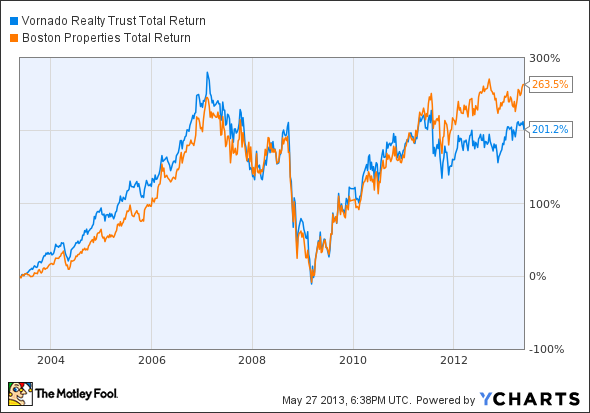

These office REITS had a big run up coming into 2013, but in the last year, the office space sector has underperformed not only the S&P 500, but also other niche REITS like apartments and mall owners.

Vornado offers a yield of 3.50% compared to Boston Properties, Inc. (NYSE:BXP)’ 2.40%. But Boston Properties’ share price is up 6.75%, to Vornado’s 0.37%, over the last year.

On the Q1 conference call, Chairman Mortimer Zuckerman said that Boston Properties, Inc. (NYSE:BXP)’ most important foci going forward will be San Francisco, with its high-tech office growth, and Boston, with its growing life-sciences industry. CFO Michael LaBelle added that the company currently has $700 million in cash, and some upcoming property sales could fund paying off maturing debt or a possible special dividend. They also raised guidance to $0.09 EPS.

VNO Total Return Price data by YCharts

Can you hear me now?

CenturyLink, Inc. (NYSE:CTL) is the largest new position for Bridgewater Associates, at 0.15% of the portfolio. At first glance, it’s easy to see why, with a yield of 5.80%. The forward P/E of 13.41 isn’t bad, but looking at the PEG at 14.03 — so much higher than its industry average at 5.19 and the S&P 500 at 1.33 — is sobering.

Its competition comes from well-established telecom titans Verizon Communications Inc. (NYSE:VZ) and AT&T Inc. (NYSE:T), as well as smaller local telecoms like Windstream Corporation (NASDAQ:WIN) and Frontier Communications Corp (NASDAQ:FTR).

This local telecom operates in 37 states and boasts 5.8 million broadband subscribers. It’s outperforming smaller rivals like Windstream, which offers 11% yield but likely unsustainable. But CenturyLink, Inc. (NYSE:CTL) is not a resounding buy, with analysts giving it less than a 1% five-year EPS growth rate and a price target of $39.00, for less than 5% upside.

The stock has a large short interest of 7.30%. It’s also underperformed the other two Dalio names in the last year, down 5.6% against a 23.8% rise for the S&P.

Frontier Communications and CenturyLink, Inc. (NYSE:CTL) slashed their dividends, but Frontier’s is still higher, at 9%.

CTL Dividend Yield data by YCharts

Hedging your bets

I think Expeditors has the most upside as a global logistics service and attractive prospects with its Transcon global rollout. Both Boston Properties and CenturyLink, Inc. (NYSE:CTL) have strong competitors as well as sector downtrends.

The article Don’t Buy a Hedge Fund, Be a Hedge Fund originally appeared on Fool.com and is written by AnnaLisa Kraft.

AnnaLisa is a member of The Motley Fool Blog Network — entries represent the personal opinion of the blogger and are not formally edited.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.