The PC market was one of the biggest tech industries in the world. However, the PC era is slowly fading away, while the market for tablets and smartphones is growing quite fast. Hewlett-Packard Company (NYSE:HPQ) is one of the leaders in the PC market along with Dell Inc. (NASDAQ:DELL) and Lenovo Group Limited (ADR) (PINK:LNVGY). While Dell has decided to go private, Hewlett-Packard Company (NYSE:HPQ) continues to surpass expectations in the stock market.

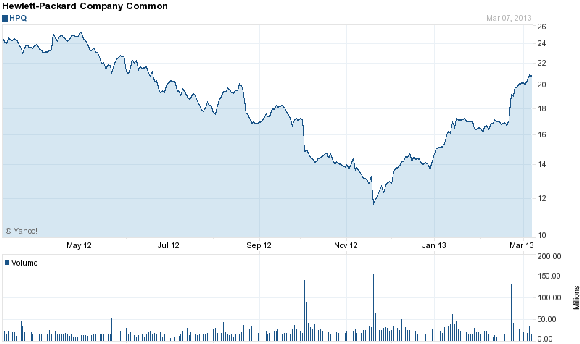

After a continuous decline in 2012, HP looks set to bounce back and is already trading between $18 to $22, which showed almost a 50% increase from November last year. Even though HP’s 2013 Q1 net income of $1.2 billion is almost 15% lower than Q1 2012, it exceeded Wall Street expectations. Revenue fell to $28.4 billion compared to estimates of $27.9 billion. The company recently announced that it will go ex-dividend from March 11 and a $0.132 dividend will be paid in April to those who have purchased the company’s share prior to March 11. Meg Whitman, HP’s CEO, recently stated that the company will see a revenue growth in 2014. She said that the new restructuring strategy will pay off in 2014, which means that the company won’t see any revenue acceleration in 2013.

Strengths

One of the biggest strengths of the company is its brand name. Hewlett-Packard Company (NYSE:HPQ) is still one of the biggest names in not just the PC market, but in the tech and electronics industry. Even though the PC market is slowly fading away, HP is still the largest PC manufacturer and enjoys benefits such as economies of scale. Dell has been another leading name in the PC market and has been HP’s biggest competitor since decades, however, after lack of product innovation and a constant decline in profits and market share, HP now has a better brand image.

Apart from the hardware side, Hewlett-Packard Company (NYSE:HPQ) is also targeting revenue growth from its software and services divisions. Even though the hardware sales contribute to most of the company’s revenue, the company’s strength in customer experience management (CEM) and software will help it to rely less on the declining PC and printers market. The company’s Cloud system service is also rising, with some of the major telecom companies using HP’s cloud system offering.

Weaknesses

One of the biggest weaknesses to HP is the declining PC market and the poor sales of Windows 8 touchscreen devices. Even though Microsoft claims that sales of Windows 8 licenses were better than expected, the new Windows 8 devices have not performed well in the market. This external weakness doesn’t only cause problems for HP, but Dell and Lenovo have also had some problems with the Windows 8 devices. Reports suggest that consumers should expect price cuts on Windows 8 touchscreen laptops and convertibles as Microsoft plans to lower licensing fees for PC manufacturers.

Another major weakness is that Hewlett-Packard Company (NYSE:HPQ) failed to capitalize on the Android platform. HP’s Palm acquisition was probably the company’s worst nightmare. HP entered into the tablets market with its webOS based touchpad while Lenovo and ASUS released Android devices. After the failure of its webOS smartphone and tablet, the company has decided to sell its webOS platform to electronics giant LG. At the recent Mobile World Congress event, HP unveiled its new Android tablet; however, this may be too little too late. Both, Lenovo and Asus, released some fantastic Android devices when they entered into the tablets market, which is the reason why both the companies have a better brand name in tablets compared to HP.