Last month, US real estate investment trusts fell the most in 19 months after the Federal Reserve said it could begin scaling back bond purchases later this year. The Fed’s announcement pushed up the yield on risk free treasuries driving investors away from REITs. TheBloomberg REITindex fell 3% during April, taking its total loss since May to 12%.

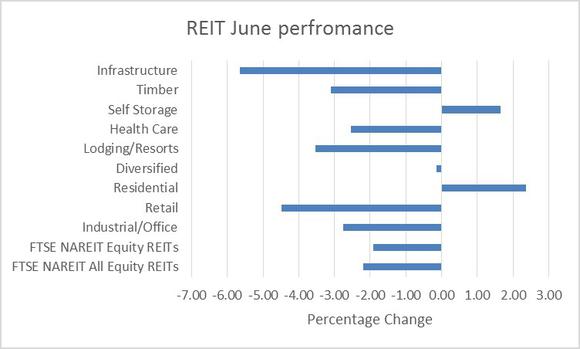

Additionally, according todata fromNAREIT, the National Association of Real Estate Investment Trusts, Infrastructure REITs declined the most closely followed by REITs owning retail property.

This decline has signaled an end to the REIT boom that has been underway during the past two years as investors search for yield. That said, this decline has also highlighted opportunities in the market as some REITs now appear to be cheap and trading below the value of assets on their books. Furthermore, with property prices surging REIT portfolios could be in for a re-rating, driving asset values higher, widening the valuation gap.

What’s on offer?

The first REIT that stands out is Chambers Street Properties (NYSE:CSG). The company came to the market at the worst possible time, just before the sector began to decline in May. Chambers Street Properties (NYSE:CSG) invests in office properties, multifamily residential properties and industrial units, which give the REIT a well-diversified asset base.

A quick overview shows that the company is trading at a PE ratio of 6, falling to 3.7 next year, a PB ratio of 0.6 and offers investors a dividend yield of 5.5%.

A quick glance at Chambers Street Properties (NYSE:CSG)’s balance sheet, reveals that the company has been making a loss for the past five years. However, the reason for this loss is the high amount of depreciation and amortization charges that the company is taking on its assets.

Indeed, on a cash flow basis, after such charges are stripped out, the company has increased its operating cash flow 130%, which easily covers dividend payments that have also grown inline, from $41 million in 2010 to $79 million in 2012.

Chambers Street Properties (NYSE:CSG) has a strong operating cash flow, is consistently raising its dividend and is trading at only 60% of its book cost. Overall, a solid investment with a good margin of safety.

Next up is CommonWealth REIT (NYSE:CWH), which has missed out on almost all of the REIT rally during the past few months. The company had an extremely bad four quarter last year due to one-off costs and this has weighed on the company.

Currently trading at a trailing P/E of 59, the company looks expensive but EPS are set to recover this year, rising back to $2.71, putting the company at a forward P/E of 8.6, hardly expensive at all when the company’s ten largest peers trade at forward P/E ratios closer to 30.