I have owned shares of the largest Canadian Banks as a long-term investment for over four years now. I initiated a position in those five banks in early 2013, and then added some more in late 2013 (1). I also added a little more a couple of years later. If prices make sense, and I have money to invest, I will likely make another investment.

Creative Lab/Shutterstock.com

The banks include:

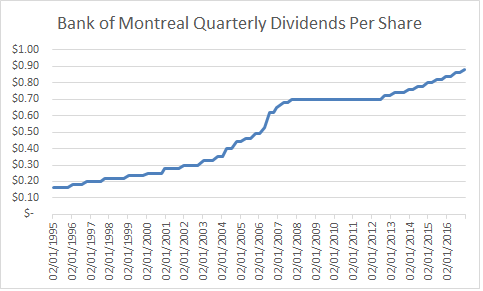

Bank of Montreal (USA) (NYSE:BMO) provides various retail banking, wealth management, and investment banking products and services in North America and internationally. It has operations in the US, in the form of BMO Harris Bank. Bank of Montreal (USA) (NYSE:BMO) has paid dividends since 1829. Over the past decade, Bank of Montreal (USA) (NYSE:BMO) has increased quarterly dividends per share by 3.10%/year. And that’s despite the fact that the dividends were left unchanged in 2009, 2010 and 2011. Earnings per share have increased by 3%/year over the same time period. The bank sells for 14.90 times earnings and yields 3.40%.

Follow Bank Of Montreal N (NYSE:BMO)

Follow Bank Of Montreal N (NYSE:BMO)

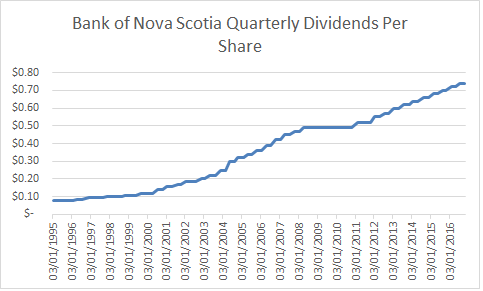

Bank of Nova Scotia (NYSE:BNS) provides various personal, commercial, corporate, and investment banking services in Canada and internationally. It operates in four segments: Canadian Banking, International Banking, Global Wealth & Insurance, and Global Banking & Markets. This is the most international Canadian bank, as it has services in the Caribbean, Latin America, Central America, and Asia. Bank of Nova Scotia (NYSE:BNS) has paid dividends since 1834. Over the past decade, Bank of Nova Scotia (NYSE:BNS) has increased its quarterly dividends per share by 5.80%/year. And that’s despite the fact that the annual dividend was left unchanged in 2010. Earnings per share have increased by 5%/year over the same time period. The bank sells for 13.70 times earnings and yields 3.75%.

Follow Bank Of Nova Scotia (NYSE:BNS)

Follow Bank Of Nova Scotia (NYSE:BNS)

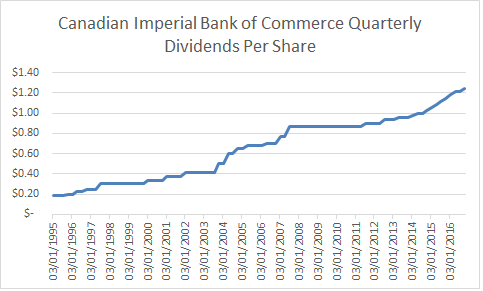

Canadian Imperial Bank of Commerce (USA) (NYSE:CM) provides various financial products and services to individuals, small businesses, and commercial, corporate, and institutional clients in Canada and internationally. The company operates through three segments: Retail and Business Banking, Wealth Management, and Wholesale Banking. Canadian Imperial Bank of Commerce (USA) (NYSE:CM) has paid dividends since 1890. Over the past decade, Canadian Imperial Bank of Commerce (USA) (NYSE:CM) has increased its quarterly dividends per share by 5.90%/year, despite the annual dividend being left unchanged in 2009 and 2010. Earnings per share have increased by 3.70%/year over the same time period. The bank sells for 11.20 times earnings and yields 4.15%.

Follow Canadian Imperial Bank Commerce (NYSE:CM)

Follow Canadian Imperial Bank Commerce (NYSE:CM)