Whether rightly or wrongly, the market always seems to want technology companies to deliver growth, or they will be punished with low valuations. Consider the case of low-rated IT security specialist Check Point Software Technologies Ltd. (NASDAQ:CHKP). The company generates huge cash flows, and holds a significant portion (over 30%) of its market capitalization in cash. On the other hand, it’s estimated to only grow earnings in the 6% to 8% range over the next couple of years. Is now the time to buy the stock?

Great cash flow, low rating

Frankly, the main attraction of Check Point Software Technologies Ltd. (NASDAQ:CHKP) is its cash flow. For example, by my calculations, the company has just generated around $944 million in free cash flow over the last four quarters. In other words, that cash flow represents nearly 8.8% of its current market value.

Putting this into context, if the company only did this for the next 11 years (with no growth) then it would have generated the equivalent of its market cap in cash. However, the company is still growing earnings and cash flows, so why is it so low-rated?

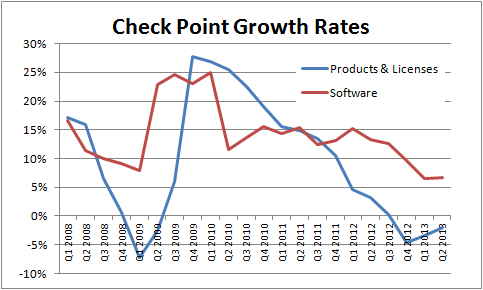

One possible explanation is that the market is concerned about its falling product & license revenues. Check Point Software Technologies Ltd. (NASDAQ:CHKP) has a razor/razorblade business model, which means its hardware products are sold into customers in order to generate future software blade sales. The fear is that falling hardware sales will ultimately lead into falling software sales.

The following chart (sourced from company accounts) demonstrates how its product & license growth has turned negative over the last year.

If this isn’t worrying enough, then investors only need look at how competitors like Fortinet Inc (NASDAQ:FTNT) and Palo Alto Networks Inc (NYSE:PANW) have lowered guidance this year due to a weakening environment. Fortinet gave a weak set of results for the first quarter, and reduced its full year revenue guidance by about 5% from its previous forecast. Moreover, its guidance for the second quarter looked weak, and implied that conditions weren’t improving. A month or so later, Palo Alto disappointed the market by claiming that its end-market conditions remained weak going in to June.

So if Check Point Software Technologies Ltd. (NASDAQ:CHKP)’s hardware sales are falling, and its competitors are warning, can investors feel comfortable with the company’s prospects?

Six reasons why Check Point investors can feel secure

Firstly, Check Point Software Technologies Ltd. (NASDAQ:CHKP)’s average selling price (ASP) has been increasing in recent quarters, and its management stated that the ASP was back to its level of two years ago. The improvement is partly due to selling a higher proportion of larger deals.

For example, Check Point disclosed that 68% of its deals were at $50,000 or above, versus 66% last year. This is clearly part of a positive trend, because in the last quarter’s results, the same percentage went up to 67% from 60%.

Second, on previous conference calls, Check Point had spoken of a trading-down effect due to its product refresh. Essentially, its customers were holding off purchasing its new higher-end solutions in favor of buying the new lower-end solutions. The customers’ rationale was that they were getting the same performance as before, but at a lower price. However, the rise in the ASP in the current report suggests that the trading-down effect has come to an end.

Third, the company has long been regarded as offering relatively expensive solutions that hinder its opportunity to sell into the small- and medium-size business market. The good news is that Check Point now has a lower-priced ($400 to $1200) entry-level product with its new 600 series. This is a market segment that Fortinet Inc (NASDAQ:FTNT) has traditionally been strong in, so look out for increased competition here.

Fourth, potential investors always need to remember that Check Point uses bundling as part of its sales strategy. In other words, it tends to try and accelerate software sales by bundling them with hardware sales. As the company is increasing the amount of software solutions that work on its hardware, it is reasonable to expect that hardware sales will fall as a percentage of the total bundled amount. Don’t panic too much over falling hardware sales.

Fifth, the guidance looks conservative. Based on company accounts and the guidance given on the conference call, I have graphed revenues and implied assumptions for revenue growth in the next two quarters. It doesn’t look like an aggressive forecast, and Check Point has a history of being conservative with guidance.

Finally, Cisco Systems, Inc. (NASDAQ:CSCO) recently announced its plan to acquire IT security company Sourcefire in a $2.7 billion deal. Cisco’s security revenues fell 5.2% at its last set of results, and this deal is clearly an attempt to regain positioning. It’s exactly the kind of deal that Cisco Systems, Inc. (NASDAQ:CSCO) needs to do in order to counteract slowing growth in its core switching and routing divisions. The immediate takeover speculation will focus on fast growing companies like Fortinet and Palo Alto Networks Inc (NYSE:PANW). However, this sort of deal usually helps to guide investors a sector, and Check Point can expect to benefit too.

The bottom line

In conclusion, while the recent results didn’t have many positive things to say about the IT spending environment, Check Point did report some underlying positives. Moreover, the valuation of the stock is attractive, and it’s a stock well worth considering for value investors looking for some tech exposure.

Lee Samaha has no position in any stocks mentioned. The Motley Fool recommends Check Point Software Technologies and Cisco Systems. The Motley Fool owns shares of Check Point Software Technologies.

The article 6 Reasons to Buy This Low-Rated Tech Company originally appeared on Fool.com and is written by Lee Samaha.

Lee is a member of The Motley Fool Blog Network — entries represent the personal opinion of the blogger and are not formally edited.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.