Should you be bullish on Cantel Medical Corp. (NYSE:CMN), Monro Muffler Brake Inc (NASDAQ:MNRO), ShoreTel, Inc. (NASDAQ:SHOR), and/or Allegion PLC (NYSE:ALLE)? According to our research, an investor can beat the market by investing in the top picks of big hedge funds. We follow around 750 funds, among which is Diker Management, which had all four of those companies among its top consumer picks. Therefore, we decided to examine these stocks, see how they performed in the third quarter, and what was the general smart money sentiment towards them.

Diker Management is a New York-based hedge fund founded and managed by Harvard graduate Mark N. Diker. Diker Management’s portfolio had a total worth of $256.82 million on June 30, which rose to $280.55 million on September 30. The increase was likely due to the fund’s stock picking performance, as its 30 long positions in non-microcap companies returned 13.58% during the third quarter. With that in mind, let’s check out the aforementioned 4 stocks and see how they performed.

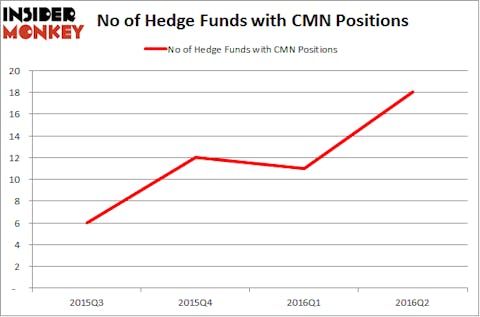

Diker Management had 1.84 million shares of Cantel Medical Corp. (NYSE:CMN) at the end of the second quarter. The overall value of this stake was about $126.53 million. This gigantic investment was beneficial for the hedge fund as Cantel’s stock returned 13.6% in the third quarter. Heading into the third quarter of 2016, a total of 18 of the hedge funds tracked by Insider Monkey held long positions in this stock, a 64% jump from one quarter earlier. Among these funds, Diker Management held the most valuable stake in Cantel Medical Corp. (NYSE:CMN), followed by Citadel Investment Group, which amassed $13.1 million worth of shares. Moreover, GAMCO Investors, Millennium Management, and Arrowstreet Capital were also bullish on Cantel Medical Corp. (NYSE:CMN).

Follow Cantel Medical Corp (NYSE:CMD)

Follow Cantel Medical Corp (NYSE:CMD)

Receive real-time insider trading and news alerts

Diker Management retained its $6.34 million stake in Monro Muffler Brake Inc (NASDAQ:MNRO), with ownership of 99,774 shares of the company at the end of June. The stock, however, returned a disappointing loss of 3.5% in the third quarter. At Q2’s end, a total of 13 of the hedge funds that we track held long positions in this stock, up by 8% from one quarter earlier. Among these funds, Akre Capital Management held the most valuable stake in Monro Muffler Brake Inc (NASDAQ:MNRO), which was worth $94.4 million at the end of the second quarter. On the second spot was Daruma Asset Management, which amassed $45.6 millions worth of shares. Moreover, Royce & Associates, Buckingham Capital Management, and Point72 Asset Management were also bullish on Monro Muffler Brake Inc (NASDAQ:MNRO).

Follow Monro Inc. (NASDAQ:MNRO)

Follow Monro Inc. (NASDAQ:MNRO)

Receive real-time insider trading and news alerts

We’ll check out two more of the fund’s stock picks on the next page.

Diker Management loaded up on ShoreTel, Inc. (NASDAQ:SHOR) in the second quarter, increasing its holding in the company by a whopping 619%, moving into the third quarter with 647,382 shares which had a total value of over $4.33 million. This was a smart investment, as the stock returned 19.6% during the third quarter. Diker was one of 16 of the hedge funds tracked by Insider Monkey which were bullish on the stock at the end of June, down by 24% from one quarter earlier. RGM Capital was the largest shareholder of ShoreTel, Inc. (NASDAQ:SHOR) among them, with a stake worth $41.3 million reported as of the end of June. Trailing RGM Capital was Park West Asset Management, which amassed a stake valued at $40.6 million. Renaissance Technologies, Portolan Capital Management, and D E Shaw also held valuable positions in the company.

Follow Shoretel Inc (NASDAQ:SHOR)

Follow Shoretel Inc (NASDAQ:SHOR)

Receive real-time insider trading and news alerts

Allegion PLC (NYSE:ALLE), a stock which lost 0.6% in the third quarter, was bought by Diker Management in the second quarter, as the fund increased its holding in the company by 37%. Diker Management reported ownership of 51,200 shares of Allegion as of June 30, with the total value of the investment being about $3.55 million. Allegion PLC (NYSE:ALLE) investors should pay attention to an increase in support from the world’s most elite money managers lately. ALLE was in 34 hedge funds’ portfolios at the end of June, up from 32 a quarter earlier. The largest stake in Allegion PLC (NYSE:ALLE) was held by Select Equity Group, which reported holding $272.9 million worth of stock as of the end of June. It was followed by Blue Ridge Capital with a $160 million position. Other investors bullish on the company included Marshall Wace LLP, Valinor Management LLC, and Columbus Circle Investors.

Follow Allegion Plc (NYSE:ALLE)

Follow Allegion Plc (NYSE:ALLE)

Receive real-time insider trading and news alerts

Disclosure: None