must be remembered that the gross margin of 61.24% and the operating margin of 21.85% are still, by far, one of the highest among its immediate peers, not to mention Alcatel-Lucent which is running in the negative.

Moreover, with over $48 billion in cash and only around $16 billion in debt sitting on the balance sheet, I would not worry too much about financial health right now. What matters is how efficiently the company is utilizing its investment base of $40 billion. With a market cap of $109.5 billion, there is sufficient economic moat around this company, and unless it messes up its own business, it should come out stronger by 2015.

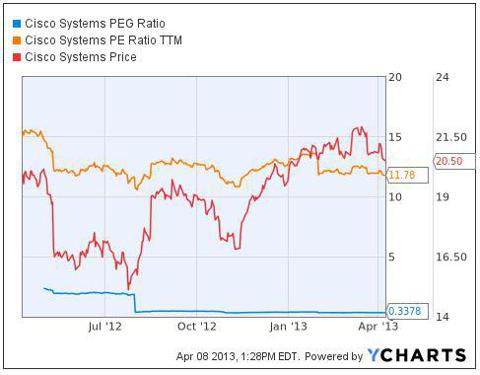

However, the price-to-sales ratio of 2.39 says that the stock is overvalued. With stagnancy in revenue in the next couple of years, the stock price will definitely see a decline in the short-term. Just to confirm that, with a higher price and stagnant P/E ratio, the price might go down if EPS stays stagnant or goes down in the short-term.

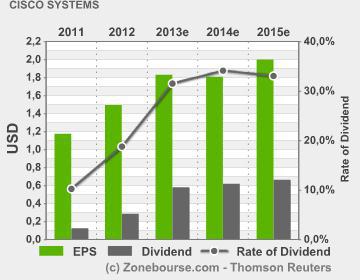

And the sad part is that EPS is estimated to be more or less stagnant in the next couple of years, which will probably result in a steep price decline.

Additionally, with the high dividend payment being increased for the shareholders last March, and which is expected to increase in the next two years, there is still much value in holding the stock.

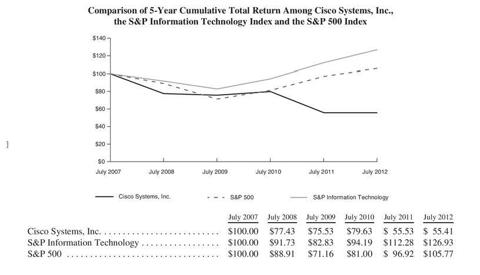

To sum it up, it is really hard to take any solid decision right now. While all the fundamentals tell me that the company is going to do well in the long run, the last five-years’ total return makes me wonder whether that is reliable or not.

In all honesty, investors who put their money based on value of the company back in 2007 burnt their hands badly. But, then again, it was the period of the Great Recession and that might not happen again. And if I were to trust Cisco Systems, Inc. (NASDAQ:CSCO) with my money again, I would not do it now. I will let the price go down a bit, and then take the plunge.

The article Cisco, Ubiquisys, and the Small Cell Industry originally appeared on Fool.com is written by Suman Chatterjee.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.