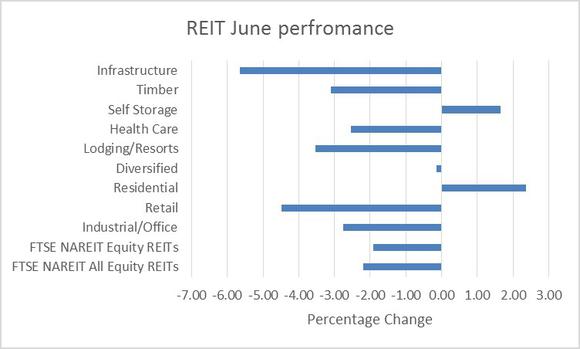

Last month, US real estate investment trusts fell the most in 19 months after the Federal Reserve said it could begin scaling back bond purchases later this year. The Fed’s announcement pushed up the yield on risk free treasuries driving investors away from REITs. TheBloomberg REITindex fell 3% during April, taking its total loss since May to 12%.

Additionally, according todata fromNAREIT, the National Association of Real Estate Investment Trusts, Infrastructure REITs declined the most closely followed by REITs owning retail property.

This decline has signaled an end to the REIT boom that has been underway during the past two years as investors search for yield. That said, this decline has also highlighted opportunities in the market as some REITs now appear to be cheap and trading below the value of assets on their books. Furthermore, with property prices surging REIT portfolios could be in for a re-rating, driving asset values higher, widening the valuation gap.

What’s on offer?

The first REIT that stands out is Chambers Street Properties (NYSE:CSG). The company came to the market at the worst possible time, just before the sector began to decline in May. Chambers Street Properties (NYSE:CSG) invests in office properties, multifamily residential properties and industrial units, which give the REIT a well-diversified asset base.

A quick overview shows that the company is trading at a PE ratio of 6, falling to 3.7 next year, a PB ratio of 0.6 and offers investors a dividend yield of 5.5%.

A quick glance at Chambers Street Properties (NYSE:CSG)’s balance sheet, reveals that the company has been making a loss for the past five years. However, the reason for this loss is the high amount of depreciation and amortization charges that the company is taking on its assets.

Indeed, on a cash flow basis, after such charges are stripped out, the company has increased its operating cash flow 130%, which easily covers dividend payments that have also grown inline, from $41 million in 2010 to $79 million in 2012.

Chambers Street Properties (NYSE:CSG) has a strong operating cash flow, is consistently raising its dividend and is trading at only 60% of its book cost. Overall, a solid investment with a good margin of safety.

Next up is CommonWealth REIT (NYSE:CWH), which has missed out on almost all of the REIT rally during the past few months. The company had an extremely bad four quarter last year due to one-off costs and this has weighed on the company.

Currently trading at a trailing P/E of 59, the company looks expensive but EPS are set to recover this year, rising back to $2.71, putting the company at a forward P/E of 8.6, hardly expensive at all when the company’s ten largest peers trade at forward P/E ratios closer to 30.

Once again, CommonWealth REIT (NYSE:CWH) is trading at a discount to the value of its assets, which are worth $32.86 per share, so currently the firm is trading at a P/B ratio of 0.7. Moreover, the REIT currently offers investors a 4.3% dividend yield that was easily covered three times by operating cash flow in the fourth quarter of 2012 and 1.3 times by operating cash flow in the first quarter of this year.

Overall, CommonWealth REIT (NYSE:CWH) presents a decent value opportunity with a well-covered dividend payout, low valuation in relation to its peers and trading at a discount to its book value.

Lastly, Brookfield Office Properties Inc (USA) (NYSE:BPO), which is in the market for premium property. The company has recently closed on the acquisition of a second tranche of London properties, purchased from one of the largest REITs in England, Hammerson plc (LON:HMSO). Brookfield’s London properties are in the center of the city, which is well known for high rents and high prices. This takes Brookfield’s assets in the city of London to four office buildings, totaling 800,000 square feet.

The company also owns two million square feet of development density in England’s capital. One of the more appealing aspects of Brookfield is its property management arm, which is much more lucrative than traditional REIT operations as there is no need for such a high level of debt and interest costs.

Like the two companies above, Brookfield is trading below the value of its assets, which are worth around $20.30 per share. However, the firms EPS are expected to drop by 50% this year, which puts the company at a forward P/E ratio of 16 – more expensive than the two above but still cheaper than the average of its ten largest peers, which trade at an average P/E of 19.

Foolish summary

All in all, the REIT index may be falling but this has now put some companies on sale with their market capitalization now being well below the value of their assets. The best company for investment in this list looks to be Chambers Street Properties (NYSE:CSG), as the company came to market at a very bad time and the sell-off looks to be overdone.

The article These REITs Are on Special Offer originally appeared on Fool.com and is written by Rupert Hargreaves.

Fool contributor Rupert Hargreaves has no position in any stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. Rupert is a member of The Motley Fool Blog Network — entries represent the personal opinion of the blogger and are not formally edited.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.